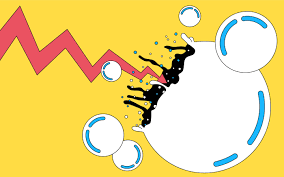

Turkey’s national stock exchange catapulted from the bottom to the top EM performers list in the brief span of a quarter, even though Turkey has no new economic story, frequently bans international investors from financial markets and has messy politics, as attested by 5-year CDS prices of 520 points. Why? Because forced by the Erdogan administration Central Bank lowered interest rates below the going rate of inflation, forcing savers out of TL deposits. Registered investors at the BIST, mostly retailers soared by 33% YoY, as amateurs began seeking their fortunes in equities. As Walter Bagehot commented as early as 19th Century when greengrocers and house maids flock to the Stoc Exchange…, you know the end is near. When will the BIST bubble bursts?

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/