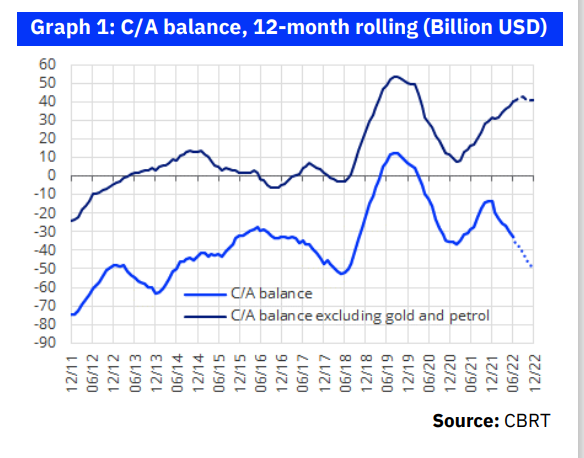

C/A deficit rises to UDS33bn in June, may reach USD50bn by end-22

cad-july-chart

cad-july-chart

June C/A deficit at USD3.5bn is slightly below the median expectation, although it continues to deteriorate on a YoY basis. In June, Turkey printed a USD3.5bn C/A deficit, slightly below our USD3.6bn estimate, which is also the median expectation. This compares unfavourably with the USD1.2bn deficit of June 2021, thereby leading to a further rise in the 12-month rolling deficit to USD32.7bn from last month’s USD30.4bn (which is revised from USD29.5bn), and up from USD13,6bn at end-2021. Meanwhile, the y-t-d C/A deficit has also reached USD32.4bn (USD13.4bn in the same period of 2021).

Official reserves fell by USD2.0bn despite the help of unregistered capital inflows. Capital account also produced an outflow of USD2.5bn, particularly attributable to the USD1.6bn outflow in portfolio investments and the private sector’s USD1.3bn net loan redemptions and USD0.8bn worth of transfers abroad.

These were partially counterbalanced by USD1.0bn inflows in FDI. Meanwhile, the net errors-and-omissions item remained significant at USD4.0bn, bringing the y-t-d inflows from this channel to USD17.5bn (on top of the USD7.6bn inflow registered in 2021). Official reserves still registered a loss of USD2.0bn, bringing the y-t-d deceleration here to USD12.3bn.

Massive energy imports have been the major factor

Massive energy imports have been the major factor behind the rising foreign trade deficit. There has been a dramatic increase in our energy import costs, particularly since late 2021. Specifically, the monthly average of energy imports, which was roughly $4 billion per month last year, reached almost $8 billion in the first 7 months of 2022. It should be noted that this amount is also well above the historical averages.

Turkish Economy Won’t Survive The Winter

For instance, even in 2011-2014, when the price of Brent oil fluctuated between $100-$110, the monthly average energy import cost was roughly $4.5 billion. Apart from the rise in Brent oil price, the increase in the spot natural gas prices has been much greater since the beginning of 2021 (European natural gas TTF prices are currently 6-7 times higher than historical averages), which we think explains the massive YoY rise in energy imports. Accordingly, the energy import cost of $50 billion last year (roughly an average of $45 billion over the last 10 years) could reach $90-100 billion in the whole of 2022

The rise in imports is actually widespread

Yet, the rise in imports is actually widespread, and not limited to energy. Apart from the spiking energy import bill, the import-dependent nature of manufacturing also adds to the rising C/A deficit, as intermediate goods imports (excluding oil and gold) rise at the same pace as exports. On top of that, we have been observing some revival in capital goods and consumption goods imports over the past few months, which respectively increased by 7% and 23% YoY in the May-July period.

C/A deficit could soar over 6% of GDP!!!

C/A deficit is likely to mount in the remainder of the year, rising to roughly 6% of GDP. Despite the very strong tourism season, we expect the rising trend in the C/A deficit to prevail in the remainder of the year, particularly attributable to the mounting energy import costs, and an expected slowdown in exports. Also considering the ongoing acceleration in imports, we now revise our end-2022 C/A deficit estimate to USD49bn (roughly 6% of GDP), or probably above, up from our prior USD43bn estimate.

Furthermore, as we do not expect a material change in capital account dynamics, we would expect this deficit to continue to be financed largely through unregistered inflows (the net errors and omissions item) and some loss in official reserves.

Serkan Gonencler, Economist, Gedik Yatirim

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/