Jefferies on Turkish equities: Companies become experts in survival

jefferies

jefferies

Key Takeaway

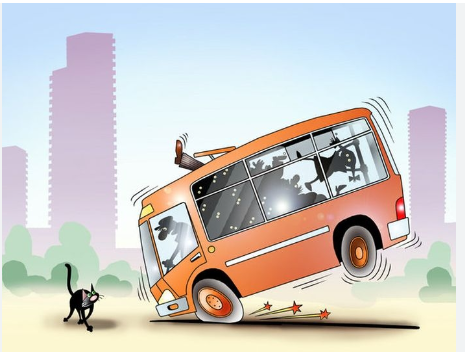

Turkey has defied the financial markets' pessimistic consequences over the past five years despite the disparities within its balance of payments. The high rates of inflation have unanchored expectations while dwindling foreign exchange reserves have been accompanied by a cutting in interest rates. However, the corporate sector has been able to manage around the economic turmoil suggesting that it is in a much better shape to manage any shock adjustment.

Turkey’s stock market has outperformed its EM peers in US$ terms YTD despite rising fuel costs and a strong dollar. The index itself has flat-lined in US$ terms for the past five years confounding the skeptics (including this analyst) who had felt the economy was overdue a balance of payment crisis. Turkey has seemed to always have skirted around the ‘inevitable adjustment’……

Economic background

Inflation expectations have become unanchored with CPI (~80% y-y) surging while the Turkish central bank’s hands are tied from raising rates. Real interest rates are ~-65%. In order to return the economy to equilibrium it would require hiking rates very aggressively to smother inflation. Consumer confidence has just bounced from record lows. The difficulty for the central bank is that as depositor’s confidence in the TRY relapses, they will try to switch into foreign currencies thereby begetting further currency depreciation.

Turkey Bears Are on Back Foot Amid Global Rebound, Russian Cash

Why has the stock market resisted the bad news?

Nonchalantly reading the Economist (July 23rd, Turkey’s economy: Inflation nation) the authors posited the same question as to how the economy had survived against such poor fundamentals. Their conclusion was that Turkey’s business dynamism was the success factor with one of the highest proportions of a population who aspired to be entrepreneurs. A good mix of conglomerates, medium-sized family firms and small unregistered businesses has insulated the economy from external shocks. We thought it might be interesting to try and substantiate these claims. We dusted off our Du Pont analysis and examined the data for a few sectors.

It is true…the top 20 listed companies demonstrated a substantial improvement in ROE since 2015. Although they raised leverage ratios, net profit margins expanded despite asset turnover being mixed. The Consumer Discretionary and Industrials had particularly good ROEs. As an aside, where appropriate the credit scores (Altman z-score) were high while the current and quick ratios were more varied. Net debt-to-equity was comfortable in general. The bottom line is that with CDS widening to the 2008 levels, another currency stress test is appearing.

It might not be time to dip the investment finger in just yet, but Turkish companies have not only shown adaptability but also a survivorship bias…

Excerpt

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/