Danske Bank: Most vulnerable EM economies are Sri Lanka, Turkey, Pakistan and Poland

danske bank

danske bank

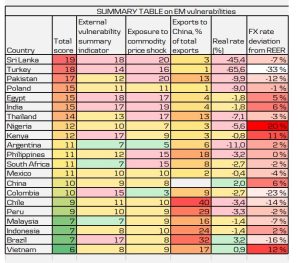

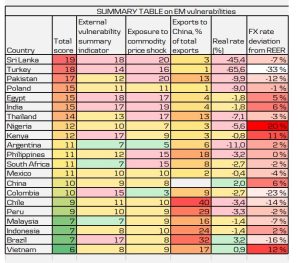

Our updated EM vulnerability heatmap looks at EM economies’ sensitivities to global financial tightening and elevated commodity prices, as well as their trade exposure to China and effectiveness of their local monetary policy.

The usual suspects top the rank of the most vulnerable EM economies: Sri Lanka, Turkey, Pakistan and Poland. Some of the larger EM, such as Brazil and South Africa rank better but the relative comparison against a number of struggling frontier economies disguises some persistent country-specific weaknesses.

USD/TRY upside risk continues. Target is 25.00 in a year.

In our updated EM heatmap analysis, we look at how countries perform in relative comparison across a number of macroeconomic indicators that measure a country’s external position and how reliant they are on net fuel imports and wheat imports from Russia and Ukraine. Our analysis also looks at countries’ trade exposure to China (as a share of total exports), and their monetary policy stance (real rate as a proxy of monetary policy effectiveness). Many of the risks we flagged in our initial EM heatmap analysis in November 2021 have by now materialised: For example, Sri Lanka has defaulted and the

Turkish lira has lost half of its value in 12M, while BRL has been a relative outperformer.

WATCH: Global Economy and how Fed's actions can effect emerging market Economies

Largely, our key conclusions remain. For example, Turkey and Poland maintain their weak rankings. Our recent note, Research Turkey – Erdogan’s risky bets extend from economics to geopolitics, 2 September, discusses the weaknesses of the Turkish economy in more detail. Turkey’s economic policies continue to undermine its existing external vulnerabilities, making it even more exposed to further capital outflows and FX depreciation. Poland’s main challenge is inflation running at above 16%, which leaves investors with markedly negative real returns. However, USD/PLN is also one of the worst-performing currencies in our table, and in REER terms, the currency is close to fair value.

WATCH: Turkish Economy Won’t Survive The Winter

Unsurprisingly, our heatmap keeps Sri Lanka and Pakistan in the spotlight. Both economies have substantial external vulnerabilities, while being exposed to high energy prices. Recent deals with the IMF give some relief in the short term but tackling the underlying economic problems will take a long time to resolve, and Pakistan’s devastating floods imply an additional burden on public finances. Egypt, India and Thailand also remain vulnerable to the global financial tightening and elevated commodity prices.

Some large EM economies, such as South Africa and Brazil, rank relatively well in our heatmap analysis. However, their relative outperformance disguises some country-specific weaknesses. For example, wide budget deficit and high debt still leave Brazil exposed to global financial tightening, although improved terms of trade and a positive real rate work as a buffer. Importantly, our analysis ignores political risk and as the country heads towards the general election in October, further fiscal slippage is likely. BRL is amongst the best performing currencies in the EM space this year, and in REER terms, the currency is 16% overvalued. South Africa, in addition to having high debt and a sustained budget deficit, remains vulnerable to elevated energy prices.

Danske Report, The usual suspects top the rank of our updated EM

vulnerability heatmap

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/

In our updated EM heatmap analysis, we look at how countries perform in relative comparison across a number of macroeconomic indicators that measure a country’s external position and how reliant they are on net fuel imports and wheat imports from Russia and Ukraine. Our analysis also looks at countries’ trade exposure to China (as a share of total exports), and their monetary policy stance (real rate as a proxy of monetary policy effectiveness). Many of the risks we flagged in our initial EM heatmap analysis in November 2021 have by now materialised: For example, Sri Lanka has defaulted and the

Turkish lira has lost half of its value in 12M, while BRL has been a relative outperformer.

WATCH: Global Economy and how Fed's actions can effect emerging market Economies

Largely, our key conclusions remain. For example, Turkey and Poland maintain their weak rankings. Our recent note, Research Turkey – Erdogan’s risky bets extend from economics to geopolitics, 2 September, discusses the weaknesses of the Turkish economy in more detail. Turkey’s economic policies continue to undermine its existing external vulnerabilities, making it even more exposed to further capital outflows and FX depreciation. Poland’s main challenge is inflation running at above 16%, which leaves investors with markedly negative real returns. However, USD/PLN is also one of the worst-performing currencies in our table, and in REER terms, the currency is close to fair value.

WATCH: Turkish Economy Won’t Survive The Winter

Unsurprisingly, our heatmap keeps Sri Lanka and Pakistan in the spotlight. Both economies have substantial external vulnerabilities, while being exposed to high energy prices. Recent deals with the IMF give some relief in the short term but tackling the underlying economic problems will take a long time to resolve, and Pakistan’s devastating floods imply an additional burden on public finances. Egypt, India and Thailand also remain vulnerable to the global financial tightening and elevated commodity prices.

Some large EM economies, such as South Africa and Brazil, rank relatively well in our heatmap analysis. However, their relative outperformance disguises some country-specific weaknesses. For example, wide budget deficit and high debt still leave Brazil exposed to global financial tightening, although improved terms of trade and a positive real rate work as a buffer. Importantly, our analysis ignores political risk and as the country heads towards the general election in October, further fiscal slippage is likely. BRL is amongst the best performing currencies in the EM space this year, and in REER terms, the currency is 16% overvalued. South Africa, in addition to having high debt and a sustained budget deficit, remains vulnerable to elevated energy prices.

Danske Report, The usual suspects top the rank of our updated EM

vulnerability heatmap

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/

In our updated EM heatmap analysis, we look at how countries perform in relative comparison across a number of macroeconomic indicators that measure a country’s external position and how reliant they are on net fuel imports and wheat imports from Russia and Ukraine. Our analysis also looks at countries’ trade exposure to China (as a share of total exports), and their monetary policy stance (real rate as a proxy of monetary policy effectiveness). Many of the risks we flagged in our initial EM heatmap analysis in November 2021 have by now materialised: For example, Sri Lanka has defaulted and the

Turkish lira has lost half of its value in 12M, while BRL has been a relative outperformer.

WATCH: Global Economy and how Fed's actions can effect emerging market Economies

Largely, our key conclusions remain. For example, Turkey and Poland maintain their weak rankings. Our recent note, Research Turkey – Erdogan’s risky bets extend from economics to geopolitics, 2 September, discusses the weaknesses of the Turkish economy in more detail. Turkey’s economic policies continue to undermine its existing external vulnerabilities, making it even more exposed to further capital outflows and FX depreciation. Poland’s main challenge is inflation running at above 16%, which leaves investors with markedly negative real returns. However, USD/PLN is also one of the worst-performing currencies in our table, and in REER terms, the currency is close to fair value.

WATCH: Turkish Economy Won’t Survive The Winter

Unsurprisingly, our heatmap keeps Sri Lanka and Pakistan in the spotlight. Both economies have substantial external vulnerabilities, while being exposed to high energy prices. Recent deals with the IMF give some relief in the short term but tackling the underlying economic problems will take a long time to resolve, and Pakistan’s devastating floods imply an additional burden on public finances. Egypt, India and Thailand also remain vulnerable to the global financial tightening and elevated commodity prices.

Some large EM economies, such as South Africa and Brazil, rank relatively well in our heatmap analysis. However, their relative outperformance disguises some country-specific weaknesses. For example, wide budget deficit and high debt still leave Brazil exposed to global financial tightening, although improved terms of trade and a positive real rate work as a buffer. Importantly, our analysis ignores political risk and as the country heads towards the general election in October, further fiscal slippage is likely. BRL is amongst the best performing currencies in the EM space this year, and in REER terms, the currency is 16% overvalued. South Africa, in addition to having high debt and a sustained budget deficit, remains vulnerable to elevated energy prices.

Danske Report, The usual suspects top the rank of our updated EM

vulnerability heatmap

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/

In our updated EM heatmap analysis, we look at how countries perform in relative comparison across a number of macroeconomic indicators that measure a country’s external position and how reliant they are on net fuel imports and wheat imports from Russia and Ukraine. Our analysis also looks at countries’ trade exposure to China (as a share of total exports), and their monetary policy stance (real rate as a proxy of monetary policy effectiveness). Many of the risks we flagged in our initial EM heatmap analysis in November 2021 have by now materialised: For example, Sri Lanka has defaulted and the

Turkish lira has lost half of its value in 12M, while BRL has been a relative outperformer.

WATCH: Global Economy and how Fed's actions can effect emerging market Economies

Largely, our key conclusions remain. For example, Turkey and Poland maintain their weak rankings. Our recent note, Research Turkey – Erdogan’s risky bets extend from economics to geopolitics, 2 September, discusses the weaknesses of the Turkish economy in more detail. Turkey’s economic policies continue to undermine its existing external vulnerabilities, making it even more exposed to further capital outflows and FX depreciation. Poland’s main challenge is inflation running at above 16%, which leaves investors with markedly negative real returns. However, USD/PLN is also one of the worst-performing currencies in our table, and in REER terms, the currency is close to fair value.

WATCH: Turkish Economy Won’t Survive The Winter

Unsurprisingly, our heatmap keeps Sri Lanka and Pakistan in the spotlight. Both economies have substantial external vulnerabilities, while being exposed to high energy prices. Recent deals with the IMF give some relief in the short term but tackling the underlying economic problems will take a long time to resolve, and Pakistan’s devastating floods imply an additional burden on public finances. Egypt, India and Thailand also remain vulnerable to the global financial tightening and elevated commodity prices.

Some large EM economies, such as South Africa and Brazil, rank relatively well in our heatmap analysis. However, their relative outperformance disguises some country-specific weaknesses. For example, wide budget deficit and high debt still leave Brazil exposed to global financial tightening, although improved terms of trade and a positive real rate work as a buffer. Importantly, our analysis ignores political risk and as the country heads towards the general election in October, further fiscal slippage is likely. BRL is amongst the best performing currencies in the EM space this year, and in REER terms, the currency is 16% overvalued. South Africa, in addition to having high debt and a sustained budget deficit, remains vulnerable to elevated energy prices.

Danske Report, The usual suspects top the rank of our updated EM

vulnerability heatmap

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/