TL on the ropes again

TL-deger-kayip

TL-deger-kayip

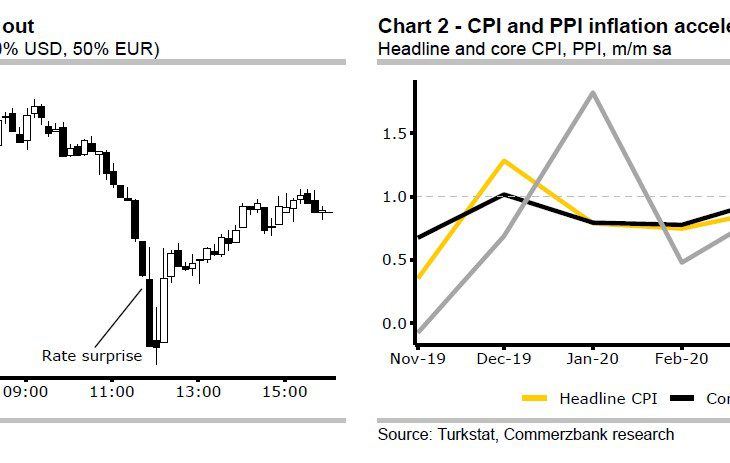

Turkey’s lira slid almost 3% to a record low on Wednesday, extending its losses since President Tayyip Erdogan announced his at the weekend following last month’s elections.

The lira which has come under pressure amid strong forex demand, weakened as much as 2.8% to 22.15 against the dollar, bringing its losses so far this year to 15.5%. At 09 am in Istanbul, TL was slumping by 5.45% vs USD.

The Turkish lira is back to running from record low to record low, comments expert Ozkardeskaya for FXStreet. The dollar-lira is up by almost 15% since mid-May, and more importantly, it looks like the central bank’s efforts to fight a stronger dollar is either fading – after Erdogan’s victory in the latest elections – or keeping the lira steady is becoming more difficult and increasingly expensive for the Turks.

In all cases, we see a movement in the lira that we haven’t seen for a long time. Keep in mind that the lira has not been trading freely since the end of 2021.

Do you get back to selling the lira? The lira is still a black box, and no one knows what the government is really up to. But we know that there is effort, after the elections, to shift Turkey’s beyond-absurd monetary policy toward a more orthodox place – which requires higher interest rates, obviously.

As a result, Turkey appointed Mehmet Simsek as its new finance minister. Mr. Simsek is well-known and well-appreciated by the markets, and is now supposed to clean up the mess of the past year-and-a-half, and eventually restore investor confidence.

But restoring confidence won’t be a piece of cake of course. In past years, Turkey didn’t lack talented finance ministers or smart central bankers. But each time sometime tried to do his/her job correctly – which in Turkey means raising the rates – he/she got rapidly sacked. Therefore, what investors want to see in Turkey is not how talented Mehmet Simsek is in finance, but how resistant he will be to the low-rate pressure from the presidential office.

Liam Peach of Capital Economics stated: “Policymakers wanting a sustainable turnaround in the current account and to attract foreign capital cannot hope to achieve this without a competitive exchange rate. Turkey needs a significant adjustment in the lira, both in nominal and real terms. A faster pace of depreciation would be a welcome sign that policymakers are easing back interventions and letting the currency return towards fair value. But the size of the required currency adjustment will be substantial. Inflation will be higher than otherwise and large and disorderly currency falls may cause strains in the private sector.

Goldman Sachs revised its Turkish lira forecast in the wake of President Tayyip Erdogan’t cabinet revamp, saying it now expected the currency to weaken to 28 to the dollar in 12 months compared with a previous prediction of 22.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/