The CBRT increased the policy rate by 500 bps to 35%

The CBRT, in its October MPC meeting, raised the policy rate to 35.0% with a 500 bps hike.

While the median market expectation also pointed to a 500 bps hike, a large portion of the market was expecting an increase below 500 bps. Specifically, out of the 22 institutions participating in the Foreks survey, 10 of them had predicted an increase below 500 bps.

The CBRT maintains its gradual tightening pledge

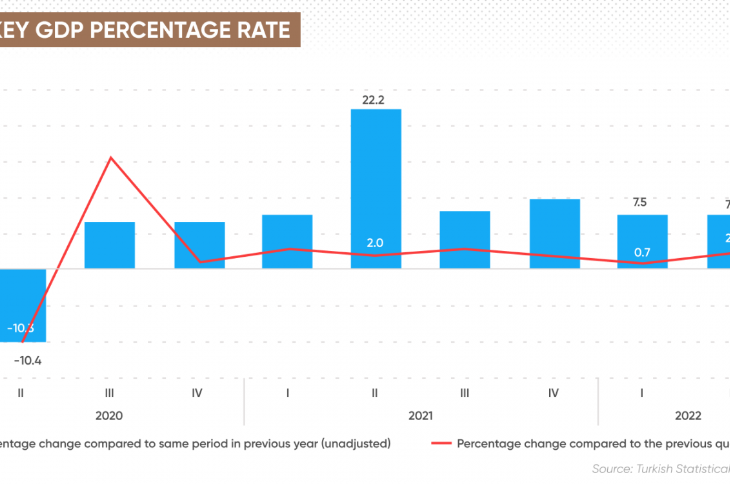

The CBRT maintains its pledge that monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in inflation outlook is achieved. We also see that the accompanying statement remains very similar to the one published last month. Accordingly, the CBRT emphasizes that the strong domestic demand, rigidity in service prices, and deterioration in inflation expectations continue to put upward pressure on inflation, while also highlighting that geopolitical developments pose risks to the inflation outlook due to oil prices.

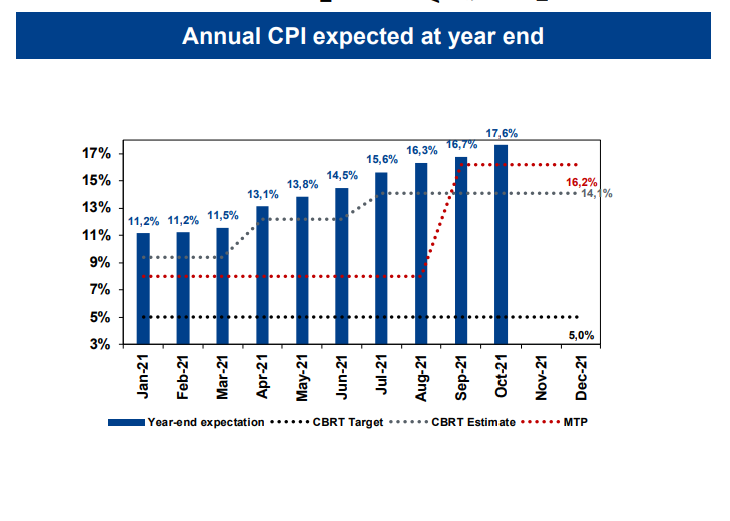

As a result, CBRT maintains its prediction that the year-end inflation will be close to the upper bound of the forecast range in the Inflation Report.

On the other hand, the CBRT evaluates that he pass-through from tax regulations and cost pressures stemming from wages and exchange rates has been largely completed, and that the underlying trend in monthly inflation is on course to decline. Like the previous month, CBRT continues to assert that the increased demand for Turkish lira assets, both domestically and internationally, will significantly contribute to price stability.

[embed]https://www.youtube.com/watch?v=DV2XuzF35AE&t=20s[/embed]

The Inflation Report to be released next week and the inflation data for October may shape policy rate expectations

Market expectations for the year-end policy rate concentrate around 40%, with the pace of rate hikes likely to be reduced to 250 bps in the November MPC meeting. We concur with this view, considering the CBRT's gradual rate hike tendency. Yet, we also think that the Quarterly Inflation Report to be announced on 02-Nov (CBRT's expectations regarding the inflation path) and the details of October inflation data to be released on 03-Nov may influence these expectations and lead to an upward revision in policy rate expectations.

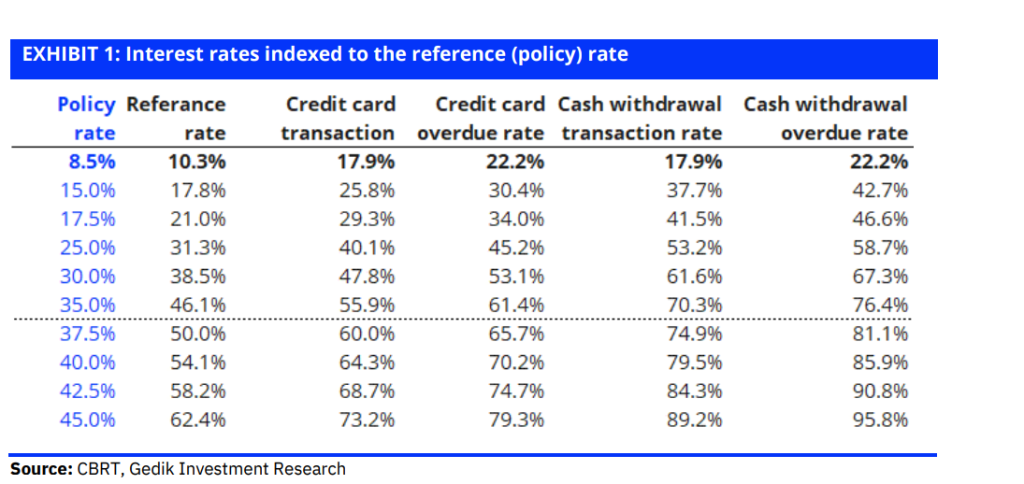

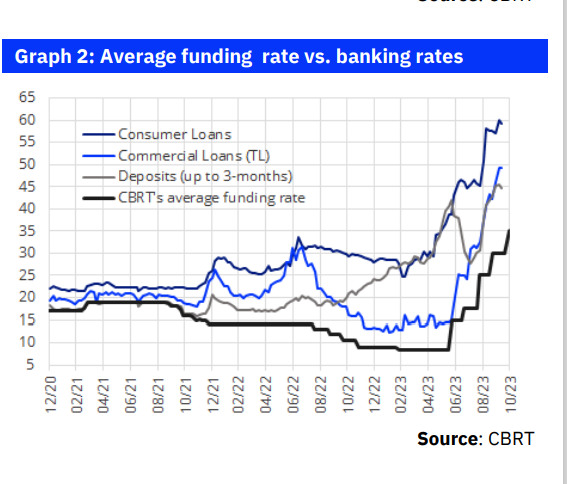

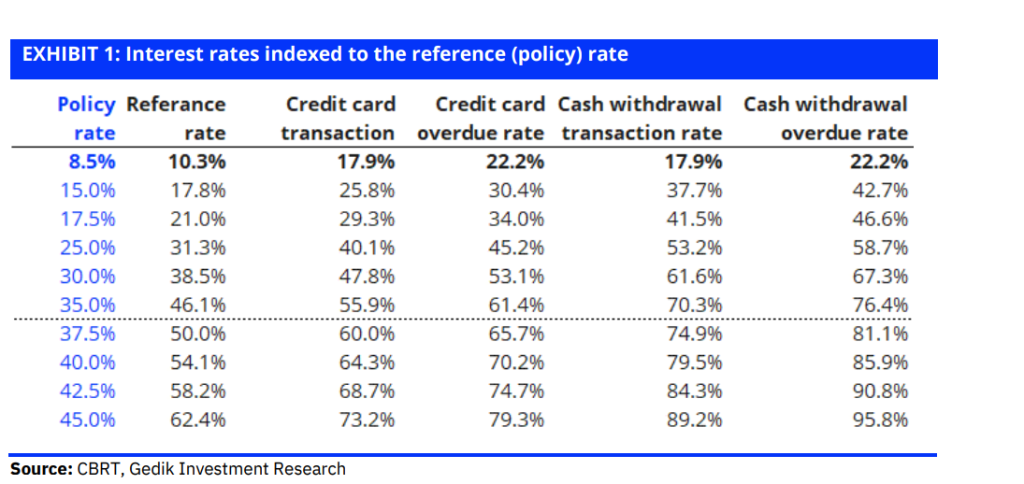

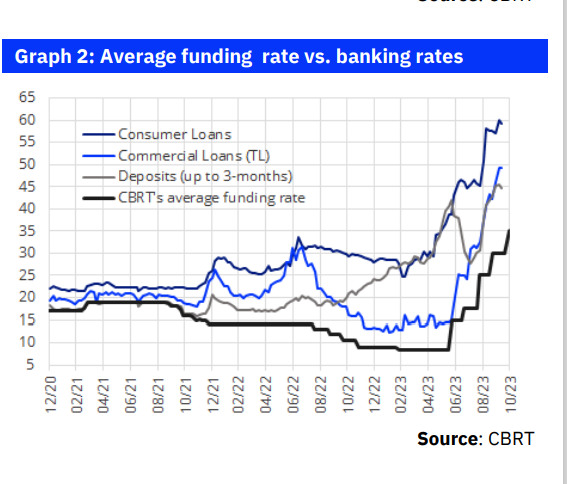

Meanwhile, following the policy rate hike, cash advance and credit card cash withdrawal interest rates are set to increase from the current monthly rate of 4.02% (annualized 61.6%) to a monthly rate of 4.47% (annualized 70.3%) in the coming days, which will help to slow down domestic demand. That said, we do believe that deposit rates should rise further to significantly higher levels, such as around 60%, in order to restrain domestic demand, break the backward-looking pricing behaviour, and encourage the savings tendency. This, in turn, requires a higher policy rate.

The steps to incentivize the conversion of Turkish Lira deposits will follow the policy rate hike

CBRT's statement also mentions that the monetary transmission mechanism will be further strengthened by taking additional steps to increase the share of Turkish lira deposits. Inclusion of this statement is in fact in line with our expectation. We understand that the CBRT is not comfortable with the decline in deposit rates in recent days, which may partly be attributed to a slowdown in loan demand and partly to banks approaching their conversion targets after the increased outflows from the FX-protected deposit (KKM) accounts. As such, we may expect upward revision of banks’ conversion targets from KKM accounts to Turkish Lira deposits. In addition to this, we also think that the CBRT may also introduce new adjustments for required reserve ratios.

By Economist Serkan Gonencler

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel:

https://www.facebook.com/realturkeychannel/

[embed]https://www.youtube.com/watch?v=Ce5SZ3HqFD0&t=635s[/embed]

cbrt2

cbrt2

On the other hand, the CBRT evaluates that he pass-through from tax regulations and cost pressures stemming from wages and exchange rates has been largely completed, and that the underlying trend in monthly inflation is on course to decline. Like the previous month, CBRT continues to assert that the increased demand for Turkish lira assets, both domestically and internationally, will significantly contribute to price stability.

[embed]https://www.youtube.com/watch?v=DV2XuzF35AE&t=20s[/embed]

On the other hand, the CBRT evaluates that he pass-through from tax regulations and cost pressures stemming from wages and exchange rates has been largely completed, and that the underlying trend in monthly inflation is on course to decline. Like the previous month, CBRT continues to assert that the increased demand for Turkish lira assets, both domestically and internationally, will significantly contribute to price stability.

[embed]https://www.youtube.com/watch?v=DV2XuzF35AE&t=20s[/embed]