ANALYSIS: Turkish exports are in trouble, rising rates could cause more damage

ihracat

ihracat

By Levent Yilmaz, Yeni Safak Daily

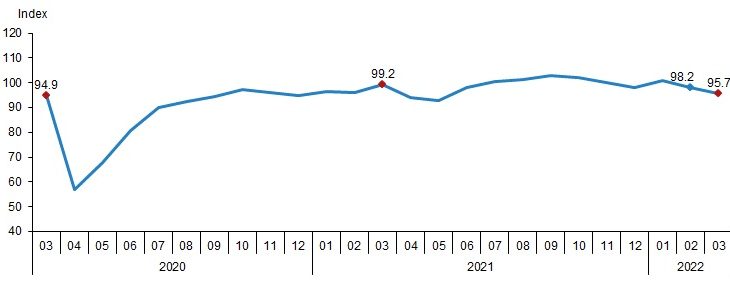

Last Tuesday, TurkStat announced Foreign Trade Statistics for September. Exports decreased by 0.5% while imports slumped by 14.6%. In the light of these data, exports decreased by 0.5% in the January-September period compared to the same period of the previous year, while imports increased by 1.2%. Thus, while the foreign trade deficit was 5.01 billion dollars in September, the cumulative deficit in the January-September rose to 87.2 billion dollars. This figure indicates an increase of 4.9% compared to the same period of the previous year.

Of course, these developments in foreign trade do not augur well. Ankara wants to increase exports and reduce imports, thus raising the positive contribution of foreign trade in reducing its chronic problem, the current account deficit. However, for such a development to occur, certain conditions must be met simultaneously.

The first of these is the improvement of foreign demand conditions. This issue depends on cyclical developments in the global economy and the internal dynamics of our main export markets. In other words, even if policy is set up correctly at home, it may not be possible to increase exports if there is no foreign demand. For example, the Eurozone, our main export market, contracted in the 3rd quarter of 2023, contrary to expectations. According to the data of the European Statistical Office Eurostat, the regional economy shrank by 0.1% in the July-September period compared to the previous quarter. Moreover, the economy of Germany, the country we export the most to, is currently technically in recession.

[embed]https://www.youtube.com/watch?v=DV2XuzF35AE[/embed]

The second condition is to be competitive. In this regard, exporters' expectation is that the exchange rate will increase as much as inflation. However, instead, the issue of being competitive on a product basis should be evaluated in detail. Because one of the Central Bank's latest studies points to the following fact: The effect of real exchange rate movements on export volume is relatively limited.

Finally, the most important issue is reducing imports for domestic demand. It is obvious that the most important step here is protectionist policies, as many other countries do. If imports aimed at domestic demand do not decrease with tight monetary policies, it is essential that regulations that will reduce imports come into play more effectively.