Güldem Atabay: Epic defeat for Erdoğan- A historic turning point in Turkish politics

Screenshot (1240)

Screenshot (1240)

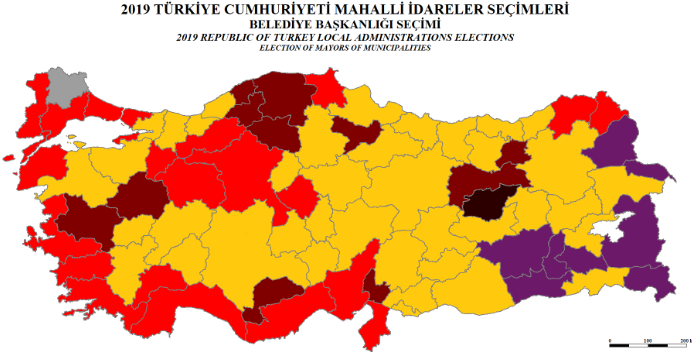

In the local elections held on March 31, Erdogan, despite securing a crucial presidential victory just 10 months prior, suffered a significant defeat. This defeat was not confined to major cities like Istanbul but was widespread across Turkey.

One of the reasons for this loss was the selection of wrong candidates, particularly Kurum and Altınok, chosen with complacency following the general election. However, the primary factor was that voters began to feel the mounting cost of the damage caused by Erdogan's economic management since 2018, particularly with Şimşek policies. This realization prompted a shift in their voting preferences.

In cities like Istanbul and Ankara, where voters were satisfied with the mayoral style of Imamoğlu and Yavaş from the main opposition party, the CHP, their positions were further solidified. This trend extended to many other cities in deeper Anatolia as well.

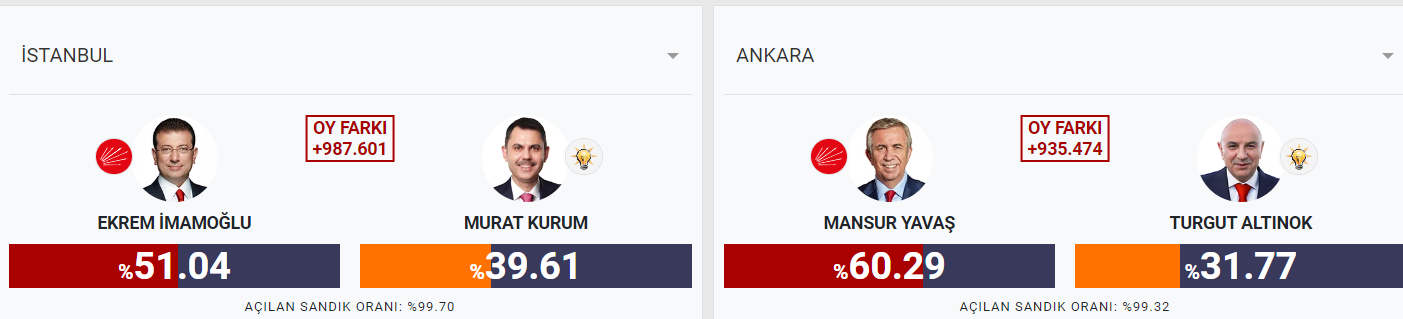

Polls in the last week indicated that Istanbul would likely remain under Imamoğlu's leadership with a roughly 6-8 point difference over Kurum. We also noted in GADT on March 29 that a significant victory for Imamoğlu in Istanbul could lead to the AKP losing votes across Turkey. However, the AKP's loss of 9 points nationwide compared to Imamoğlu's 11-point difference in Istanbul indicates a notable shift in Turkish politics.

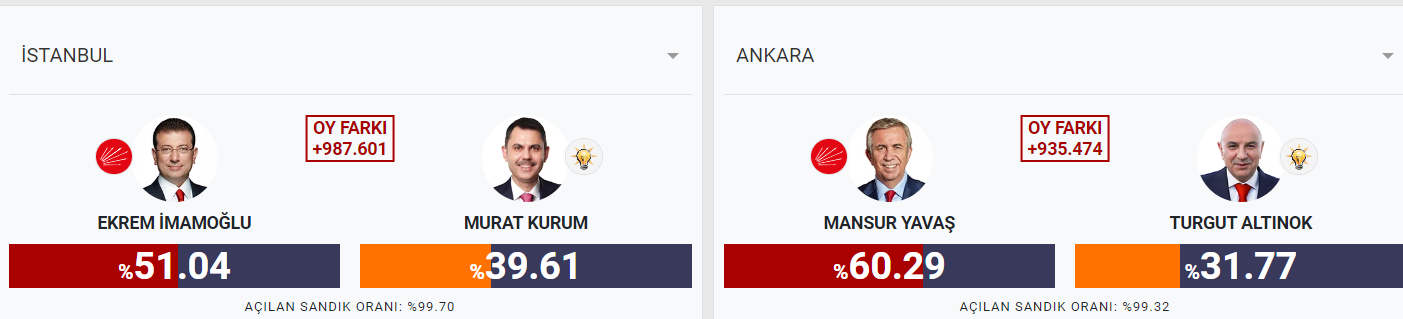

The standout victor of the election is undoubtedly Imamoğlu. Securing over 51% of the votes in Istanbul, crossing the crucial 50% threshold, marks a significant milestone and serves as a prelude to the 2028 presidential election. Imamoğlu's strategic move to step onto the stage in Saraçhane just as Erdogan delivered his speech in Beştepe holds symbolic importance for the upcoming presidential race, whether it occurs in 2028 or earlier. Following last night's outcome, Imamoğlu emerges as the sole and formidable rival to Erdogan, having defeated him for the third time.

Furthermore, Imamoğlu's victory extends within the CHP itself. If the CHP leader, Özgür Özel, refrains from engaging in a leadership battle, avoids obstructing Imamoğlu's path, it is plausible to anticipate a shift towards a more stable and cohesive political discourse within the CHP.

The standout victor of the election is undoubtedly Imamoğlu. Securing over 51% of the votes in Istanbul, crossing the crucial 50% threshold, marks a significant milestone and serves as a prelude to the 2028 presidential election. Imamoğlu's strategic move to step onto the stage in Saraçhane just as Erdogan delivered his speech in Beştepe holds symbolic importance for the upcoming presidential race, whether it occurs in 2028 or earlier. Following last night's outcome, Imamoğlu emerges as the sole and formidable rival to Erdogan, having defeated him for the third time.

Furthermore, Imamoğlu's victory extends within the CHP itself. If the CHP leader, Özgür Özel, refrains from engaging in a leadership battle, avoids obstructing Imamoğlu's path, it is plausible to anticipate a shift towards a more stable and cohesive political discourse within the CHP.

In the latest local elections:

In the latest local elections:

The standout victor of the election is undoubtedly Imamoğlu. Securing over 51% of the votes in Istanbul, crossing the crucial 50% threshold, marks a significant milestone and serves as a prelude to the 2028 presidential election. Imamoğlu's strategic move to step onto the stage in Saraçhane just as Erdogan delivered his speech in Beştepe holds symbolic importance for the upcoming presidential race, whether it occurs in 2028 or earlier. Following last night's outcome, Imamoğlu emerges as the sole and formidable rival to Erdogan, having defeated him for the third time.

Furthermore, Imamoğlu's victory extends within the CHP itself. If the CHP leader, Özgür Özel, refrains from engaging in a leadership battle, avoids obstructing Imamoğlu's path, it is plausible to anticipate a shift towards a more stable and cohesive political discourse within the CHP.

The standout victor of the election is undoubtedly Imamoğlu. Securing over 51% of the votes in Istanbul, crossing the crucial 50% threshold, marks a significant milestone and serves as a prelude to the 2028 presidential election. Imamoğlu's strategic move to step onto the stage in Saraçhane just as Erdogan delivered his speech in Beştepe holds symbolic importance for the upcoming presidential race, whether it occurs in 2028 or earlier. Following last night's outcome, Imamoğlu emerges as the sole and formidable rival to Erdogan, having defeated him for the third time.

Furthermore, Imamoğlu's victory extends within the CHP itself. If the CHP leader, Özgür Özel, refrains from engaging in a leadership battle, avoids obstructing Imamoğlu's path, it is plausible to anticipate a shift towards a more stable and cohesive political discourse within the CHP.

In the latest local elections:

In the latest local elections:

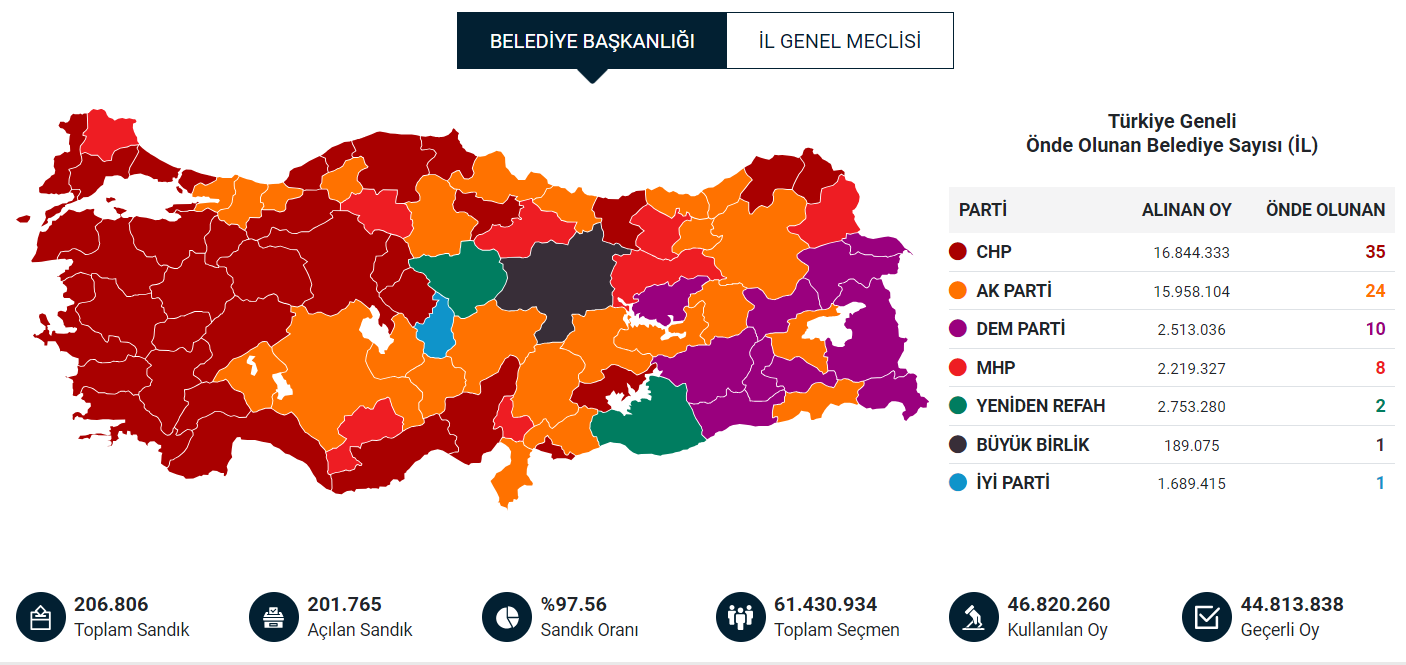

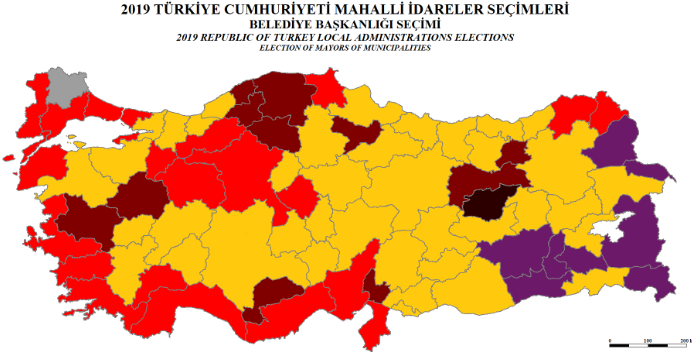

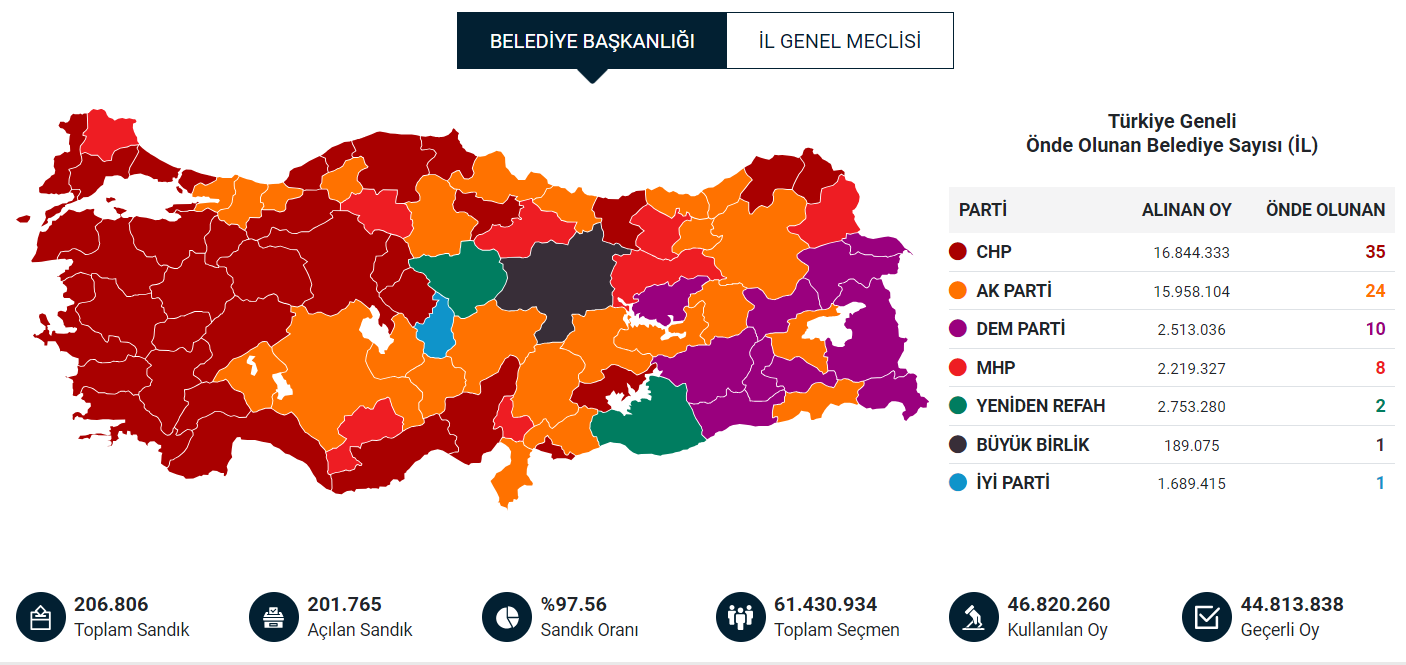

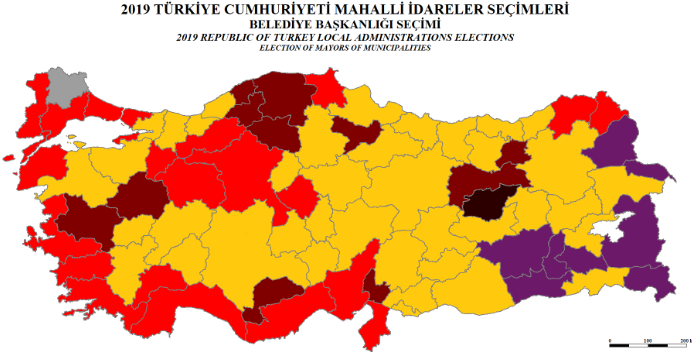

- The CHP saw a notable rise in support, climbing from 30.1% to 37.6%, securing its position as the leading party in Turkey.

- The AKP experienced a decline in its nationwide vote share, dropping from 44% in 2019 to 35.6%.

- Both the MHP and İYİP faced declines, with the MHP falling from 7.3% to 4.9% and İYİP experiencing a steeper drop from 7.45% to 3.8%. Their lack of coherent policies left them vulnerable amidst increasing social challenges.

- A surprising outcome was the shift of voters dissatisfied with the AKP, particularly over its Israel policy, towards the Islamist YRP, which saw its vote share increase to 6.1%.

- While the DEM's increase from 4.3% to 5.6% was not dramatic, it maintained its regional stronghold in the Kurdish-populated southeast.

- Several parties, including the extreme nationalist Zafer Partisi, right-wing Gelecek Partisi, DEVA Party, and Islamist Saadet Partisi, suffered significant setbacks.

- Hüdapar, a radical Islamist party and member of the governing coalition, which had a notably higher voice in previous elections, was virtually non-existent in this one.

The risk for Simsek is the "lame duck" role

On the night of the May 2023 victory, Erdogan had already set his sights on reclaiming Istanbul. While the CHP's victory in Istanbul was anticipated, the broader outcome across Turkey raised a pressing question for the market:- Will Şimşek be held accountable for the defeat or not?

- Erdogan openly acknowledged the failure, expressing a commitment to self-critique and corrective measures over the next four years in the absence of election cycles.

- This statement implies that plans for a constitutional referendum aimed at bolstering Erdogan's authority have been shelved abruptly.

- While Erdogan's assurance of no early elections may not be absolute, the presence of a stronger opposition in the form of the CHP and the resilient emergence of the YRP suggests a more challenging political landscape for the AKP.

- With the AKP undergoing a period of introspection, there's a possibility that some deputies from DEVA, Gelecek, and Saadet Party may find themselves "inclined" to continue their political careers within the AKP fold.

- The appointment of trustees in regions won by the Kurdish DEM Party is unlikely to occur in the next five years, given the significant losses suffered by the AKP and nationalist parties.

- The continuation of tight monetary policy is imperative, and in fact, it may need to be further tightened. With depleted reserves and Erdogan's political stability at risk, there's no room for risking a significant depreciation in the Turkish Lira. While there might be an initial negative reaction in the TRY, it can likely be contained swiftly.

- However, Şimşek may encounter constraints in implementing the fiscal policy adjustments he desires post-election. This could render him ineffective in combating inflation, making him essentially a lame-duck minister.