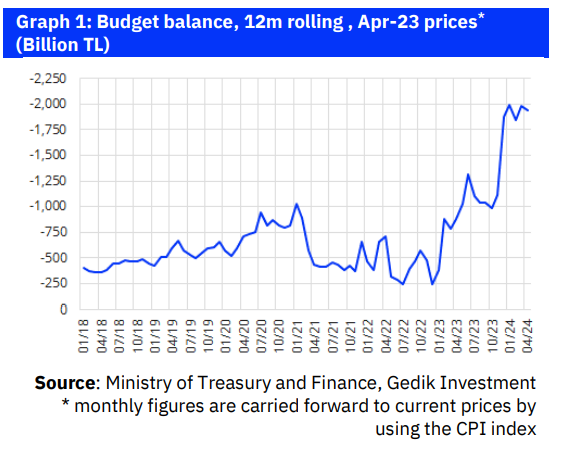

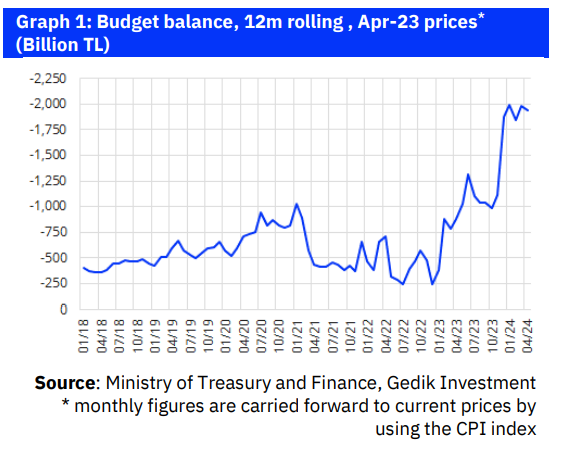

The central government budget posted a TL178bn deficit in April, while the 12-month rolling deficit rose to TL1.68trl.

In April, the central government budget posted a TL177.8bn deficit compared to the TL132.5bn deficit in the same month of last year, while the primary deficit was TL63.8bn vs. last year’s TL98.0bn primary deficit. During the first four months period, a budget deficit of TL691bn was recorded compared to TL383bn in the same period of 2023, leading to an increase in the 12-month cumulative deficit to TL1.68 trl from TL1.37trl at the end of 2023. During the same period, the non-interest budget deficit increased from TL700bn to TL780bn.

[embed]https://www.paturkey.com/news/important-revelations-from-mehmet-simsek-in-qatar-economic-forum/2024/[/embed]

Earthquake-related budgetary spending remains limited.

Recall that, there was a cash deficit of TL191.5bn in December 2023 vs. the accrual-based budget deficit of 842.5bn TL in the same month. This is because a significant portion of earthquake-related budgetary allocations has accrued but not been utilized in 2023. As Graph 3 depicts, the continued sizeable deviation between cash-based and accrual-based budget deficits indicates that payments made from the budget for earthquake-related purposes remain much below initial projections.

Rising budgetary expenses, interest payments in particular, continue to impact the budgetary dynamics adversely. There is still a sizeable 80% YoY nominal increase in non-interest expenditures in April, despite a slight easing compared to previous few months. For the January-April period, we see a whopping 95% YoY rise here (in nominal terms), reflecting a broad-based escalation rather than being solely attributed to earthquake-related expenses. In addition, the impact of interest payments was more pronounced in April with a rise to TL114.0bn from 34.5bn in April 2023. For the January-April period, interest expenditures stand at TL364bn, which suggests a significant deterioration compared to TL135bn in the same period of 2023.

[embed]https://www.youtube.com/watch?v=GIFC4ME9wig&t=3s[/embed]

Robust tax revenues have been mitigating the deterioration of the budget deficit. Despite this deterioration on the expenditure side, the significant uptick in tax revenues, driven by post-election tax hikes, and, more particularly continued robustness in domestic demand, continues to limit the worsening of the headline budget balance since the second half of 2023. Tax revenues registered a 110% YoY nominal increase in April, with the increase in revenues from domestic VAT and Special Consumption Tax on fuel reaching 151% and 322%. The YoY nominal increase in domestic VAT revenues reached 197% for the January-April period and 210% for the last 12-month period, which is a clear reflection of the robustness in domestic demand, although there has been some easing in the previous few months.

This is another indication that domestic demand related inflation inertia remains quite strong.

Year-end budget deficit/GDP ratio likely to remain above 5.0%.

Our preliminary estimates suggest that the recently introduced savings package may marginally alleviate the budget deficit, albeit by a modest 0.3-0.4% of GDP under an optimistic scenario. Despite this contribution, we expect the year-end budget deficit/GDP ratio at slightly above 5.0%.

By Serkan Gonencler, Chief Economist, Gedik Investment

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel:

https://www.facebook.com/realturkeychannel/

budget deficit-april

budget deficit-april

budget deficit-april

budget deficit-april