Commentary: Economic slow-down is undermining the stock market

markets brake

markets brake

The great volatility experienced in the first two days of the past week gave way to cautious waiting towards the end of the week. The panic atmosphere caused by the Central Banks of Japan and the USA was brought under control with the verbal intervention of the two authorities. While risk indicators started to normalize completely, on the Turkish front, the slowing economy and its impact on stocks began to be talked about loudly.

First of all, on Friday, TurkStat announced industrial production data for June. In June industrial production contracted by 4.7% on an annual basis and by 2.1% compared to the previous month. As you may remember, the Istanbul Chamber of Industry (ISO) Turkey Manufacturing PMI, which is the leading indicator of growth, reported a value below the critical threshold of 50 (47.2) in July, indicating that the slowdown in the sector had entered its fifth month. The tightening cycle (policy rate 8%), which the Central Bank (CBRT) started in June right after the Presidential elections last year, continued until the local elections in March and has remained stable at 50% for the last 4 months. During this time period, while the “antibiotics” taken began to restrain inflation, the stagnation in the economy (side effect) began to spread to macroeconomic data.

Although it is desirable for the economy to slow down in the fight against inflation - the rate of increase in prices slows down as high interest rates hinder demand by increasing the habit of saving - we need to note that currently, consumption is not decelerating faster than production. To put the current slow-down into context: After the pandemic period, people who were 'imprisoned' at home suddenly went out and splurged, with the slogan "There is only one life, live it well"; or the Turkish lira has been on a turbulent course for the last 10 years, increasing inflation and raising interest rates. This boost in demand was bolstered by new generation's demand for houses and cars. The fact that dreams of buying a home are becoming more difficult day by day is one of the main reasons why consumption is still ticking strongly. Although this change is a hot topic in itself, we can easily say that the steps taken by the authority in the fight against inflation have caused serious damage to the outlook of the real sector.

[embed]https://www.youtube.com/watch?v=9oTDu0QzJL8&t=1260s[/embed]

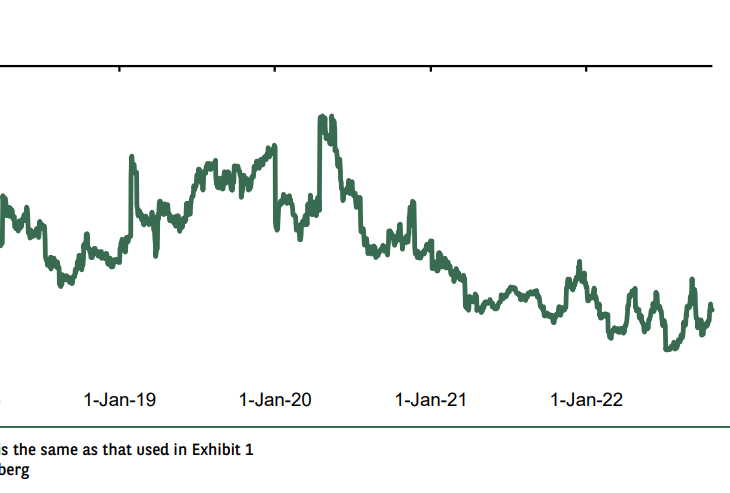

In this regard, the bank stock (XBANK) index, which has been the locomotive of Borsa Istanbul for a long time, has faced a serious sell-off in recent weeks, especially in the global panic atmosphere experienced last week. As a banker who manages the treasury, I can clearly say that the slowdown signals from the real sector, the restrictions on loan growth via additional macro-prudential measures and high deposit interest rates began to put pressure on the asset structure of the banks; which reflected to 2Q2024 financial results. While the contraction in net interest margins (loans - deposits) was very visible in the balance sheets, international credit rating agency Fitch announced that Turkish banks were under margin pressure; with moderate deterioration in asset quality under way.

Let me remind you once again that foreigners have sold 1.3 billion dollars in Turkish stocks, while buying 11 billion dollars in government bonds since the beginning of the year, attesting to falling attractiveness of the former.

In this context, while the BIST100 index completed the last business day of the week with a decrease of nearly 2%, the XBANK index decreased by 4.4% in parallel with the perception that the credit quality of banks has deteriorated. In the last three weeks, the banking index has fallen by 20% vs main index by 12% from its peak! Let me also note that we reached our target of 11-12 thousand index levels in the main index three weeks ago.

On the exchange rate front, let's note that the CBRT, which sold ~ 6.7 billion dollars in the first three days of the past week, where turbulence was quite intense, accumulated reserves of 0.5 billion dollars again on Thursday. Thus, net reserves excluding swaps decreased to 14.6 billion dollars. While the USDTRY exchange rate has fluctuated at 33.50 levels in recent days after peaking at 32.60, the 5-year CDS risk premium was withdrawn by 277 basis points after testing 300 basis points.

Author: Emre Degirmencioglu, Treasury Director, Kıbrıs İktisat Bankası

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/