Turkey’s new Medium Term Economic Program to be unveiled this week, what to expect?

mtep

mtep

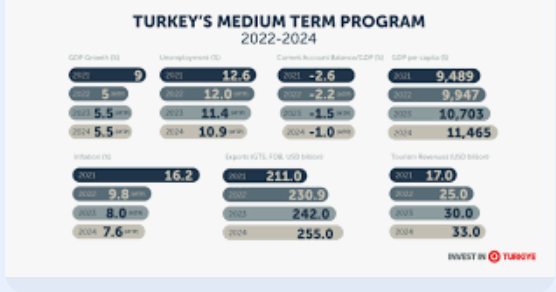

While work to update the Medium Term Program (MTP), which will be the most critical economic document in recent history, is nearly finished, there is very little accurate information about its content. President Erdoğan barely mentioned the economy and the MTP in his speeches in August, which might mean it will lack positive news for investors. To recall the economic management team was planning to announce more similar measures after the first tax package was approved by the Turkish Grand National Assembly, but it was not clear whether these would be included in the MTP.

Bloomberg published the last important news about the content of the MTP, and in the news we have shared below, there was information that the political will tolerate low growth in 2025-2026 to reduce inflation.

Turkey Set to Cut Growth Outlook as Inflation Fight Continues

A more comprehensive analysis appeared in pro-government Yeni Şafak Newspaper on August 30. The news stated the following:

[embed]https://www.youtube.com/watch?v=bPo2f5azRIY&t=956s[/embed]

The final touches of the Medium Term Program, which will be announced to the public on September 5, were made at the Economy Coordination Board meeting. This year's growth target is expected to be reduced from 4%, and the year-end inflation target, which is 33% in the current MTP, is expected to be increased, in line with data. Current account deficit and budget deficit to GDP ratio forecasts will be reduced.

According to the information obtained by Yeni Şafak; There will be no increase to the 2025 inflation target. The target of reducing inflation to single digits in 2026 will be maintained. "The prescription prepared at the beginning of the year is working. Despite earthquake spending, this year's budget deficit is below expectations. The real decrease in earthquake expenditures will begin from the second quarter of the year. The budget deficit, which was at the level of 2.6 trillion liras in the 2024 budget, will be reduced significantly in the 2025 budget," was the information shared by sources who were privy to the resolutions of the meeting. Sources stated that it is estimated that earthquake expenditures will permanently decrease as of mid-2025.