Last week was pivotal for the Turkish economy. First, second-quarter growth data was released, revealing the initial effects of deepened monetary tightening on growth dynamics, particularly in the “election-free years” that began after the local elections. This was followed by August inflation data, which underscored the continued strength of inflation, even in one of the most seasonally favorable months for the “disinflation process.”

The growth-inflation dynamics for 2025 were already becoming evident in these figures, and the government further clarified its economic outlook by announcing the 2025-2027 Medium Term Program (MTP), which included revisions for 2024. When these three elements are considered together, a clearer picture of 2025 emerges: after 22 years of AKP rule, the most challenging year for the average citizen may be on the horizon.

What Does the Growth Data Tell Us?

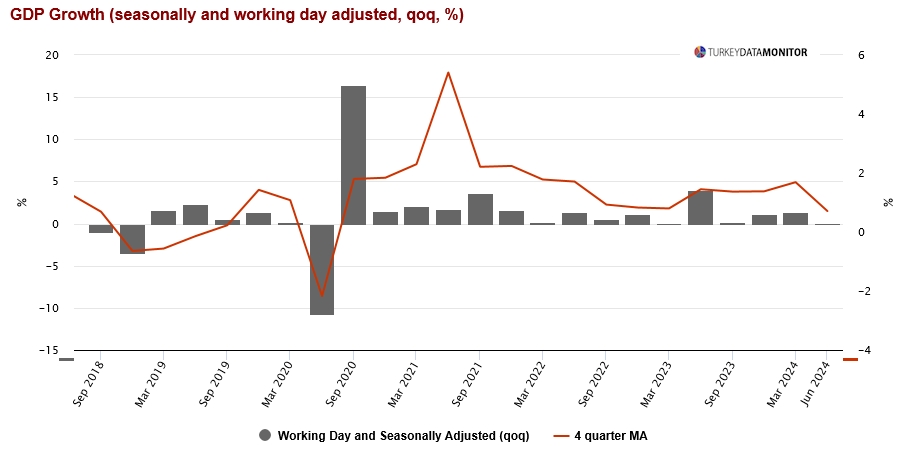

The CBRT’s blog post evaluating the second quarter 2024 GDP data aligns with broader economist views. Since the pandemic, Turkey’s growth has largely been driven by strong domestic demand, which has consistently pushed growth rates above potential. However, in the second quarter, following local elections, growth moderated significantly, rising by just 0.1% quarter-on-quarter and 2.5% year-on-year. This is a noticeable deceleration compared to the 1.4% and 5.3% growth rates seen in the first quarter. The CBRT attributes this slowdown to its monetary tightening efforts aimed at curbing inflation, viewing it as a necessary step in stabilizing the economy.

Both the CBRT and Minister of Treasury and Finance Mehmet Şimşek have repeatedly emphasized that growth is undergoing a “rebalancing” in response to the economic slowdown. This suggests that while first-quarter growth was primarily driven by robust domestic demand, the second quarter marked a shift where the contribution of domestic demand diminished, and net exports began to play a positive role in growth.

In its latest Inflation Report, the CBRT indicates that the current “output surplus” will likely turn into an “output deficit” in the coming quarters. It anticipates that a negative quarterly growth rate could ease the inflationary pressures stemming from strong domestic demand, potentially leading to a reduction in inflation beyond what base effects alone would provide.

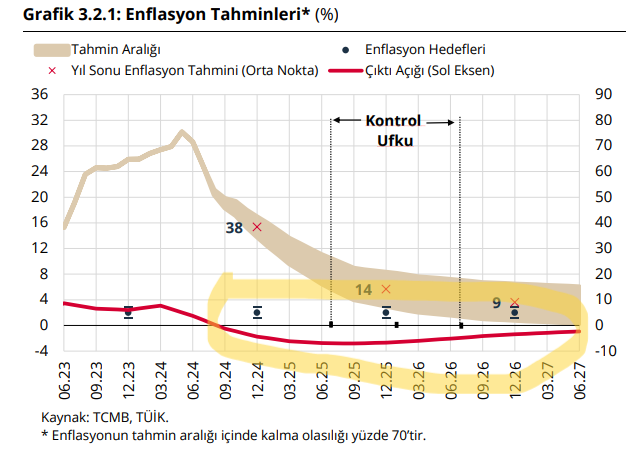

Given this outlook, the CBRT has forecast below-potential growth for 2025-2026 and set inflation targets of 38% for the end of 2024 and 14% for the end of 2025. The CBRT has also suggested that it would tolerate inflation up to 21% by the end of 2025, based on a +/- 7% margin around its target. Should inflation remain above this threshold, additional measures will likely be implemented to bring it down.

These measures could involve calling for fiscal policy to align with disinflationary objectives and potentially revising inflation expectations upward through 2025, as was done in 2024. In its Article IV Review, the IMF emphasized that interest rate hikes may be necessary if fiscal policy does not tighten, assuming that the inflation targets are to be taken seriously.

The overall approach reflects the CBRT’s commitment to balancing economic growth with inflation control, though the success of this strategy may depend heavily on the coordination between monetary and fiscal policy.

What Does August Inflation Tell Us?

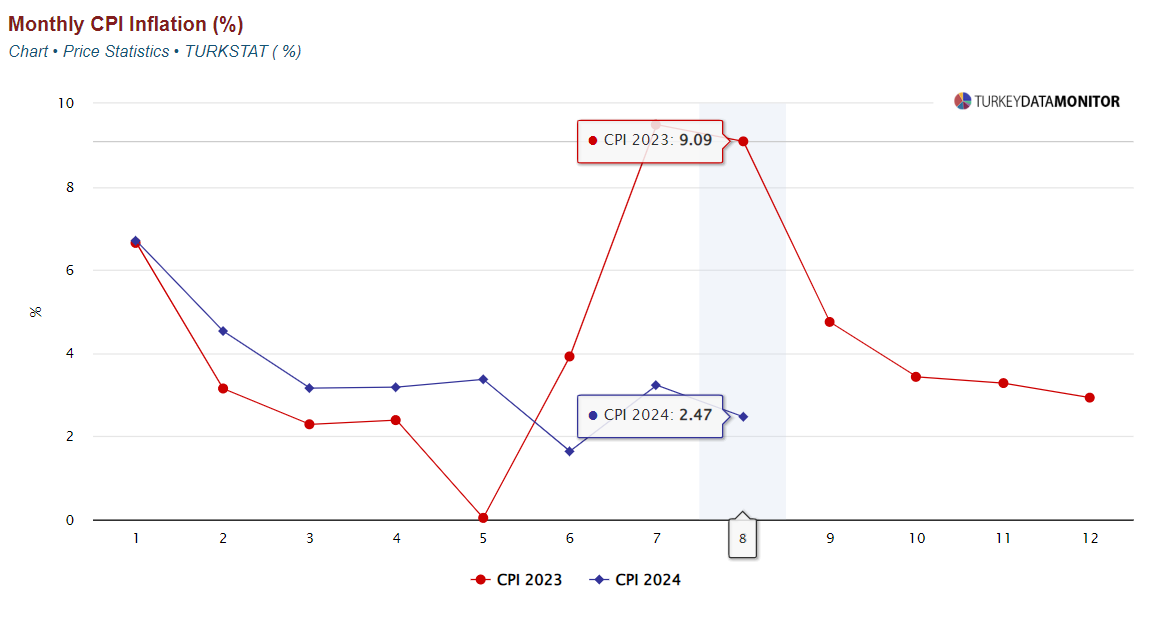

In August 2024, typically the most favorable month for inflation seasonality, consumer prices increased by 2.47%, significantly higher than the 20-year average of 0.4%. Despite this, the base effect—stemming from the high 9.09% inflation recorded in August 2023—helped reduce annual inflation by 9.81 percentage points, bringing it down to 52%. This also represents a 23-point decline from the peak of 75% in May 2024.

These figures serve as the foundation for political claims that the “transition period in inflation is over” and that the “disinflation period has begun.” While the annual rate has indeed slowed, the relatively high monthly increase in a seasonally favorable period signals that inflationary pressures remain a challenge, raising questions about the sustainability of disinflation without stronger measures. The political narrative may emphasize progress, but underlying data suggests that achieving consistent inflation control will likely require ongoing efforts and policy adjustments.

The CBRT’s Monthly Price Developments report offers a detailed look into the sources of inflation, highlighting areas of concern also emphasized by economists. Notably, food prices saw a 1.1% decline for the first time in a while, driven by a sharp 10% drop in fresh fruits and vegetables, thanks to the seasonal effects of summer. However, processed food prices increased by 2.4% month-on-month. Meanwhile, public sector price hikes that exceeded inflation targets contributed to higher energy costs, and persistent inflationary pressures in transportation (9.2%) and education (11%) within the services sector remain significant.

Despite this, the CBRT has maintained its end-2024 inflation target at 38%, without updating it. However, economists suggest this target is unrealistic, with inflation unlikely to drop below 40% by year-end. Current expectations hover between 43-45%, while projections for 2025 average around 28-30%.

In addition to headline inflation, seasonally adjusted core inflation (B-C indices) remains elevated, exceeding 3% month-on-month. For the CBRT, which aims for a monthly inflation target of 1.5% in the last quarter, this trend remains uncomfortably high. Therefore, an interest rate cut is unlikely for at least the next three months.

When analyzing both growth and inflation data, a clear picture emerges:

1. Economic momentum is not slowing fast enough: Growth is decelerating amid tighter monetary policies, but not at the pace needed. The output gap—negative quarterly growth that the CBRT sees as necessary to meet its inflation targets—has yet to materialize. The CBRT’s strategy for lowering inflation through 2025 relies on continued low growth, emphasizing the need for a further slowdown in domestic demand to achieve this.

2. Inflation targets lack credibility: In an interview with Reuters, Deputy Governor Karahan called for stronger support from fiscal policy, signaling that monetary policy alone won’t be enough. The CBRT is urging fiscal policy to adopt the same “rational” focus on reducing inflation as its own efforts.

To accurately evaluate the 2025-2027 Medium Term Program (MTP), these two key realities—slower-than-needed growth and questionable inflation targets—must serve as the foundation of any analysis.

Where will the MTP take us?

The Medium-Term Program (MTP) lays out a clear goal: to gradually reduce inflation to single digits over the next three years. Achieving this objective places significant importance on the CBRT’s (Central Bank of the Republic of Turkey) growth-inflation relationship and its projections, particularly as the central bank is tasked with the responsibility of controlling inflation.

The CBRT’s ambitious inflation targets assume that economic growth will need to fall below 3.5% to succeed in disinflation efforts. However, this creates a tension with the MTP’s growth targets, which are critical to assess for overall credibility.

The interplay between slowing growth, inflation reduction, and unemployment is an essential part of this equation, as the inevitable rise in unemployment due to reduced growth will impact various sectors of society.

Fiscal policy, in this context, plays a key role in determining how the burden of this adjustment will be distributed.

The consistency of macroeconomic aggregates and public finance plans among and within each other also constitutes the credibility of the MTP. As the credibility increases, the degree of ownership of the program rises. As ownership increases, targets naturally become achievable.

It is worth looking at whether there is a consistent MTP that can be owned.

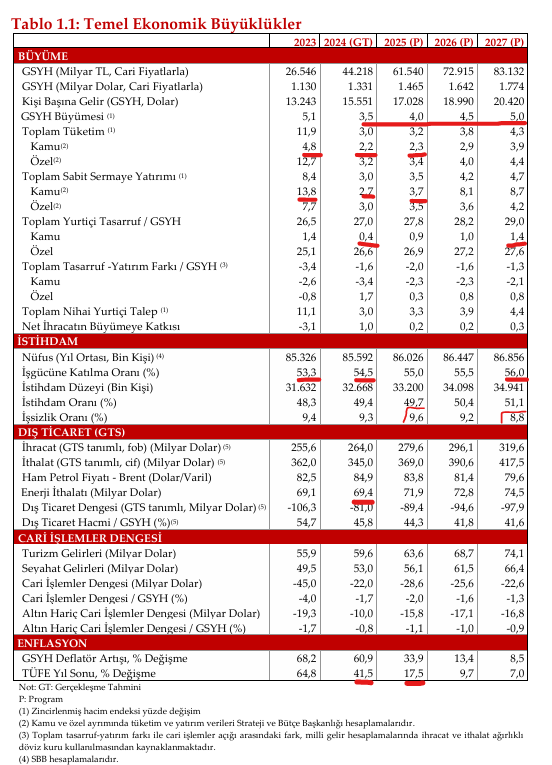

1. Economic growth in the MTP is above the CBRT’s assumptions for disinflation: We do not see the slowdown in growth implied for 2025, the most critical year for the CBRT in the fight against inflation, in the MTP targets. On the contrary, GDP growth is planned to slow to 3.5 percent in 2024 and then gradually increase by half a percentage point to 5 percent in 2027.

Instead of the inflation target of 14 percent in 2025, which the CBRT kept unchanged just a few weeks ago, the MTP expects 17.5 percent. It is difficult to explain the difference in expectations for the same data in such a short period of time. 17.5 percent is actually within the CBRT’s upper limit of expectations (21 percent). However, we can think that the reason why the CBRT insists on 14.5 percent is the desire to increase the minimum wage in December 2024 according to the target inflation. It is possible that the CBRT may raise the end-2025 target to 18-20 percent after having made a reference to limiting the minimum wage increase to 20-25 percent by keeping the target at 14 percent. For the 2025 official CPI target to hold, GDP should not grow by more than 2 percent in 2025, roughly.

In this case:

– If the 4 percent GDP growth in the MTP is realized, it is impossible to bring inflation down to 17.5 percent,

– Or, if inflation slows down to 17.5 percent, it is impossible for growth to even approach the MTP target of 4 percent.

This is a major contradiction for a government that has set its goal to reduce inflation with a three-year program.

From the words of President Erdoğan, who gave “strong support” to the MTP in his X message after the announcement of the program, we understand that the confusion that led to the current inflation situation persists despite Şimşek, the CBRT and the MTP, even as he supports all three. Erdoğan still cannot accept the fact that prioritizing growth will not reduce inflation.

Evaluating the MTP beyond 2025 is already meaningless at this point:

“Prioritizing investment, production, employment, exports and growth while decisively fighting inflation…”

2. Current account deficit-discrepancy as a function of growth changes the TL assumptions: The unchanged structure of the Turkish economy over the last years creates an increase in the current account deficit in years when growth exceeds potential and above, and a narrowing effect on the current account deficit when growth slows down in the opposite direction. This is at the root of the unsustainable macroeconomic imbalances created by the Albayrak-era economic policies that over-prioritized growth. It is also at the root of the growth slowdown we are currently going through. Since the derived economic policies have failed to change the basic production structure, it is inevitable that the current account deficit will increase during periods of higher growth.

Therefore, it is a reasonable expectation that the current account deficit, which reached 4 percent of GDP at the end of 2023, will fall to 1.7 percent in a year when growth is assumed to slow to 3.5 percent. What is unreasonable is a current account deficit-to-GDP ratio of 1.3 percent if growth were to move back towards 5 percent.

The current account deficit and the external financing it requires have a significant impact on the value of the TL. Its positioning in the MTP, incompatible with growth, also makes the TL/dollar assumptions implied in the MTP too optimistic.

Turkey is in a free exchange rate regime, but the CBRT and increasingly the government have been implementing a managed exchange rate regime since 2018. From this perspective, despite the “we have no exchange rate target” statements, we see the plan to keep the real value of the TL higher throughout the MTP period than the average exchange rate level implied by dividing the current GDP value by GDP in dollar terms. The aim, of course, is to continue to use the TL, which will be kept valuable in real terms, as a tool to reduce inflation in terms of reducing cost pressures as well as interest rate hikes.

In the MTP, the 2025 TL/USD average is taken as 42. Assuming that 2024 will be completed in the 36-38 band, the TL/dollar should be 43-44 at the end of 2025 when the depreciation equal to inflation is added to it. It is also confusing that the year-end exchange rate is so close to the average. In 2025, it may give an idea about the timing of the expected interest rate cuts that we can expect to move the TL. It would also mean a deterioration in the CBRT’s plans to reduce inflation.

3. Unemployment is in line with growth expectations – incompatible with plans to reduce inflation: Broadly defined unemployment, which today reaches 30 percent, is not included in the MTP’s expectations. The government assumes that headline unemployment will decline as inflation falls during the MTP period, when it declares that it will realize the model that prioritizes “flexible working”, which unions oppose as precariousness. Although for 2025 it is planned to rise only slightly, the mismatch between growth and inflation suggests that unemployment is also confused.

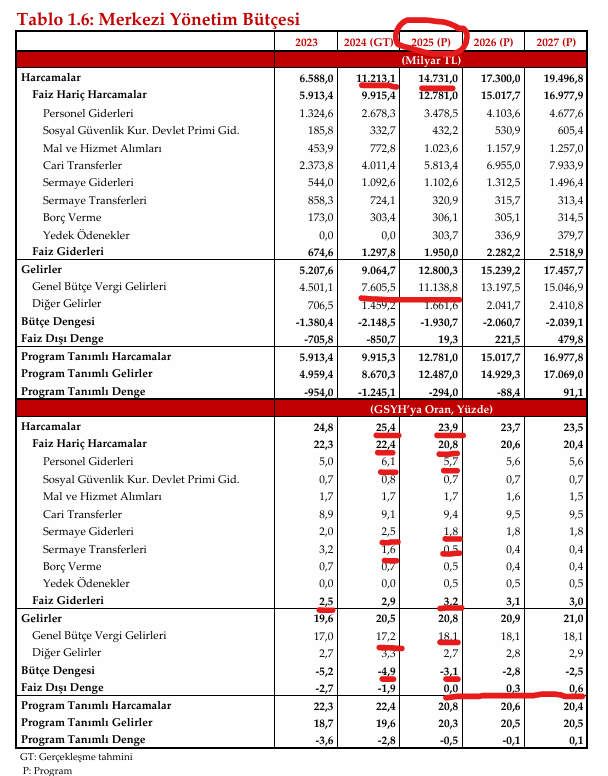

4. The CBRT’s call for fiscal discipline in the fight against inflation is reflected in the MTP, but its achievability is uncertain: For 2024, the budget deficit to GDP ratio was revised to 4.9 percent, below the initial target of 6.4 percent. This is a reasonable level and realization is possible. The target for the end of 2025 is then to reduce the deficit to 3.1 percent.

The implication that the budget deficit will narrow significantly in 2025, the most critical year of the fight against inflation, is very valuable. It means that the support for the CBRT, which has been delayed for the last year, will finally start to arrive. However, it is not clear exactly how it will be realized in the MTP. From the details of the MTP, we observe that the share of non-interest expenditures to GDP will be maintained at 22.4 percent for 2025. According to the plan, interest expenditures will move towards 3 percent with a reasonable expectation.

On the revenue side, the ratio of tax revenues to GDP increases by 1 percentage point for 2025 and 2026. For this to happen, additional taxes are necessary. Or it means that growth will really pick up. The first case prevents growth and inflation from reaching the targets. The second case means deeper polemics over the mismatch between growth and inflation targets.

At first glance, the MTP’s reform list is a list of wishes. Important milestones such as impact analyses, periodic realization checks, and new plans in case they are not realized are not included in this list.

The 100-page long text can be summarized as follows:

1. The CBRT, which focuses on reducing inflation, has not received the support it seeks from fiscal policy.

2. The internal inconsistencies of the MTP jeopardize the already low credibility of the inflation target.

3. The erosion of real wages/income in minimum wage/pension increases is an important third tool for the CBRT in its fight against inflation besides high interest rates and a valuable exchange rate. The CBRT is not alone here and seems to have the support of the government. 20-25 percent wage increases are the main plan for 2025.

4. While it is clear from the announced figures that additional taxes are coming, it is also unclear how much of the list of reforms is realizable.

Taken together, it seems inevitable that 2025 will be the most difficult year of the 22 years of AKP rule for the electorate and will set the stage for political turmoil.