Turkish Wealth Fund planning debut Islamic bond sale

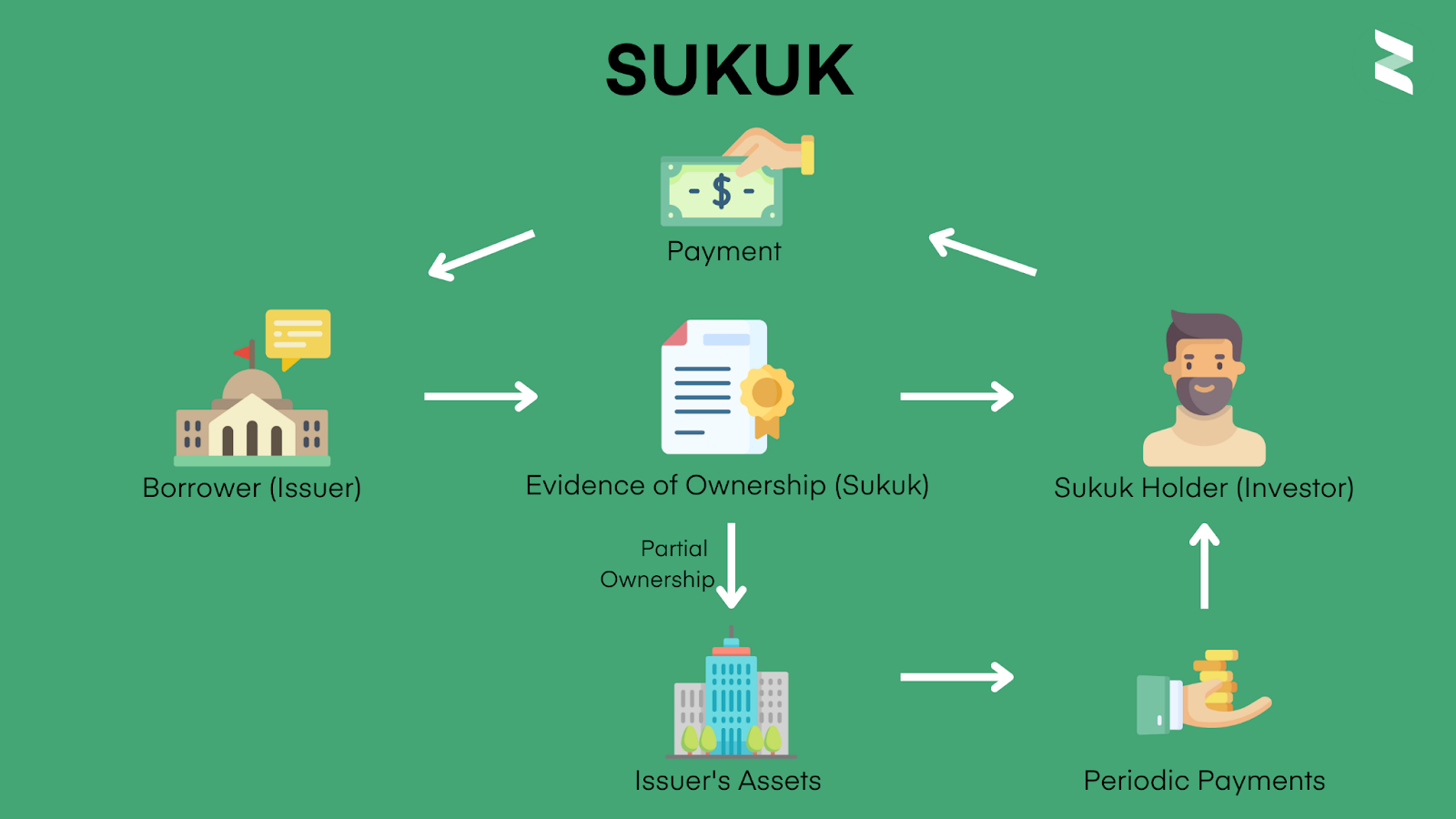

SUKUK

SUKUK

Turkey’s Sovereign Wealth Fund (TWF) is reportedly exploring the possibility of launching its first sukuk offering, according to Bloomberg.

The fund has engaged in discussions with investment banks to assess both the timing and the potential scale of the issuance, said the sources, who requested anonymity as the details are not yet public. The proposed sukuk could raise $500 million and would have a 5-year maturity, they added.

TWF has not yet provided any official comment regarding the potential issuance.

Earlier this year, the wealth fund attracted $7 billion in orders for its debut dollar-denominated bond, which raised $500 million. That 5-year bond was priced at 8.375%.

Established in 2016, the Turkish sovereign fund was tasked with leading large-scale investments that are beyond the reach of the private sector. It holds various assets transferred from Turkey’s Treasury, including stakes in state-owned banks like Turkiye Halk Bankasi AS and TC Ziraat Bankasi AS, as well as significant holdings in Turkish Airlines, the nation’s top telecommunications company, and the Istanbul Stock Exchange.