While acknowledging the strengthening domestic demand in the fourth quarter and the recent acceleration in loan growth despite being at disinflationary levels, the Central Bank of Turkey (CBT) delivered a third 250bp cut earlier this month, highlighting the decline in the underlying inflation trend in February

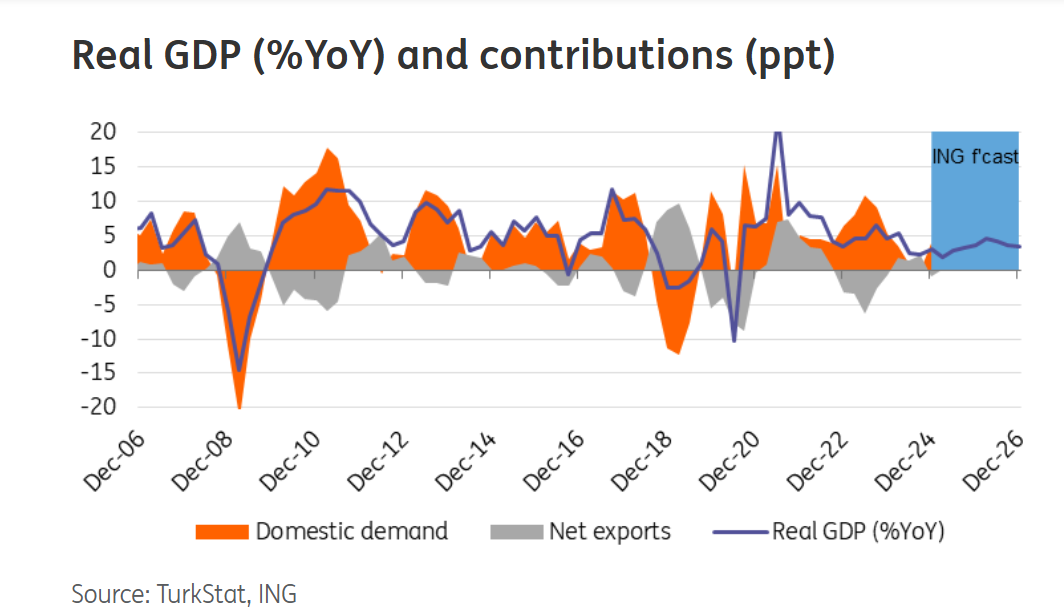

Economic data for the fourth quarter of 2024 shows domestic demand recovering despite tight monetary policies. Private consumption reached a record high after declines in mid-2024, while net exports made a negative contribution to growth. Indicators suggest GDP growth will continue to recover in early 2025, though the central bank considers demand conditions to support lower inflation. If demand grows faster than expected, the bank may introduce new measures or slow interest rate cuts.

February inflation was lower than expected, contributed by both food and non-food items, following a sharp rise in January. The Finance Ministry reversed the increase in hospital copayments, which contributed to last month’s better inflation figure. While strong domestic demand has led producers to pass on higher costs to consumers, inflation is expected to continue declining as the central bank maintains tight policies, currency strengthens, and service inflation improves.

Inflation is likely to fall further in March, allowing for a potential 250bp interest rate cut in April, in our view. Future central bank decisions will depend on factors like foreign currency deposits, exchange rates, and foreign reserve levels. In February, the Central Bank shifted from buying to selling foreign currency due to increased local demand. Sustained pressure on the currency may lead to stricter policies, smaller rate cuts, or a pause.

The central bank is taking a flexible approach, deciding on interest rates at each meeting and signaling further cuts as inflation declines. We expect inflation to be at 27%, with a policy rate of 29% by the end of 2025, though risks remain on the upside.

Despite stricter loan growth limits introduced in January, bank lending has accelerated, especially in foreign currency loans. To slow this trend, the central bank reduced the FX lending growth cap further and narrowed exemptions for this type of loan.

FX and rates outlook

The Turkish lira (TRY) seems unconcerned with the start of the CBT cutting cycle despite three 250bps rate cuts since last December. Our baseline remains that the lira will continue to appreciate in real terms, however the trend sees some cracks with shrinking carry and harder to beat forwards. Despite this, we believe the Turkish lira remains the most favourable carry trade in the emerging market space for now, and it’s too soon to alter this perspective.

Despite heavy long positioning on the foreign investor side, the main risk to TRY is actually the local market and its demand for FX. Yet, February’s central bank data showed some shift from buying to selling FX due to increased local demand. For now, this can be seen as more of a market normalisation, however, if the pressure continues, we could see a more cautious approach from the central bank, which we believe is risk aware of the sudden outflow of domestic holders from TRY into FX, threatening the market stability of the local currency. Overall, as a baseline, we expect a continued USD/TRY uptrend in the coming months with 38.71 mid-year and 43.00 year-end.

In the TURKGB’s space, MinFin covered roughly 18% of this year’s supply with mute activity in February, according to our estimates. However, March should bring several auctions in the coming days, especially in the belly curve, while the long-end supply remains light. February’s lower-than-expected inflation brought a short-lived rally and yields have stabilised after the February sell-off well above January lows. We still believe bond valuations remain attractive, especially when we look at the 2y-5y part of the curve in the context of our inflation profile for next year and current direction. Foreign holdings have jumped back above 10% after some downside in December and visible interest in TURKGBs is gradually increasing, but still, foreign demand is mainly directed to the short end of the curve, betting on an imminent rate cut story.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/