Akbank: Strongly Positioned, Attractively Valued

akbank

akbank

1Q20 net income in line with expectations

The bank announced its 1Q20 solo net income as TL1.31bn (-1% q/q, -7% y/y), corresponding to 9.7% quarterly ROE, in line with our TL1.35bn and TL 1.34bn consensus estimates. The deviation from our estimate mainly stems from higher trading losses of TL434mn vs our TL280mn estimate. The positive highlight of the quarter is the 8% improvement in NII, on adjusted NIM of 4.8% (4Q19: 4.7%), higher CPI-linker income of TL647mn (4Q19: TL403mn) and flat swap costs of TL738mn (4Q19: TL746mn). On the asset quality side, NPL ratio was realized at 6.7% in 1Q20 vs 6.6% in 2019 (9M19: 6.0%), indicating a deceleration of asset quality deterioration thanks to lower NPL originations of TL1.3bn (4Q19: TL4.3bn, 3Q19: TL3.3). Provisioning costs remained at an elevated level of TL2.6bn (-5% q/q, +46% y/y) due to the additional provisions of TL871mn related to the mark-to-market adjustments of LYY and additional free provisions of TL250mn (total free provision buffer of TL900mn), implying 201bps net cost of risk. Note that Bank management sees upside risks to NPL ratio and provisions due to the pandemic impact. Fee remained flattish y/y in 1Q20 while opex was up by 22%, implying 31% CIR.

2020E net income increased slightly despite higher provisions

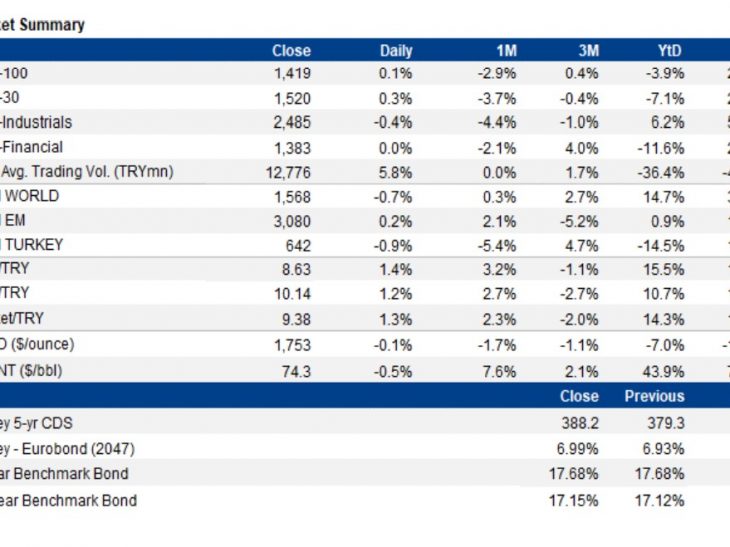

Akbank has delivered strong growth, margin and operating dynamics in 1Q20, offset by high provisioning costs, which came as a precaution for potential asset quality deterioration due to the pandemic. In the view of continuing rate cuts, decreasing funding cost trends triggered by new regulations such as the recently announced asset ratio, we expect margin resilience in coming quarters, despite lower yielding security and loan books. The Bank’s strong capital position and elevated provisioning could reduce the reported negative impact of Covid-19 on the Bank’s balance sheet in 2H20; while TL valuation against hard currencies is the main caveat. With this background, we increase our 2020E net income slightly to TL7.1bn level (previously: TL6.9bn), %5 above the Bloomberg consensus.

Target Price revised from TL8.6 to TL8.1

Our valuation is based on 15% sustainable ROE (previously 16%), 14.0% risk free rate (unchanged) and a 5% equity risk premium (unchanged). We underline upside risk to our Target Price in case further shifts in the yield curve, which carried the 10-year TL bond yield to 11.84% and 2-year yield to 8.96% currently. Should the said lower rates become the new normalized level, they may trigger an adjustment to our risk free rate assumption and target P/BV for the Bank.

Upgrade to Outperform on 36% upside potential

Akbank is trading 2020E P/BV of 0.51x and P/E of 4.4x. The lower growth scenario for Turkey and its consequences over demand shortfall/cash flow cycle has delayed the ROE recovery prospects for Turkish banks to 2021. This may keep the equity risk premium at elevated levels, but with 36% upside potential to our revised Target Price, it is worth looking past the short-term risks. Akbank has strong Tier-I of 16% (unadjusted), TL20.9bn excess capital as of 1Q20, prudent lending and provisioning policies, as well as strong focus on operating efficiency (31% CIR). As a result, it should trade at a valuation point close to our 0.65x target P/B.

Serhan Gök

serhan.gok@yf.com.tr

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/