Inflation, Monetary Policy and Currency Crisis

inflation-turkey

inflation-turkey

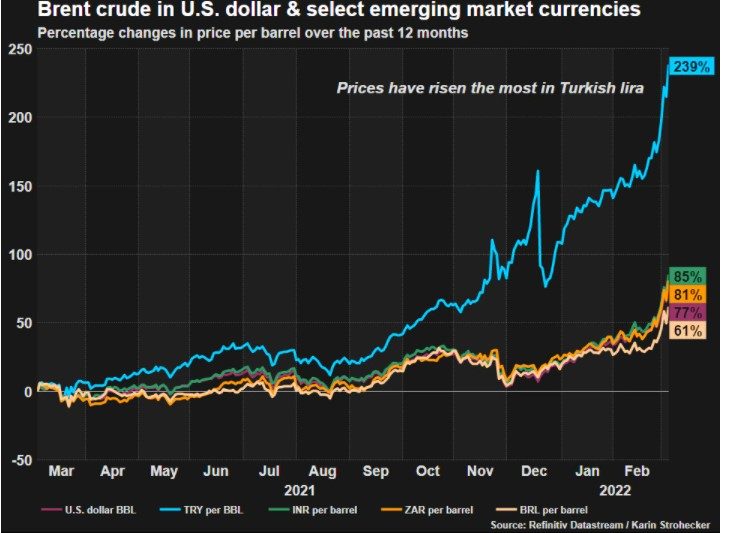

Real Turkey Channel Video: Central Bank of Turkey cut interest rates by another 50 basis point today, to 8.25% vs. 11% CPI inflation. TL deposit rates are now under 9% gross (before tax) per annum. Turkey’s deeply negative interest rates are very harmful to inflation and exchange rate. Turkish savers have no incentive to hold TL deposits, which means either moving to consumption, or to hard currencies. CBT decisions is also likely to stoke inflation once corona-related restrictions are mostly lifted in June. Too much money chasing too few goods and services is a time-proven adage of economics, which appears to be Turkey’s fate. It is also known that higher inflation will lead to faster currency depreciation. That is, Turkey is facing the threat of a currency crisis because of ultra-lax monetary and fiscal policy. This video explains in fully CBT’S OMO and asset purchase operations, as well as its underhanded interventions in the foreign exchange market to sustain a slow-depreciation, low-inflation environment, as per orders by President Erdogan. While many EMs act as Turkey does, their governments are more responsible, and their inflation much lower.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/