Is Turkey’s monetary easing over?

tcmb-rate cut possbility

tcmb-rate cut possbility

Central Bank of Turkey delivered its ninth successive rate cut last week, reducing its key policy rate to 8.25%. Currently, Turkey’s CPI is running at 10.9% per annum, while CBRT’s Monthly Survey of Expectations reveals participants anticipating headline inflation rates 12 and 24-month ahead are 9.2% and 8.3%, respectively. Turkish banks offer TL deposit rates of 7.58% per annum on average. No matter how one views it, Turkey is operating with deeply negative interest rates, one of the very few in EM world to do so. Negative rates may be, and that is just a “may be” fine for Developed nations, but it is a brave experiment to try them in a country with an unstable currency, dollarization and a 4-decade history of chronic high inflation. Will CBRT stop here, or is there more easing to come. Here is what experts say:

Capital Economics: Rates cut, door opens for more easing

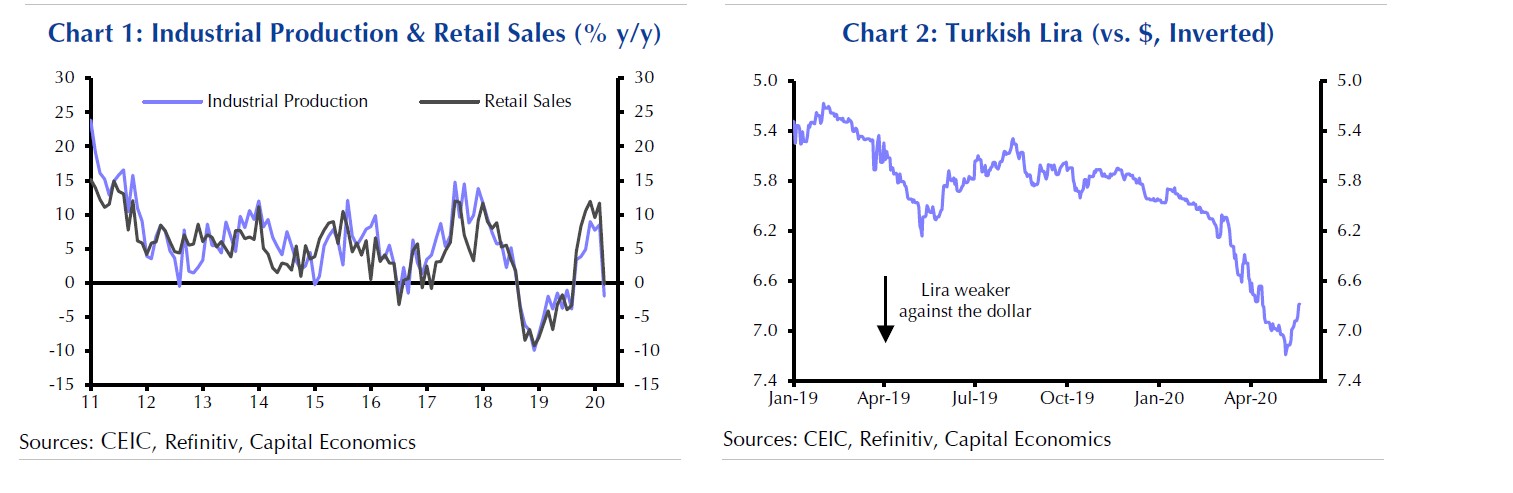

Meanwhile, inflation pressures have eased. The headline rate dropped from 11.9% y/y in March to 10.9%

y/y in April. This was partly due to the collapse in global oil prices pushing down local fuel prices, but

there were also signs that core inflation is softening.

• Perhaps most importantly, however, the lira has stabilised. The currency had fallen to a record low earlier in May as investors’ confidence in the policy response to the crisis evaporated. But the lira has recouped some its losses over the past two weeks on hopes that Turkey will secure financial support to help it cope with the balance of payments strains that have resulted from the crisis.

• Indeed, earlier this week, Turkey tripled the size of its currency swap line with Qatar’s central bank from $5bn to $15bn. And today, Japan’s prime minister, Shinzo Abe, announced that the country will provide medical and financial support to Turkey to help with economic fallout from the crisis (details yet to be announced). Turkey is also reportedly in talks with the Bank of England and the People’s Bank of China over currency swap lines, although it’s not clear how successful these talks will be.

• That said, it does buy the Turkish authorities a bit of time and provides more firepower to the central bank in its efforts to support the lira. Accordingly, assuming that the lira avoids another sell-off in the coming weeks, we think that the central bank will probably ease monetary conditions further at next month’s MPC meeting. We have pencilled in a further 50bp reduction in the one-week repo rate, to 7.75%.

• Further out, we think the main risk is that – once the economy starts to recover – political pressure forces the central bank to keep monetary policy too loose for too long, as happened after the global financial crisis. This would cause inflation to rebound sharply and fuel a fresh build of macro imbalances, with the result being that interest rate hikes come on to agenda in Turkey much sooner than in the rest of the world.

JP Morgan: CBRT reduces the pace of easing and sounds more cautious

Although, on the whole, the interest rate announcement note resembled the note last month, there were rather significant differences that provide some policy guidance. First of all, the CBRT mentioned the sharp weakening in economic activity in April but also underlined the signs of bottoming out following the steps taken towards partial normalization of economic activity in the second half of May. Second, the CBRT appreciated the increase in the disinflationary effects of aggregate demand conditions but also warned that headline inflation could follow a higher course in the short term due to seasonal and pandemic-related effects on food prices.

In contrast to recent announcement notes, the CBRT made no reference to the downside risks to inflation. In fact, in one of the more important sentences of the note, the CBRT stated that “under the current monetary policy stance, inflation outlook is considered to be in line with the year-end inflation projection”. The CBRT was indeed making similar comments when it was reducing the pace of monetary easing towards the end of 2019. This reference to policy stance and the expected disinflation path was dropped from the announcement in the previous two meetings when the CBRT most probably gave priority to policies aimed at mitigating the impact of the pandemic. It seems that, with economic activity showing signs of recovery, the CBRT started feeling the need to focus on inflation dynamics and policy credibility. Hence, a more cautious tone.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/