OECD: Unless there is a 2nd wave of the virus, Turkey will be shrinking 4.8 percent this year

Organization for Economic Cooperation and Development (OECD) expects a 4.8 percent contraction for Turkey’s economy this year due to coronavirus pandemic. In case of a second wave in the virus pandemic, predicts that the slump will become more severe.

The OECD expects the economy of Turkey to contract 4.8 percent this year due to coronavirus pandemic. In case of a second wave in the virus pandemic, this contraction is predicted to be 8.1 percent.

In the condition that a second wave will not happen in 2021, there is a 4.3 percent growth forecast for Turkey’s economy. In the scenario where there is no second wave in the outbreak, the average consumer price expectation for 2020 is 10.6 percent and the expectation for 2021 is 9.1 percent.

The report stated that as the global measures against coronavirus epidemics began to be eased, the recovery path is very uncertain and the economies are fragile against the second wave.

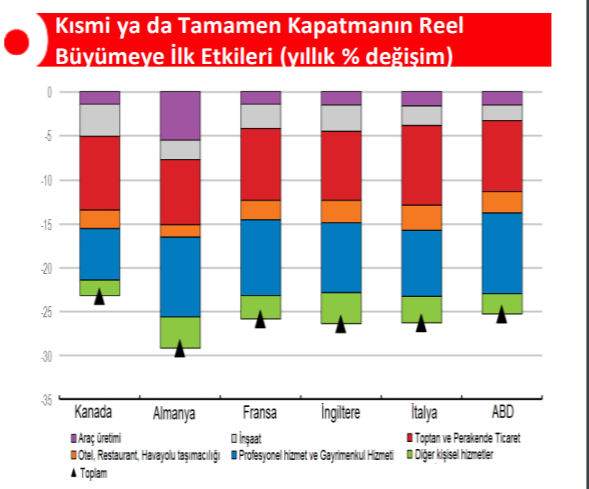

OECD expects a 6 percent contraction in the world economy this year. The institution predicts that this shrinkage will reach 7.6 percent in the case of a second wave.

A few days before OECD, World Bank predicted a %3.8 slump in the economy, but raised its 2021 forecast to 5%.

Summer will be critical for Turkish economy and Erdogan’s fortunes. He needs to steer the economy to rapid growth, as several polls express dissatisfaction with economic management, despite giving the administration high marks for its efficient handling of the epidemic.

Erdogan’s rapid growth plans may be frustrated by rising cases of Cvoid-19 in Ankara and South Eastern provinces, which may necessitate a second round of lock-downs. Tourism is unlikely to recover, as Germany advised its citizens not to travel outside EU borders. Russia, Middle East and Iran, which supply the bulk of tourists are all battling the epidemic and may not be able to send tourists.

Erdogan has jumped gun in his haste to gear-up the economy, by promising to re-start costly and low-return mega-projects like Canal Istanbul, while investing more funds into gigantic “City Hospitals” which extract very expensive concessions from the Treasury to subside loss-making operations. All these efforts are being financed money-printing by Central Bank. Monetary and fiscal stimulus may help Erdogan achieve his growth goals, but in case Covid-19 returns, excess money in the market is expected to spill into the foreign exchange market, triggering yet another round of TL weakening.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/