Macro Thoughts: The Return of Inflation

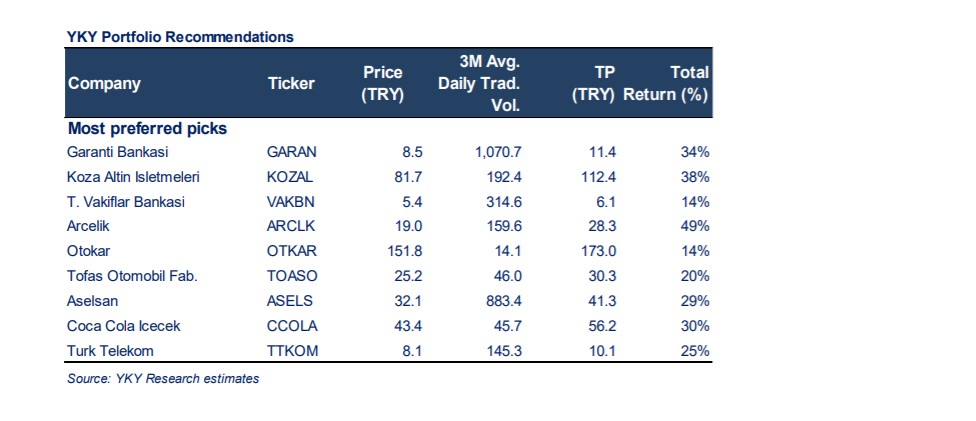

yk-top picks

yk-top picks

One needs to be careful not to simply be contrarian for contrarian’s sake, but we think the probability of inflation becoming a global market theme is much higher than what seems to be conventional wisdom. In fact, we think higher inflation is likely the most important structural change no one seems to be ready for.

Most simply put we believe it’s a mistake to use the post 2008 GFC path as an analogy. This time is different! Actually, two major things are different: a) fiscal policy is much more simulative b) the way governments around the world, including such free market champions UK and the US under center right centered governments “encourage“ commercial banks to lend credit. We think these two will become permament features of the policy tool kit. And together with loose monetary policy and supply bottlenecks around the world will prove to be inflationary.

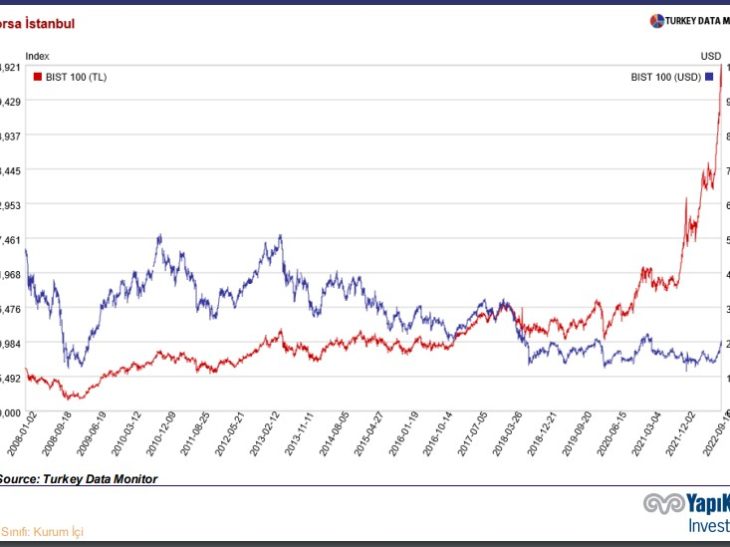

As William Gibson once said: “The future is already here – it's just not evenly distributed.“ Inflation is likely to become more visible first in some EMs (including Turkey) before developed markets but in both within the coming months.

If inflation becomes a major global market theme as we expect, then most investors risk getting caught wrongly positioned. Investors will need to relearn and question many of their beliefs taken for granted.

Gold remains our favorite asset class. Equities will need to be viewed much more selectively. Please refer to our model equity portfolio for our top picks.

2020 year to date, S&P 500 and MSCI World down by 5.5%, 7.7% respectively, while MSCI EM decreased by 11%. (MSCI Turkey decreased by 17%).

• In 2019, MSCI Turkey increased by %7, underperforming MSCI EM, MSCI World and S&P500, which registered returns of +15%, +25% and +29% respectively.

According to IIF, EM securities attracted around $4.1 bn in May, lower than the $18.6 bn in April.

• Equity and debt inflows were $0.7 bn and 3.5 bn respectively. (April: $2bn and 15.1bn)

• EM x/ China equity flows remain depressed. Outflows from EM x/ China equities amounted to $4.1 bn, while flows to China equities posted a net inflow of $4.8 bn, highlighting the divergence in performance between China and the rest of the EM complex.

CBRT kept the one week repo rate constant at 8.25%, at June 26 meeting.

• CBRT emphasized that, despite the restraining effects of aggregate demand conditions, pandemic-related rise in unit costs have led to some increase in the trends of core inflation indicators.

• And as the normalization process continues, supply-side factors, which have prevailed recently due to pandemic-related restrictions, will phase out and demand-driven disinflationary effects will become more prevalent in the second half of the year.

• 12-month rolling current account recorded a $3.3bn deficit in April (+$1.3bn in March)

• CBRT expects that the recovery in exports of goods with the ongoing normalization and low levels of commodity prices will support the current account balance in the upcoming periods.

YK Invest global strateyg by Murat Berk and Yesim Sarisen

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/