CB governor to be tested on Monday

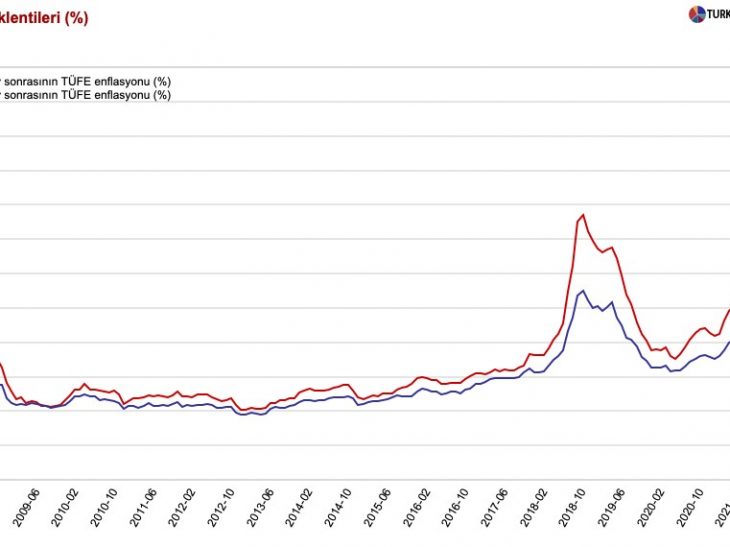

inflation

inflation

TL firmed on Thursday, thanks to extremely strong March export figures, which helped the monthly trade deficit narrow to $4.7 bn by 14.2% vs the same month of 2020, but more importantly by promises of tight monetary policy by new Central Bank governor Prof Sahap Kavcioglu. Prof Kavcioglu will be tested on Monday, when March inflation figures are due. Several surveys show CPI will reach a 1.5 year peak. More is in the pipeline.

Turkey's annual inflation rate is projected to rise to 16.21% in March, an Anadolu Agency survey found on Thursday. Turkey's annual inflation rate in February was 15.61%, up 0.64 percentage points from the previous month.

The Turkish Statistical Institute will announce the March consumer prices index on April 5.

A group of 20 economists predicts that monthly inflation will average at 1.09%, varying between 0.49% and 1.75%.

BloombergHT’s monthly survey of inflation expectations also found similar projections. Because of Ramadan, a severe draught and the pass-through from the recent currency devaluation, CPI is expected to exceed 17% in April, and could possibly plateau around 18%.

WATCH: Turkey is doomed to double-digit inflation! Why?

With a 19% policy rate, Prof Kavcioglu doesn’t need to hike rates, because all he promised was to pay a real rate of return on headline inflation. However several surveys and an alternative CPI index compiled by a group of academicians, called ENA Group find CPI exceeding 25% per annum. This is the reason why Turks shy away from TL deposits.

WATCH: Turkey on the Verge of Currency Crisis

Dollarization could pick up speed after the release of Monday’s CPI data, as well as driven by rising US bond yields and a firmer dollar Index. In this regard, too, the reckoning is near. A higher-than-consensus print in tomorrow’s US non-farm payrolls could rekindle the fires in US bond market.

Finally, Turkey has a very sticky inflation, meaning it is not too responsive to supply or demand fluctuations. Deflation needs a strong and credible policy response, headlined by budgetary belt tightening and a real policy rate in 5-6% range. Neither of these is present in Turkey.

In the best case scenario, Prof Kavcioglu can avoid another rate hike in 15 April MPC meeting, but in May, he shall face the dilemma which led to the sacking of his predecessor.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/