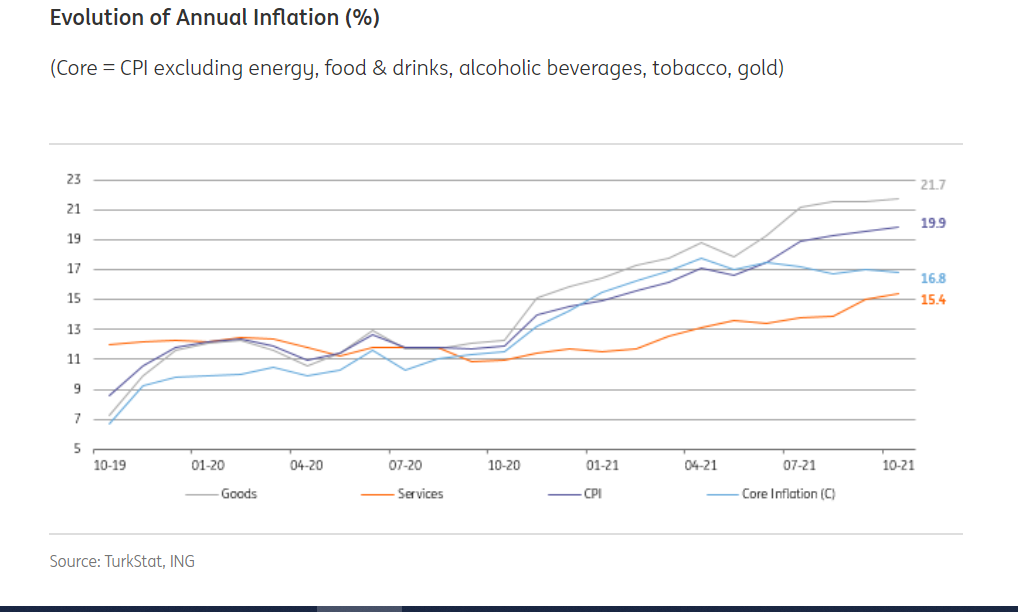

Monthly CPI in October was 2.39%, lower than the consensus at 2.76% (slightly higher than our call at 2.3%), while annual inflation rose to 19.9%. Both ‘B’ (excluding unprocessed food, energy, alcoholic beverages, tobacco and gold ) and ‘C’ (excluding energy, food and non-alcoholic beverages, alcoholic beverages, tobacco and gold) core inflation indices moderated to 18.5% and 16.8%, but remained elevated.

In the breakdown of the CPI, we see

- goods inflation moving up to 21.7% amid higher energy and tobacco products. This is despite the supportive impact from durable goods and unprocessed food.

2) services inflation accelerated to 15.4%, driven by rent and catering services, with the latter almost doubling since the beginning of this year.

Recent momentum on a seasonally-adjusted basis (3m-ma, annualised), on the other hand, somewhat moderated for the headline rate, while the core ‘C’ inched up, though both have remained high, indicating current the level of inflationary pressure. For services, both annual inflation and the recent trend showed increases in October on the back of deteriorating pricing behaviour and backward indexation, along with the continuing impact of reopening.

WATCH: How Bad is Fed Taper for Turkish Assets?

The October Domestic Producer Price Index (D-PPI) recorded one of the highest monthly increases at 5.24% and pulled the annual figure up to 46.3%, an all-time high in the current inflation series. The difference between CPI and PPI is now at a record level, 26.3ppt, showing the escalating cost-push pressures driven by higher commodity prices, cumulative exchange rate effects and continuing supply constraints in some sectors etc.

Regarding the main expenditure groups:

Food prices provided the biggest contribution to the headline, at 52bp, attributable to processed food while bread and cereals recorded the highest October reading in the current 2003=100 series. Despite adverse seasonal effects, unprocessed food and particularly fresh fruit and vegetables showed a relatively benign change, and limited the impact on the headline rate from the food group.

Clothing pulled the monthly inflation rate up by 40bp reflecting seasonality, but it was slightly better than the long-term October average.

Among other segments, transportation and housing were each responsible for a 36bp increase in the monthly figure. For the former, higher energy prices and currency weakness were the drivers, while the higher contribution from the latter was attributable to a 29% increase in coal and a 14% increase in firewood prices.

WATCH: How Erdogan is Destroying Turkish Economy ?

Despite the jump in global natural gas prices, the impact on the housing group was negligible as the government hiked prices only for industrial users and power plants while consumers have not been affected. However, keeping natural gas prices unchanged for much longer would be challenging for the government given the higher fiscal burden. This increases risks to the inflation outlook.

Alcoholic beverages and tobacco products impacted the monthly figure by 26bp due to recent price hikes in cigarettes.

The October figure likely shows a cyclical peak given the strong base in the last two months of the year, but the risks are skewed to the upside given the Central Bank of Turkey’s less restrictive policy stance, pricing pressures through a weaker exchange rate and higher inflation expectations. Even though the outlook suggests hikes not cuts may be warranted, the CBT is likely to deliver another cut this month as it sees room, albeit limited, for additional downward adjustment to the policy rate.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng