Turkey: Central Bank sells over 7 bn dollars in a month

TL4

TL4

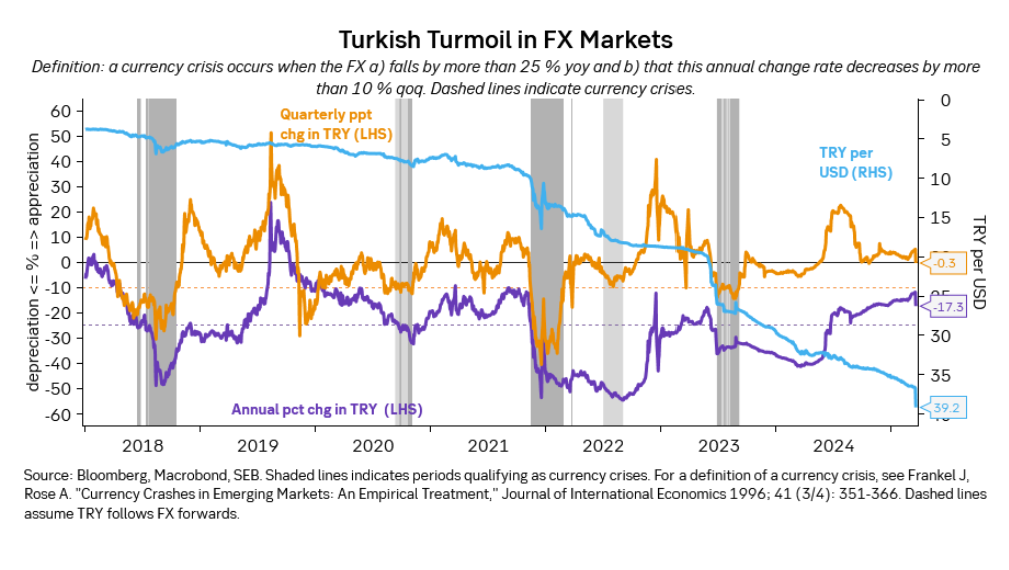

The Central Bank of Turkey sold 7.28 billion dollars in December to inject liquidity into the market in an attempt to stem the devaluation of the Turkish lira, according to data from the banking institute in regards to five interventions carried out last month. During the interventions TL lost 18% vs US dollar, how the presumed back-door sales might have prevented a second meltdown, with the exchange rate potentially shooting back to 18TL for 1 US dollar.

On the other hand, lira resumed the downtrend in the latter part of the week, as political tensions heated up. The reluctance of the CBRT to change course and the political pressure to lower interest rates in the current context of rampant inflation are forecast to keep the lira under intense pressure for the time being.

Despite the measures, the national currency closed 2021 with a loss of almost half of its value against the dollar, and even in the first week of 2022 the lira showed no clear signs of recovery.

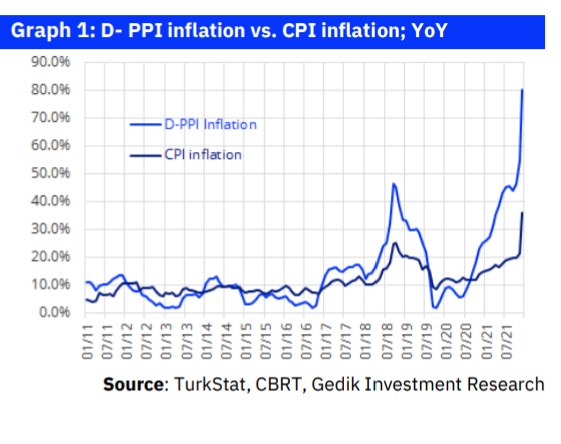

The devaluation had worsened in recent months concurrently with regular cuts in the Central Bank's reference interest rate (-500 basis points since September), which now stands at 14%.

This decision was made by the Central Bank in line with the economic vision of Turkish President Recep Tayyip Erdogan.

WATCH: Turkish Economic Outlook 2022: WHAT a train wreck! | Real Turkey

The weak national currency coupled with robust demand from EU, Turkey’s number of trading partner, caused an export boom in 2021 (over 225 billion dollars, up 32.9% compared to 2020), but also a widespread increase in the prices of various products, which was perceived negatively by the population. Since the import content of exports is estimated to be as high as 35% by Central Bank, soaring exports may have slowed down the decline in imports, perversely keeping 2021 trade deficit only 6.5% lower than 2020.

WATCH: Has Erdogan Averted a Currency Crisis? | Real Turkey

The latest official data found inflation of 36% on an annual basis.

The government recently presented a reform to try to improve the economic situation by guaranteeing citizens that bank deposits of Turkish lira can be withdrawn at the same value as the day they were paid - after periods of three, six, nine or 12 months - even if in the meantime the national currency lost value.

According to the measure, the treasury ministry will pay investors the difference.

Have interventions stabilized the exchange rate?

USD/TL seems to have met quite a decent barrier near 14.00 the figure on Friday, although it managed to record new highs for the year, nonetheless, writes FXStreet.

In the meantime, the lira remains under scrutiny amidst the current feeble outlook, which has been exacerbated after inflation figures recorded a 19-year peak beyond 36% in the year to December.

From the Turkish cash markets, yields of the 5y and 10y bonds reversed the recent multi-session weakness and resume the upside to past the 24% mark and just above 23%, respectively. The recent decline in yields have been promoted by purchases of government debt by the Turkish central bank (CBRT) according to latest news.

What to look for around TL

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government scheme to protect deposits in the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favor lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the lira under intense pressure for the time being, That said, another visit to the all-time high north of the 18.00 mark in USD/TL should not be ruled out just yet.

Eminent issues on the back boiler

Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Presidential elections in 2023.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng