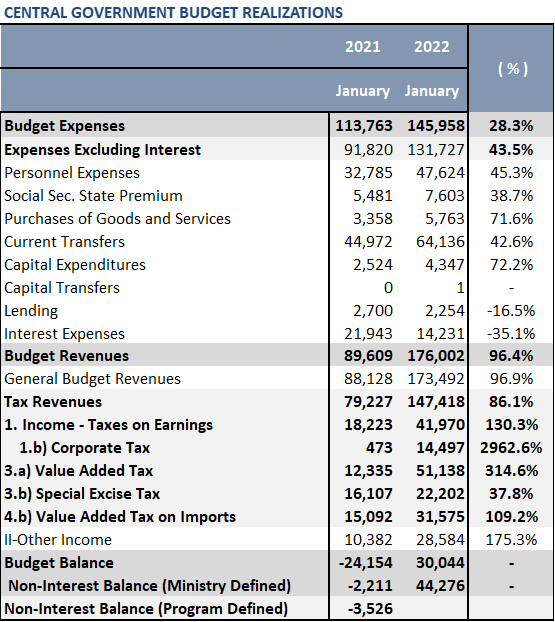

Turkey reported a budget surplus of 30 billion liras ($2.2 billion) in January as business tax revenues skyrocketed by2963%. The January 2022 surplus compares with a deficit of 24.2 billion liras in January 2021, as per the Treasury and Finance Ministry figures.

According to the ministry, budget expenditures increased by 28.3% in January compared to the same month last year, while revenues increased by 96.4%. In January, budget expenses were 145.9 billion liras and revenues were 176 billion liras. The increase in tax revenues is also notable at 86.1%. The increase in income taxes is strong at 130%.

In particular, the increase in corporate tax was notable in January. Corporate tax increased by 2.962% to 14.5 billion liras from 473 million liras in January last year. The economic basis of this jump is the corporate tax, in the absence of inflation accounting, owes to the profit performance of Turkish companies amidst currency moves and higher inflation.

The sudden and rapid rise of inflation also has an impact on VAT revenues: VAT increased by 79.5% and amounted to 22.1 billion liras. The devaluation of TL is behind the increase in vat on imports by 109.2% to 31.6 billion liras.

The Special Consumption Tax increased by 37.8% in January, while the new year’s hikes along the CPI inflation had a significant impact.

The budget for February is expected to be strengthened by an inflow of central bank profits to a tune of 49.3 billion liras for 2021.