Turkey Morning Bulletin: Market review, economy & politics

market-sum

market-sum

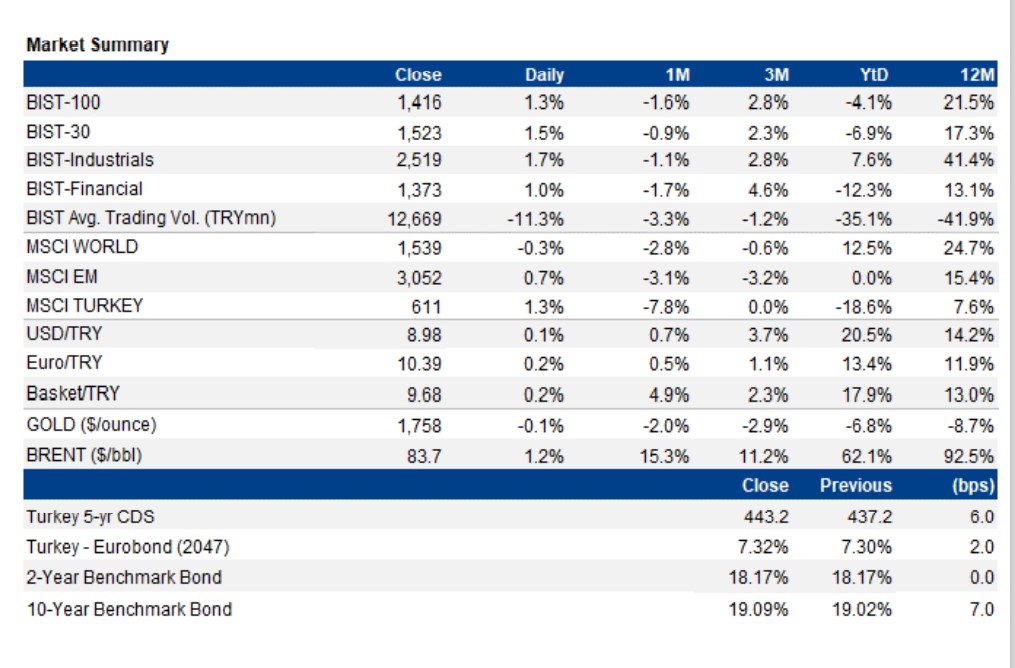

MSCI Turkey outperformed the MSCI EM by 0.6% yesterday. BIST-100 gained 1.3%, closing at the level of 1,416 with a trading volume lower than the last 5 days’ average. Banking index gained 1.3% and industrials index gained 1.7%. Interest rate on 2-year benchmark bond rate remained stable at 18.17% while 10-year bond rate inched up to 19.09% (up 7bps). TRY depreciated by 0.1% vs USD to 8.98 yesterday, while trading around 9.01 this morning. In terms of local dataflow, IP, August (YF – YoY NSA: +20.5%, YoY SA: +11.6%, MoM SA: +5.8%), Retail Sales (August), Turnover Indices (August) would be watched today. We expect a flat opening for Turkish equities.

Governor Kavcioglu said rate cut was not a surprise for lira

Governor Kavcioglu made a presentation at the parliamentary’s Planning and Budget Commission. Governor Kavcioglu gave similar messages with the last week’s investor meeting with economists. Key messages are given below:

- According to Kavcioglu, a 100bps basis-point interest-rate cut last month was not a surprise and had little to do with the sell-off that resulted in the lira.

- Kavcioglu said Inflation is following a volatile course and the CBRT “will continue to take a risk-based approach in monetary policy from now on,”.

- Kavcioglu also stressed that an improvement in the current account deficit has begun, emphasizing its importance for price stability.

He reiterated that a current account surplus is expected for the rest of the year as the strong upward trend in exports and the strong acceleration in vaccination stimulate tourism, adding that the current account balance is also improving thanks to the decline in gold imports. Kavcioglu said that positive foreign demand conditions and the tight monetary policy being implemented also affect the current account balance positively.

- The central bank governor stated that the CBRT reserves have increased to $123.5 billion as of Oct. 8, which will be announced this week. “CBRT reserves have recently gained stability and are showing a strong upward trend. In the coming period, as the central bank, we aim to continue the accumulation of reserves in order to strengthen the transmission mechanism of the monetary policy,” he said.

- Adding that leading indicators point to a strong course of domestic economic activity in the third quarter with the effect of foreign demand, Kavcioglu said, “The acceleration of vaccination allows the services, tourism and related sectors that were adversely affected by the pandemic to revive and economic activity to be continued with a more balanced composition.”

- Kavcioglu went on to say that the short-term debt position of the real sector is at a level that can manage the exchange rate-caused risks. He noted that the reasons behind the recent rise in inflation are supply-side factors such as increases in food and import prices and disruptions in supply processes, increases in administered/directed prices and growing demand due to the reopening.

- He reiterated that these effects are caused by incidental factors, noting: “Meanwhile, the slowing effects of strong monetary tightening on loans and domestic demand continue. The tight monetary stance has started to have a contractionary effect on commercial loans, and the macro-prudential policy framework has been strengthened so that retail loans will return to a moderate course.”

WATCH: How Erdogan is Destroying Turkish Economy ?

President Erdogan: Turkey out of patience for attacks from northern Syria

President Erdogan said Turkey has run out of patience after the latest deadly attack on its police force in northern Syria and violent activities targeting the country’s territories. Erdogan said Ankara is determined to eliminate threats emanating from northern Syria, either itself or with the support of active local forces. “We will take the necessary steps in Syria as soon as possible.”, he said.

Two Turkish special operation police officers were killed and two others wounded in the Operation Euphrates Shield zone of northern Syria when the YPG, the Syrian offshoot of the PKK terror group, struck an armed vehicle with guided missile.

In August, the CA posted a monthly surplus of USD582mn (Consensus: USD -0.1bn, YF: USD -0.4bn).

This was the first monthly surplus since October 2020. CA posted a USD4.1bn of deficit in the same month of the previous year. The main drivers of a USD4.6bn of YoY improvement in the current account were USD5.4bn of drop on the foreign trade deficit (USD[1]2.8bn) and USD1.8bn of rise on the net service revenues (USD+4.1n).

BoP Statistics have been revised in line with the “International Trade in Services Statistics, 2020” bulletin published by TURKSTAT on September 28, 2021. On the other hand, total net primary and secondary deficit increased by USD303mn to USD791mn. Normalization trend on gold imports continued. In August, net net non[1]monetary gold exports was USD-0.2bn (Aug.20: USD-3.8bn). However, net energy deficit increased by USD1.9bn to USD3.7bn.

Accordingly, core figures (excluding gold and energy) indicated a USD4.4bn of surplus (Aug.20: USD+1.5bn). Therefore, 12-month CA deficit decreased from USD27.6bn in July to USD23bn in August whereas 12-month core surplus increased from USD16.2bn to USD19.1bn.

FDI recorded a net outflow of USD319mn (first monthly outflow since Oct.20) whereas portfolio investments recorded a net inflow of USD1.3bn. Non-residents were net buyers in equity and in GDDS markets by USD523mn and USD336mn, respectively. Regarding the bond issues in international capital markets, other sector realized net borrowings of USD750mn.

WATCH: Turkey’s New Economic Program Explained | Real Turkey

Other investments recorded a net inflow of USD7.3bn. Banks’ currency and deposits within their foreign correspondent banks decreased by USD318mn whereas nonresident banks’ deposits held within domestic banks increased by USD1.5bn. Regarding the loans provided from abroad banks and government realized net repayments of USD838mn and USD57mn, respectively whereas other sectors realized net borrowing of USD759mn.

Additionally, Special Drawing Rights (SDR) increased by USD6.3bn due to the IMF’s general Special Drawing Rights (SDR) allocation to all IMF members in August. Net errors-omissions recorded a net inflow of USD4.4bn.The official reserves increased by USD13.2bn.

In 8M21, current account (CA) deficit was USD14bn (8M20: USD-26bn). According to a yearly comparison on 8-month figures, foreign trade deficit narrowed by USD6.4bn to USD19.2bn whereas net service revenues increased by USD6.5bn to USD12.5bn. Net gold imports decreased by USD10.7bn whereas net energy imports increased by USD6.2bn in 8M21 compared to the same period of the previous year. Hence, the net contribution from the gold and energy imports was USD4.5bn. Net travel revenues increased by USD5.1bn in the same period. Core surplus (excl. gold and energy) rose by USD7.5bn to 10.5bn. Strong upward trend in exports, normalization in gold imports and the strong progress in the vaccination program stimulating tourism activities were shown as the main drivers of the improvement on year-to-date figures.

Leading foreign trade figures for September indicated that trade deficit was lower than USD 2.3bn than the perivous year (Sep.21: USD-2.6bn, Sep.20: -4.9bn). Hence, improvement trend on 12-month CA figures could continue in September. On the other hand, we should also note the financing structure (low FDI inflow vs high net error-omissions inflow) CA deficit seems unhealthy.

The government expects USD 21bn of CA deficit in 2021 according to 2022-2024 Medium Term Program. According to the current realizations and trends, this figure seems achievable. Hence, the risks are downward on our year[1]end current account deficit forecast is at USD22.5bn which refers to 2.9% of GDP. Turkey’s CA data of September would be announced on November 11.

Turkey’s unemployment rate was 12.1% in August.

Turkey’s Seasonally Adjusted unemployment remained stable at 12.1% in monthly basis. Total number of unemployed in unadjusted series decreased by 75,000 YoY to 4mn whereas it increased by 11,000 MoM to 4mn in SA figures. SA Participation rate decreased by 0.1pps MoM to 51.2%. Employment rate decreased by 0.1pps MoM to 45%. Composite measure of labor underutilization decreased by 1.7pps MoM to 22%. It is the ratio of the sum of unemployed, time-related underemployment and potential labor force to the sum of labor force and potential labor force.

Treasury borrowed 11.6 tons of gold (around TRY5.9bn) from the market via gold bond and lease certificate issuances.

Treasury concluded 3-year gold denominated bond (TRT091024T19, total sale: 1.4 tons)/lease certificate(TRD091024T17, total sale: 10.2 tons) auctions. The settlement date is on October 13 whereas the maturity date is on 9 October 2024 (1092 days) and coupon (rent) rate is at 0.75% and annual rate is at 1.5%.

Therefore, the total amount of the borrowings with 5 of 10 planned auctions for October reached to TRY21.3bn, covering around 46.1% of the TRY46.2bn redemption (also, 53.2% of domestic borrowing projection of TRY40bn for October completed). Treasury’s next scheduled issuances would be on

- October 18 2-year fixed coupon G-bond (20.9.2023), 5-year TLREF Indexed (13.1.2027)

- October 19 8-month T-bill (15.6.2022), 2-year lease certificate (18.10.2023), 7-year floating coupon G-bond (13.9.2028)

Sources: YF Finans, Press sources

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng