ING: Despite revisions to current account deficit is still widening

cad-sept2022

cad-sept2022

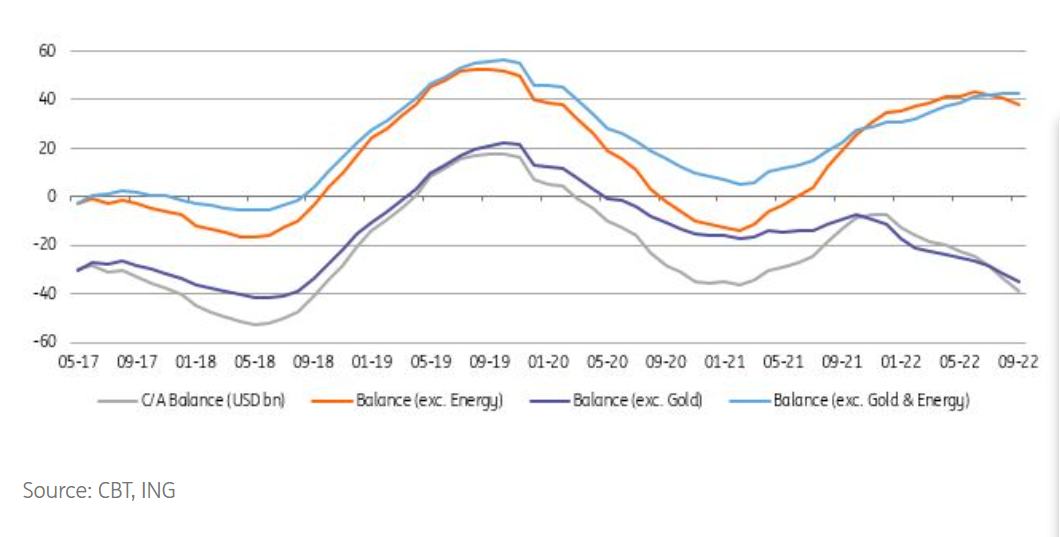

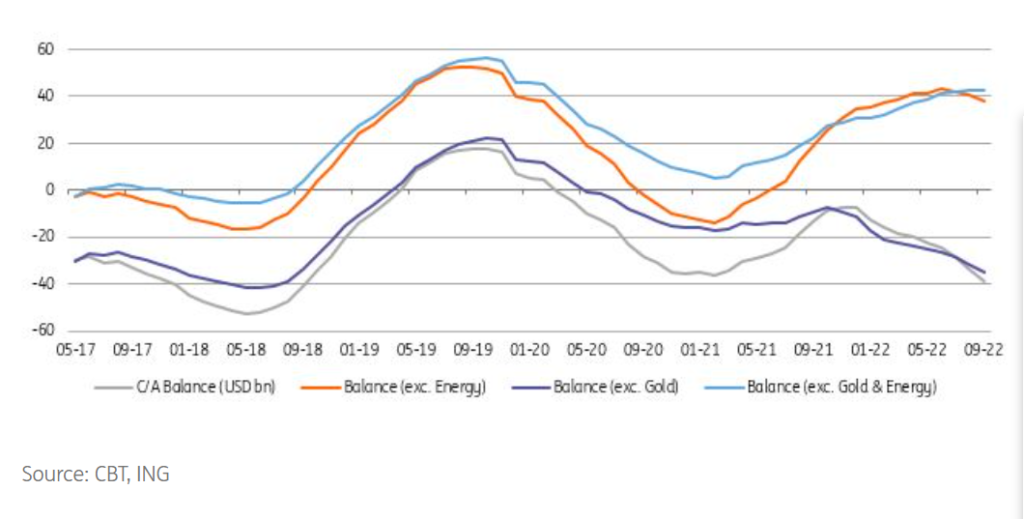

Despite large revisions to the balance of payments data, which significantly raised tourism revenues, the current account continued to widen rapidly in September, driven by a notable pick-up in the energy bill and gold imports, wrote ING analysts.

As announced earlier, the Central Bank of Turkey revised two items in the balance of payments data

- tourism revenues under the services balance and

- ii) the compensation of employees under primary income. Accordingly, total revisions for the former item for the 2012-2002 period turned out to be $22.4bn while they were $4.4bn for the latter.

Despite significant adjustments, the current account outlook has not changed and continued to widen rapidly. With the September data at $-3.0bn (a slightly higher deficit than the consensus and better than our call), the 12M rolling figure was revised to $-39.2bn from $-33.5bn (translating into c. 4.7% of GDP).

While the data shows no sign of pressure easing in the external accounts, the key drivers in the monthly reading were the same as we have observed this year:

- the continuation of higher net energy imports, almost double in comparison to the same month of last year,

- a significant acceleration in net gold trade to $-2.6bn from a mere $-0.3bn a year ago and

- a contracting surplus in core trade (excluding gold and energy). Services income has remained strong, with a 28% year-on-year increase in September, limiting the deterioration in the current account to some extent.

After FX inflows related to the construction of the Akkuyu nuclear plant by Russian state-owned Rosatom, the capital account weakened again in September with $1.3bn of outflows, driven by asset acquisitions of locals abroad. With the current account deficit and continuing strength in net errors & omissions at $2.6bn ($24.9bn on a year-to-date basis, which is still very high despite the latest revisions), official reserves recorded a marked $1.7bn decline.

READ: Barclays: TL doomed to drop in 2022-2023

In the breakdown of monthly flows, residents’ assets abroad recorded a $1.8bn increase driven mainly by the rise in external financial assets. For non-residents, we saw a mere $0.5bn of inflows:

- regarding non-debt creating flows of foreign investors, gross FDI ($0.8bn) more than matched the sell-off in the equity market ($0.5bn)

- for debt-creating flows, we observed $3.7bn of outflows driven by the Treasury’s Eurobond repayments and maturing Eurobonds of banks. However, trade credits at $0.6bn and the rise in deposits of foreign investors in the banking system (including the CBT) by $3.1bn offset the outflows in debt-creating items. Net borrowing, on the other hand, turned out to be barely positive as corporates’ long-term borrowings exceeded banking sector debt repayments. Accordingly, we saw a strong long-term debt rollover rate for corporates at 134% (195% on a 12M rolling basis), while the same ratio for banks stood at 93% (91% on a 12M rolling basis).

WATCH: Is Turkey Headed For a Debt Crisis?

The way ahead

The widening in the current account deficit continued in September driven by a notable pick-up in the energy bill and gold imports despite further strength in tourism revenues. A declining surplus in the core trade balance and domestic demand-driven factors also contributed. The deterioration in the terms of trade and efforts to support domestic demand along with growing pressure on exports amid deteriorating external demand point to continuing external imbalances ahead.

On the capital account, net errors and omissions, which are not a stable source of funding, have remained the major financing item, feeding into concerns about sustainability. Official reserves, on the other hand, recorded a slight increase on a year-to-date basis.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/