Real Turkey Special Video: Global Debt Crisis Beckoning!

world-debt

world-debt

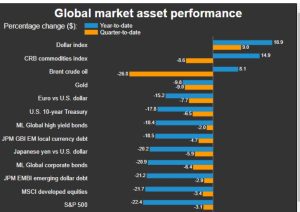

Since the beginning of the year global bond markets shed $20 trillion in value.

- Last week, BoE had to intervene in the gilt market to bail out mortgage debtors and retirement funds.

- PBoC is getting ready to support the yuan.

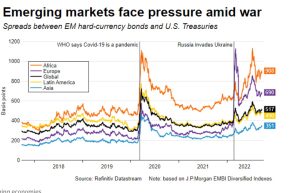

- The global havoc in debt and currency markets is caused by the fiercest monetary policy tightening in 5 decades.

- Such episodes usually end in debt crises. 2023 will spell either relief, or a recurrency of history.

- Higher interest rates and stronger dollar in 2023 could upend the 20 year old borrowing binge.

- Not only EM, but everyone with flexible interest debt is in jeopardy.

For more;

Subscribe to the channel http://wedia.link/RealTurkey

Follow & read the latest Independent news from Turkey in English ► https://paturkey.com/

For sponsorship, ad, and other business inquiries ► [email protected]

#RealTurkey #Debt #GlobalCrisis