TEB Invest banking report: Still solid despite headwinds

bank-pe

bank-pe

Investment thesis

Despite a raft of banking sector regulations since our last strategy report, (see: “Hope is not a strategy”, dated 1 July 2022), we observed that private banks impeccably managed the regulations and maintained their profitability.

Additionally, we expect the continuation of the rate-cut cycle to help banks’ funding costs while the “FX-protected TRY deposit scheme –KKM” facilitates banks in managing their maturity mismatch by increasing TRY deposits’ duration. For 2023, while elections bring its own set of uncertainties, we take comfort that banks’ 2023E earnings would be shielded by hefty CPI-linker proceeds.

Following the 354% y-y earnings growth we expect in 2022 for private banks we cover, we expect such a strong earnings base to be broadly maintained in 2023. For VAKBN, the only public bank in our coverage, we forecast 589% y-y net income growth in 2022 but a 36% y-y contraction in 2023.

We continue rating AKBNK, GARAN and YKBNK as BUYs while retain HOLD on ISCTR and VAKBN.

Private banks we cover trade at 2023E P/E of 1.75x, still at a discount to their 3-year average NTM P/E.

Catalysts

- Low policy rates that contribute to banks’ funding costs together with relatively stable FX rates.

- Strong net earnings expectations for 2022 and for 2023 despite regulatory limits on loan pricing and higher security-book portfolio of banks.

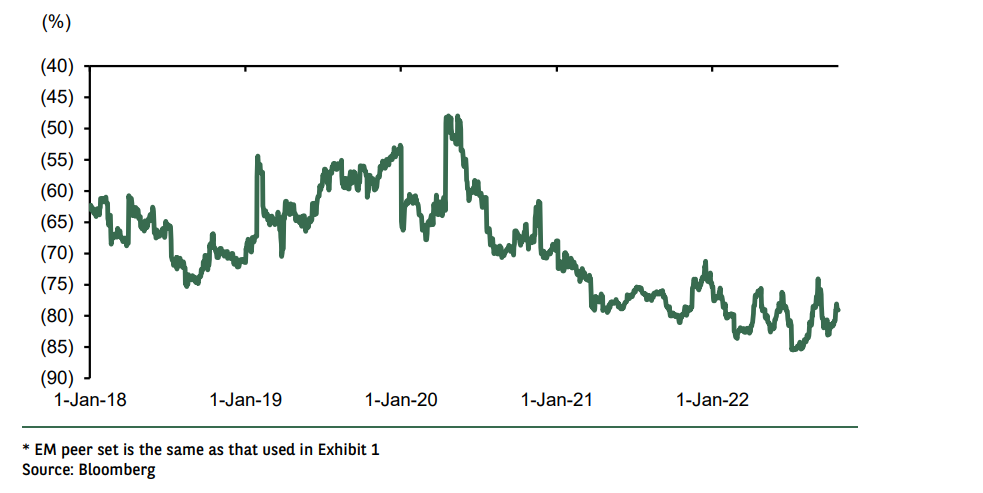

- Significant discounts to MSCI EM peers in terms of 2023E P/E (83% discount) and P/BV (74%).

Risks to our call

- Abrupt changes in monetary policy regarding rate hikes.

- New regulations that would cap banks’ earnings.

- Risks to economic growth and sour global risk appetite.

Raising TPs and estimates, Retain BUYs on AKBNK, GARAN and YKBNK

Even after the 26% outperformance of the XBANK vs the BIST-100, we remain positive on Turkish Banks. Except for a brief period in late-August/early-September, we think the rally was not unsubstantiated due to sustained upgrades in consensus EPS estimates and valuation multiples remaining at a discount to historical averages and to that of EM peers. But, we think deep negative real rates will hinder any multiple expansion going forward.

Our revised TPs put the average 2023E P/E for our banks coverage at 2.6x, still at a 37% discount to the last 3-year average NTM P/E.

Our favourites remain AKBNK, GARAN and YKBNK while we reiterate HOLD on VAKBN and ISCTR…

2023 can be eventful but earnings should be shielded by large CPI-linker proceeds

Being an election year, 2023 may bear a lot of surprises. Yet, starting from a very low base this year, any policy-rate normalization in 2023 should be gradual, shielding banks’ earnings for 2023. While we still expect the 2023 policy rate to rise to 28% (2022E: 9%), we now expect a steady normalization of rates instead of an abrupt hike. This marks a key delta from our prior numbers as we cut our 2023E average funding costs. While the policy-rate path is debatable, we take comfort that CPI-linker proceeds would account for 84% of the total 2023E EBT of the 5 banks we cover. We raise our 2023E earnings for our coverage by 33%, on aggregate, leading to a modest earnings slip of 8% y-y.

Banks are wearing tighter jackets with stricter regulations; bigger and more efficient wins

With regulations dictating loan pricing, deposit composition, fee structures and securities management, we think competitive advantage boils down to asset size as large balance sheets can better absorb the adverse impacts of regulations and running an efficient business model becomes even more important. In a more commoditized banking environment, we think big banks would win.

With this in mind, our favourites remain AKBNK that boasts the lowest 2023E C/I ratio of 26%, YKBNK, with a large portion of earnings shielded by its large CPI-linker book, and GARAN, owing to

its largest customer network that matters a lot when managing ex-KKM deposit costs.

By Pinar Uguroglu, excerpt only