Atilla Yesilada: The fate of the world economy will be shaped by the end of 1Q2023

atilla1

atilla1

Since the beginning of the year, fund managers have entered the mood of “the worst is over”, rejoicing at the stronger-than-expected economic data. In any case, it is difficult to dissuade young executives from the addiction that the Fed, ECB or d BOJ will rescue their portfolios, whenever the risk of a crisis looms.

The main reasons for this new optimism are:

- Fed ends interest rate hikes soon and then initiates monetary easing.

- The euro-area has survived the threat of the energy crisis unscathed, in 2023 it will exhibit slow-paced growth, not recession.

- The end of the Covid-19 epidemic in China has come to an end, soon Beijing and PBoC will turn to rapidly growing the economy.

If you notice, these 3 big themes, or stories, are a boon for Emerging Markets (or countries, EM) including Turkey. Hot money inflow to EM, which started in October 2022, reached $13 billion monthly in January. Press opinion leaders like Bloomberg yelled over their headlines, “This year, EM will be the king” will be the GOP!!!”. Morgan Stanley exaggerated the hyperbole by the good tidings that “GOÜ’s Golden Decade Begins”.

Is the worst over? Well, it could be. I adopted IMF/Georgieva’s confession at the end of 2022 that “the only thing we know for 2023 is uncertainty” as my motto this year. I see a very Quantum future hanging between good and bad scenarios. Of course, high uncertainty doesn’t last forever, I’m not in the mood to sit on my lazy ass all the time, saying “wait, there’s more uncertainty, I can’t yet make a prediction”. In my opinion, the fate of the world economy will be shaped by the end of 1Q2023, because we will see how realistic the 3 big developments I mentioned above which exhilarated fund managers like they had a testosterone shot. For my predictions to be finalized I need to see, how Russia’s impending launch of a final offensive in Ukraine within a month fares.

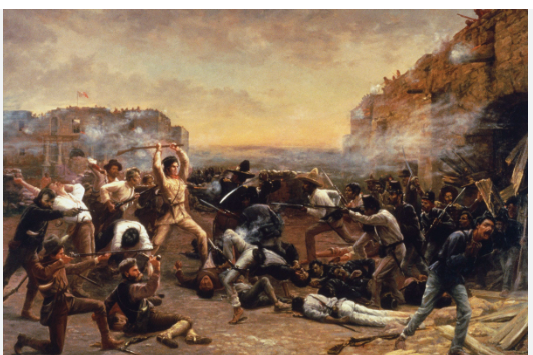

In my opinion, Ukraine will repel the attack, inflicting heavy losses on the Russians. In the dark and smoky backrooms of the Kremlin, which smells of vodka and borsch, debate shall begin as to who will replace Putin. But, I might be wrong about this, too, maybe Ukraine will suffer heavy losses in terms of weapons, infrastructure and lives in this attack, unwittingly returning to the negotiating table as Putin wanted.

Frankly, my heart is with the pessimists, because I would like to see the Judgment Day before I pass from this mortal world. World Bank President David Malpass, who thinks like me, and most men amidst mid-life crisis , said just last Sunday that he would grow a ponytail along with the prophecy of “We may have entered a long-term slowdown phase”. In the remainder of the article, I will describe the pessimistic scenario. Because I would like to guide the economic teams of the Table of Six, which will come to power on the night of 28 May, on how to deal with a bad external conjuncture as well as removing the internal debris.

Just over half of US business leaders say the economy is already in a recession or they expect it to start next year, according to a survey by the National Association of Business Economists (NABE). However, compared to a previous survey in October where 64% of respondents were convinced of an impending recession, I would say that morale in the US is starting to improve.

The Fed’s battle with inflation has not yet been won. An early break from monetary tightening can produce long-term inflationary trends. However, I would not object out loudly to the expectation that the recession will be moderate in the USA. But for the rest of the world, the situation is more dire, according to WB Chairman David Malpass.

According to the WB, there is a growing threat of a GDP slowdown that will last for years, especially in the developing countries, which are heavily burdened by external debt and have been hit hard by the shock waves spreading from Ukraine.

In an interview with Sky News on Sunday, Malpass made a very gloomy prophecy: “We may be entering a phase of prolonged slowdown.”

Malpass described the continuing economic consequences of the epidemic and the high food and fertilizer prices caused by the Ukraine war as the perfect storm to hold the developing world back in development for years.

Now, “pay attention this point is very important for Turkey, I say, imitating our former but not forgotten economy czar Mr. Berat Albayrak : “Poverty is getting worse; education levels are falling in many countries”.

According to IMF Managing Director Georgieva, the world economy may have passed the worst, but “it’s also possible we may have to settle for less bad.” Georgieva reminded that the IMF is gladly watching the improvement in current economic data, but that these are not at the level to raise their global forecasts.

Malpass warned that slowing growth for much of the world could hamper global development for years: “My concern is that the period of slow growth for the world could last into 2024”. “What’s worse, when you look one and two years ahead, it’s hard to see a strong rebound”.

For months, Malpass has warned of overlapping crises creating devastating economic conditions in the developing world and now referred to as “polycrisis” in economics literature. He said in June that much of the world was heading towards recession and stagflation, in September he described the scenario as “a perfect storm of challenges”.

While the WB warned in its annual report that the world is dangerously approaching a global recession, Malpass said developing countries are already seeing “disastrous setbacks in education, health, poverty and infrastructure”. Wait, the darker prophecies are not over, funding for climate change adaptation in Developing Countries is non-existent, if it is not already syphoned off by corrupt leader and their cronies.

Although developed economies may not go into deep recessions, EMs may have a difficult time growing, contrary to investment bank forecasts, because well, demand from China, US and EU may disappoint. One of the experts I follow closely, Moody’s chief economist Mark Zandi, for example, wrote that the most likely scenario in the US would be lackadaisical economic that almost stalls but never goes negative.

During his interview, Malpass emphasized the signs of debt crises becoming more evident in the EM. The total debt/GDP ratio in the EM was already high before the pandemic, but the epidemic caused debt levels to rise, while the strong dollar increased borrowing costs for poor countries. This gave rise to my concern that the 2023-2024 period might be the scene of chain defaults.

Financial Times writer Martin Wolf, who I follow closely, in his article titled “We must tackle the looming global debt crisis before it’s too late” thinks that if an EM crisis pops up, G-20 may have new obstacles to working out a solution quickly:

“Between 2000 and 2021, the share of public and publicly-guaranteed private foreign debt held by bond funds of low- and lower-middle-income countries jumped from 10 percent to 50 percent, while the share owed to China increased by 100 percent. Meanwhile, the share held by 22 predominantly western members of the Club of Paris, which is made up of official lenders, fell from 55 percent to 18 percent. Thus, coordinating creditors in a comprehensive debt restructuring operation has become much more difficult because of their number and diversity”.

In other words, in the past, the G-20 could intervene in defaults to prevent them from spreading to other developing countries through panic behavior. Even if China now participates in the debt forbearance, mutual funds may flee from a country’s defaulting debt; selling off EM bonds en masse.

Is the worst over? Probably, possibly. Is it easy to return to the good old days? Maybe, possibly, not necessarily.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/