S&P/Frank Gill: Turkey still has a lot of work to do to climb to investment grade

frank-gill

frank-gill

S&P upgraded Turkey’s sovereign rating a second time this year on Friday, with economy czar Mehmet Simsek heralding more such upgrades being in the cards. Turkish currency and stocks failed to benefit from the good news, as Erdogan ousted three Kurdish mayors, triggering so far minor protests in Kurdish provinces and October CPI turned out higher than expected. Turkish stocks are down almost 3% by 17:30 Turkish time.

Gill commented that it will take several years for Turkey to achieve single digit inflation:

Frank Gill, sovereign ratings senior director at S&P Global Ratings, provided an analysis of Türkiye’s economic trajectory, acknowledging recent progress while cautioning about the complexities that lie ahead in achieving sustained disinflation and economic stability.

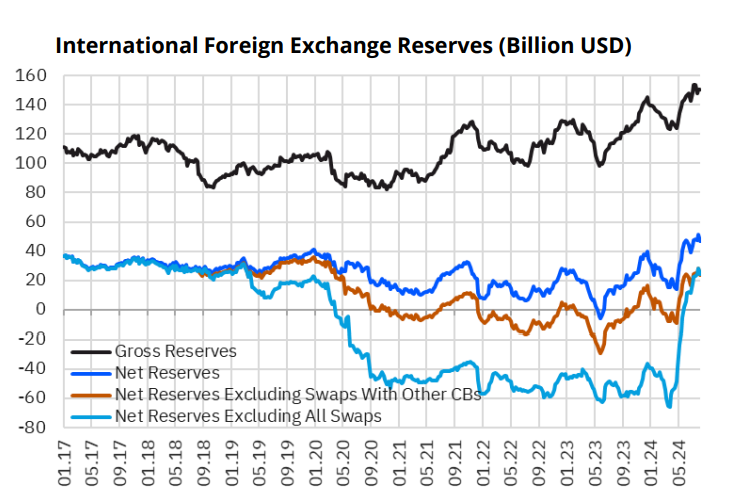

Gill told Anadolu New Agency that a significant shift in Türkiye’s economic landscape, particularly in terms of foreign currency and FX protected deposits, which now comprise 45% of total foreign currency reserves — a considerable decrease from earlier levels.

“This shift,” he remarked, “reflects the effectiveness of Türkiye’s transition to more orthodox monetary policy,” highlighted by the recent increase in the policy rate to 50%.

This adjustment is fostering economic rebalancing, as evidenced by a 12-month rolling current account deficit of around 1% of GDP as of August.

However, the official warned that the next stages of Türkiye’s disinflation and rebalancing efforts will be “challenging to execute.”

One key difficulty is the “sticky” nature of services inflation, which remains elevated above headline inflation levels.

He also pointed to the substantial gap between inflation expectations among households and market participants, indicating further obstacles in achieving synchronized economic sentiment.

A positive development Gill emphasized is the shift in household deposits from foreign currency to Turkish lira, a move that has supported the Central Bank’s accumulation of foreign currency reserves.

“This has reduced Türkiye’s need for external financing,” he observed, underscoring the progress in stabilizing the economy.

Nonetheless, he cautioned that maintaining this balance will depend on closely coordinated income policies aligned with inflation targets.

No rate cuts before 1Q2025

Looking ahead, he discussed the Central Bank’s approach to rate cuts, initially expected to begin in November but now projected for the end of the first quarter in 2025, following recent inflation data.

He explained that any adjustments would be conservative, with the Central Bank remaining “watchful of the exchange rate, reserve levels, and capital flows.”

US elections, yield volatility threat to credit rating

Gill also highlighted potential external risks to Türkiye’s economic stability, specifically pointing to the upcoming US election on Tuesday and recent volatility in US Treasury markets, which could influence capital inflows into Türkiye.

“Higher interest rates and a steep yield curve in the US could pose challenges for emerging markets, including Türkiye,” he warned.

Cautiously optimistic

On Türkiye’s growth prospects, Gill expressed a cautiously optimistic view.

“We are still forecasting headline GDP growth of just over 2% this year,” he said, while acknowledging that growth could be impacted by the Central Bank’s policy rate adjustments and December’s wage decisions.

He emphasized that a negative growth rate would be “unusual” for Türkiye, considering its population growth and anticipated demand from European trading partners.

Gill also commented on S&P’s recent upgrades to Türkiye’s credit rating, noting that “upgrading twice in a single year is significant.”

However, he tempered expectations regarding inflation reduction, suggesting that returning to single-digit levels would likely require “three to five years of tight monetary and fiscal policy,” a demanding task in a democratic context, where economic pressures impact household confidence.

Despite these challenges, Gill highlighted Türkiye’s resilience as an open economy with strong services exports.

He concluded: “Net exports are expected to support growth in the coming years, although household spending may weaken, a deliberate part of the government’s plan to reduce inflation.”

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/