2025 Offers Opportunities, But Vulnerabilities Remain: Ak Yatırım

CBRT

CBRT

New index target 14,700, up 50%: According to our company-based model revisions, we have updated our 12-month BIST-100 index target to 14,700, which promises a 50% return. We believe that the stock market now offers a more stable return potential for investors in a falling interest rate environment. However, our expectation that interest rate yields will remain attractive for a while, the fact that positive expectations in some thematically prominent sectors have already been priced in for some time, signals that the recovery in the remaining sectors will be delayed, and finally the risk that global uncertainty may increase make stock selection difficult, at least in the short/medium term.

The interest rate cut cycle will still be a catalyst for the stock market: Last year, the benchmark index tested a peak level of 11.2 thousand (340 USD) in July, but the 12-month index target of 12,000, which we set at the beginning of the year, was not reached during this period (we revised the index target to 14,500 in September). Last year, BIST’s annual return of 32% (10% in USD terms) was below the annual CPI increase and deposit and money market fund returns. The last interest rate hike of 500 basis points in March was as effective as the company performance in keeping the index return weak. With the interest rate cut process starting at the end of December, we expect the stock market return to be more competitive than inflation in 2025.

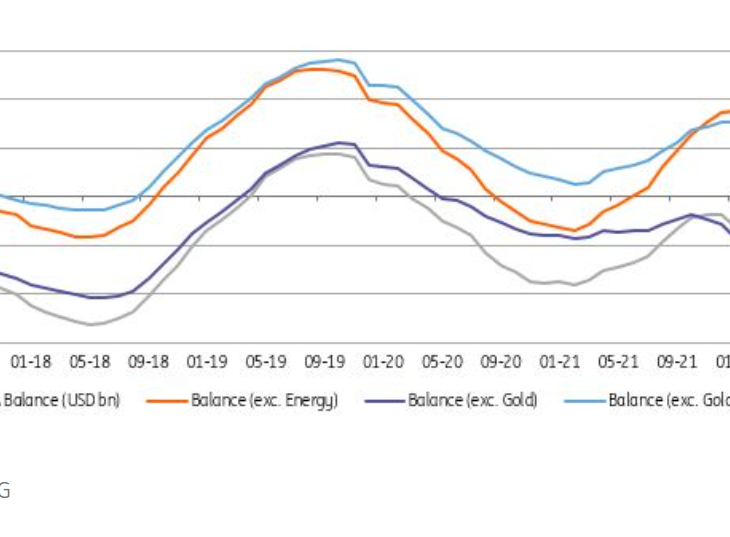

The theme of financial stabilization supports the stock market: The course of macro stability over the last year has generally been in line with our forecasts in our last September Strategy update: Year-end inflation came in at 44.4%, close to our forecast of 43%. The Turkish lira strengthened by around 20% in real terms against a basket of currencies, as we expected. CBRT started to cut interest rates in December as we had anticipated. In this report, we have slightly revised our macro forecasts for 2025. Accordingly, we expect (i) CPI inflation to be 27.5% at the end of 2025 and 16.5% at the end of 2026, (ii) the CBRT to cut the policy rate relatively strongly (250 basis points) in the next four meetings and lower in the remaining three meetings after July, bringing the policy rate to 30.5% at the end of the year, (iii) in addition to this, we expect the policy rate to fall to 20% at the end of 2026 with a 10.5 percentage point rate cut in the following year, (iv) we expect GDP to increase by 3.2% in 2025 and 5.0% in 2026, (iv) the current account balance, which posted a deficit of less than 1% of GDP in 2024, to deteriorate slightly to a deficit of less than 2% of GDP in 2025, despite our expectation of a significant acceleration in import momentum, and (v) real exchange rate appreciation to be limited (below 5%), with an 18% nominal depreciation of the TL against a basket of currencies in 2025.

The first half may be challenging for non-financial sectors and exporters: The lower-than-expected minimum wage was welcomed positively in terms of inflation trends and labour costs. However, the weakening in incomes and the limited retreat in consumer loan rates will also lead to a slowdown in consumer demand. For companies, high financing costs, the impact of the real appreciation of the TL for the last one and a half years on margins, the expectation that demand will remain weak at home and abroad, as well as the strengthening of the dollar against the euro make the short/medium-term outlook disadvantageous for many sectors. Therefore, in the first six months of the year, when the real appreciation of the TL will be more pronounced, the banking, insurance, food and food retail, healthcare and telecoms sectors, which we have highlighted in our previous reports, will continue to stand out in terms of financial performance; we think that the interest in construction, cement, building materials and REITs will continue in aviation, where the growth momentum continues, and in construction, cement, building materials and REITs with the strengthening of the interest rate cut phase and regional opportunities; on the other hand, in sectors such as glass, iron/steel and white goods, China and Europe-based incentive packages, the course of global trade and domestic demand conditions will be awaited in the second half of the year.

The outlook is uncertain in terms of the impact of global developments: Geopolitical developments have been an important negative component of Turkey’s risk premium at least in the last decade. In particular, 2024 was a year in which conflicts in our region escalated further. Increasing optimism regarding the resolution of the Russian-Ukrainian war in 2025, regime change in Syria at the end of 2024, and the continuation of the ceasefire in the Israeli-Palestinian conflict may reduce geopolitical risks and offer some opportunities for Turkey in terms of reconstruction of the region and exports. However, it is difficult to make a reliable prediction about the course of geopolitical developments for the time being, given the decreasing predictability in global diplomacy with the new era in the US, protectionist tendencies and the strengthening of the dollar, and the risks of trade wars, although Turkey is considered to be among the relatively less affected countries in academic studies.

The CBRT has a very strong hand to manage potential pressures on foreign exchange: The CBRT’s FX reserves are currently at record levels and have accumulated more than USD 120 billion in the last one year. It is estimated that the CBRT has purchased around USD 17.0 billion of foreign exchange from the market since the beginning of the year, driven by strong portfolio flows. The decline in the CCC from its peak level to below USD 30 billion, down by around USD 100 billion, also helped the CBRT’s reserve management. The 500 basis point increase in the withholding tax rate on time deposits and mutual funds excluding equities to 15% at the end of January and the zero withholding tax on equity funds will undoubtedly play a supportive role in the equity market as well as supporting the budget. On the other hand, this may increase the sensitivity of money market fund investors to interest rate cuts after a certain period. Indeed, savings in money market funds have increased more than 10-fold in the last year, reaching approximately TL 1.5 trillion (USD 43 billion). To maintain exchange rate stability, these savings and the $30 billion in the KKM must remain in TL. On the other hand, with the strong reserve accumulation of the CBRT in the last year, we do not see the possibility of such volatility in the near term.

Expectations of non-bank economic units are critical for the new phase in the fight against inflation: Despite the success achieved since May in curbing inflation, CPI expectations of households and the corporate sector for the next 12 months as of end-January remain high at 63.1% and 47.6%, respectively. The gap between the inflation expectations of market participants and the real sector has been almost constant at 20 points since the first quarter of 2024. To reduce price pass-through and improve expectations, the public sector may be expected to make measured and timely price adjustments in areas such as electricity and natural gas, where it has a decisive influence on prices. As the CBRT’s analysis shows, household inflation expectations are particularly critical to service inflation. We think that the limited increase in the minimum wage may have a positive impact on households’ inflation expectations in the coming months. In addition, a seasonally adjusted monthly CPI inflation rate below 2% in the coming months would also have a positive impact on households’ inflation expectations.

Source: Ak Yatırım

Translation: Cem Cetinguc