ANALYSIS: Trump tariffs: Boon or calamity for Turkish economy?

trump trade

trump trade

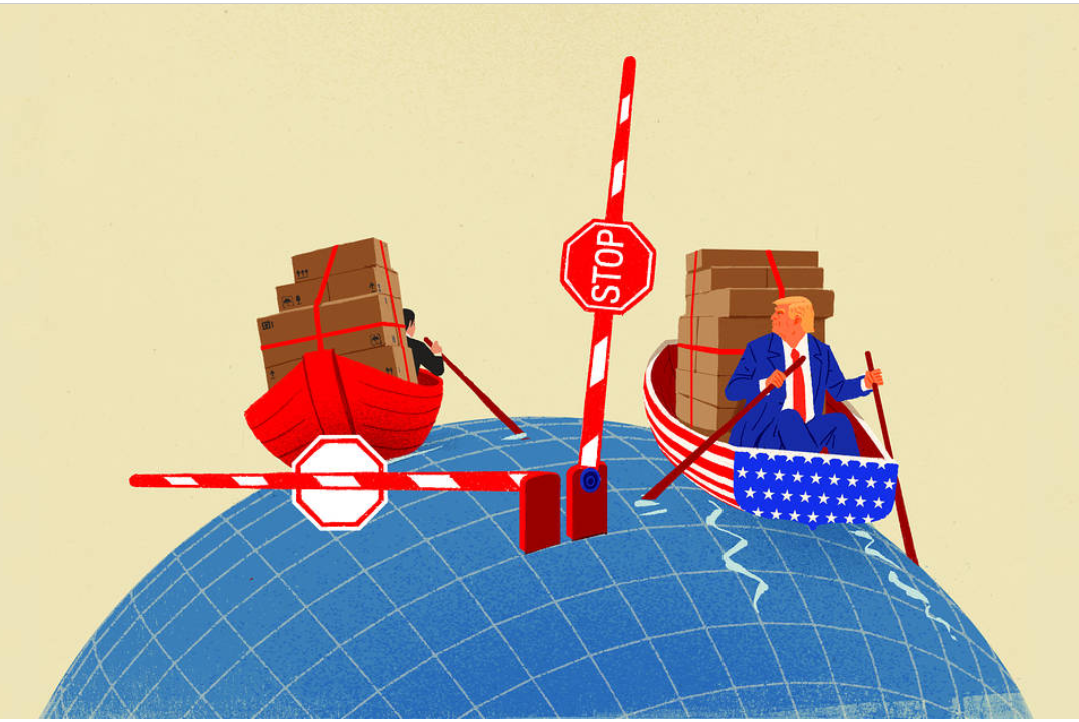

The implementation of U.S. tariffs under President Donald Trump has sparked concerns over a global trade war and led to significant market fluctuations.

Trump also hinted that European Union goods could soon face tariffs, adding to economic uncertainty.

Experts believe these measures could exert pressure on exchange rates and shift market dynamics, affecting Türkiye’s trade and economic outlook.

Could tariffs affect Turkish Lira?

Analysts speaking to the BBC Turkish, suggest that tariffs could indirectly pressure the Turkish lira. Ecevit Sanli, president of the Turkish-American Business Association (TABA), warned that tariffs could strengthen the U.S. dollar, placing emerging market currencies, including the Turkish lira, under strain.

Sanli also noted that exchange rate fluctuations could impact Türkiye’s foreign trade, making raw material and intermediate goods imports more expensive due to disruptions in global supply chains.

Economist Hayri Kozanoglu echoed these concerns, stating that tariffs might increase U.S. inflation and slow down interest rate cuts by the Federal Reserve. Higher U.S. interest rates make dollar-denominated investments more attractive, causing the dollar to appreciate against major currencies, including the Turkish lira.

However, Kozanoglu believes Türkiye’s high-interest policies aimed at curbing inflation could limit the depreciation of the lira. “The Turkish lira generally does not experience dramatic shifts against its main trading currencies,” he added.

Indeed, Turkey’s economy czar Mehmet Simsek reiterated the commitment to strong TL policy, according to Bloomberg: Turkey’s finance minister signaled the lira will continue strengthening in inflation-adjusted terms, paving the way for investors looking into longer-term bets.

“You could bank on real exchange-rate appreciation lasting as long as the program delivers,” Mehmet Simsek said at a Bloomberg event in Istanbul on Tuesday, referring to Turkey’s pivot to more orthodox monetary and fiscal policies since mid-2023. “Right now, the delivery is there. I can tell you that there are more opportunities going forward.”

Central Bank of Turkey holds gross FX reserves of over $160 bn, considered adequate coverage against foreign investors abandoning Turkish markets, in response to shock caused by strong USD and rising bond yields, which are rationally a bane for EM.

Türkiye’s market share and trade opportunities

Yet, there seem to be some opportunities for Turkey to benefit indirectly from Trump tariffs, though the reasoning is speculative and requires some structural reforms at home:

The U.S. tariffs on Chinese goods could reduce demand for these products, prompting American importers to seek alternative suppliers.

Wolfango Piccoli, co-president of international consultancy firm Teneo and a geopolitical risk expert, suggested that Türkiye could gain a competitive edge in sectors such as textiles, auto parts, and home furnishings. However, he cautioned that Türkiye’s gains would likely be modest.

Economist Kozanoglu pointed out that China, facing U.S. trade barriers, is redirecting its exports to other regions. Türkiye is not a primary beneficiary of this shift due to higher production costs compared to low-wage economies.

“Türkiye does not hold a special advantage because its labor costs are higher than countries like Bangladesh or Egypt. Additionally, geographically, shifting production to Türkiye is not the most practical option,” Kozanoglu explained.

On the other hand, it is plausible for some Chinese multi-nationals catering to the EU market to switch some production to Turkey to benefit from the Custom Union and shorter delivery times.

A more remote possibility is American imports from China and even Mexico to be sourced from Turkey, but there the composition of Turkish export industries pose a problem:

Former Overseas Private Investment Corporation (OPIC) advisor Faruk Kahraman emphasized that Turkish manufacturers struggle to meet U.S. market demands due to differences in product preferences.

“We have not fully adapted to American consumer expectations, whether in services or goods,” Kahraman noted.

Meanwhile, TABA President Sanli suggested that Türkiye could emerge as an alternative supplier for the U.S. in sectors such as textiles, automotive components, and chemicals.

However, he warned that as China pivots to alternative markets, Türkiye could face intensified competition in key export industries.

Potential impact on Türkiye’s EU trade

Trump’s warning about potential tariffs on EU goods could also affect Türkiye’s economy. If tariffs strengthen the U.S. dollar against the euro, it could lead to a depreciation of the euro against the Turkish lira.

Sanli warned that fluctuations in the euro/dollar exchange rate could affect Türkiye’s export revenues, as Türkiye conducts most of its foreign trade in euros.

Kozanoglu agreed, noting that a weaker euro could widen Türkiye’s current account deficit by reducing its euro-denominated income. He also highlighted that an economic slowdown in Europe, triggered by U.S. tariffs, could weaken demand for Turkish exports.

“Additionally, increased competition in the European market may force Turkish exporters to lower their prices,” Sanli added.

Piccoli estimated that a broad 10% tariff on EU goods could reduce the region’s gross domestic product (GDP) by 0.3% within two years, indirectly affecting Türkiye’s exports.

Financial consultant Kahraman pointed out that Türkiye lacks the capital investment to replace lost EU imports. “China can fill a 100-container order instantly. Türkiye’s fragmented industrial sector struggles to meet such large-scale demands,” he explained.

Turkiye Today, Bloomberg, PATurkey editors

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/