ANALYSIS: Year-end CPI revised up, fewer rate cuts penciled in

Atilla Yeşilada

•

April 3, 2025 4:27 pm

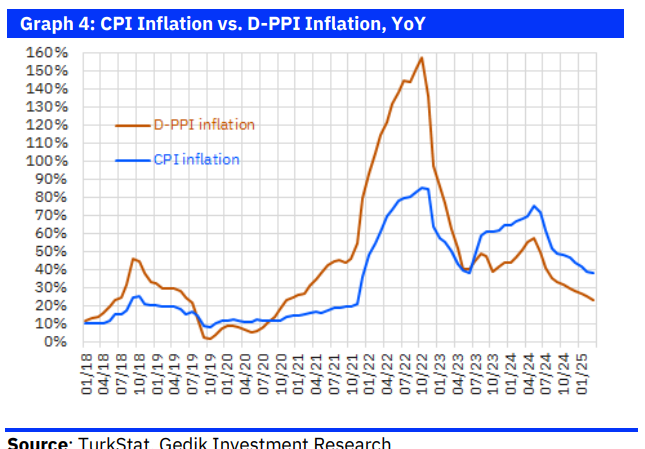

March CPI inflation at 2.46% MoM came below expectations, bringing the annual rate down to 38.1% from 39.1%. March CPI inflation came in at 2.46%, below the median market expectation of 2.9% (Bloomberg HT survey: 2.78%) and our forecast of 3.1% (March 2024: 3.16%). As a result, YoY CPI inflation eased from 39.1% to 38.1%. Core CPI inflation (Group C) also fell short of our 2.5% expectation, registering at 1.46% (March 2024: 3.52%), bringing YoY core inflation down to 37.4% from 40.2%.

On the producer side, D-PPI inflation remained contained, supported by currency stability and moderating global commodity prices, registering 1.88% MoM (Mar-24: 3.29%). The disinflation trend in D-PPI inflation, which started from 57.7% in May 2024, persisted, with the annual rate declining further from 25.2% last month to 23.5%.

Our forecast deviation is attributable to clothing and services components.

A closer look at the breakdown reveals that food inflation, where we had flagged upside risks, materialized in line with our expectations at 4.94%. The increases in energy (0.0%), tobacco and alcoholic beverages (10.0%), durable goods (1.6%), and other core goods (2.1%) components also aligned with our projections.

The key driver pulling the headline figure below our forecast was the clothing component, which, contrary to historical averages, recorded a 2.6% decline instead of the 2.5% increase we had expected. As a result, the clothing component, which we have noted as significantly diverging from headline inflation over the past 3–4 years, appears to have declined by roughly 12% since the beginning of the year.

A relatively positive factor in this month's inflation data is the moderation in services inflation, which retreated from 10.3% in January and 3.6% in February to 2.0%, below our expectation of 2.9%.

Thanks to the lower-than-expected services and clothing inflation, core inflation (C index) also came in at 1.5%, below our 2.5% forecast.

Additionally, we calculate that services inflation excluding rent—a metric recently highlighted by the CBRT—stood at 1.55%.

Clothing inflation has exhibited a notable divergence since late 2021. Given its distinct divergence compared to other components, we believe that clothing inflation warrants a separate discussion. As in the first two months of the year, clothing inflation in March at -2.6% remained well below expectations and historical averages (March 2021-2024 average: 1.7%; March 2024: 2.6%), and exerting a downward impact of approximately 0.2 percentage points on headline inflation. Taking the post-November 2021 period as a reference, TurkStat data reveals that cumulative CPI inflation has reached 389%, whereas cumulative clothing inflation has been significantly lower at 121%.

We revise our end-2025 CPI inflation forecast to 33%; rate cuts could be paused in April and June

[embed]https://www.youtube.com/watch?v=Ia_KCIM06GA&t=55s[/embed]

We expect the inflationary effects of the currency depreciation in the second half of March to start materializing from April onwards. Consequently, while we had previously projected CPI inflation to decline to 33-34% by June, we now anticipate it may remain around 37-38% over the next three months. Given this outlook, we believe the CBRT is likely to pause rate cuts in its April and June MPC meetings.

In light of these developments, we are also revising our year-end 2025 CPI inflation forecast to 33.0% from 29.0%.

By Serkan Gonencler, Chief Economist, Gedik Invest

inf-march2025-eng

inf-march2025-eng