Fatih Ozatay: Not a good start to the year in production

sanayi üretim,

sanayi üretim,

Industrial Production Declines in January: A Volatile Start to the Year

January’s industrial production data has been released, showing a 2.3 percent decline compared to the previous month. While it’s unwise to draw sweeping conclusions from a single month’s figures, other indicators suggest that the year has not started on a strong note.

Capacity utilization rates for the first two months indicate a significant drop, both compared to the last quarter of 2024 and the year’s overall average. Meanwhile, the Istanbul Chamber of Industry’s Turkey Manufacturing PMI remained below the critical 50 threshold in both January (48) and February (48.3), signaling contraction in the sector.

A Mismatch in Economic Signals

Despite the weak start to 2025, industrial production and GDP data for the final quarter of 2024 painted a more optimistic picture. After shrinking by 3.8 percent in Q2 and 1 percent in Q3, industrial production rebounded sharply in Q4, rising by 3.34 percent. Similarly, GDP increased by 1.7 percent in Q4 after minor contractions in the previous two quarters. These figures suggested that economic activity was picking up—perhaps even that the worst was over.

However, the early 2025 data challenges this optimism. More precisely, it suggests that the recovery may not be as solid as initially thought. Economic indicators have become increasingly volatile, making it harder to predict future trends. Friday’s upcoming data on services and construction output will provide further insight, but a few more months of data are needed before we can draw firmer conclusions.

Structural Weaknesses Remain

A fundamental issue remains: the current economic program is incomplete. It relies almost entirely on monetary policy, while fiscal policy focuses primarily on containing the budget deficit. However, there has been little effort to ensure broader ownership of the program or to distribute the economic burden fairly. Crucially, structural reforms are missing.

Moreover, the slow pace of interest rate hikes in the program’s early months delayed progress in controlling inflation. As a result, with inflation remaining stubbornly high, loan interest rates have stayed elevated, and the domestic currency has retained its strength—fueling growing frustration among businesses and consumers alike.

Learning from the Past

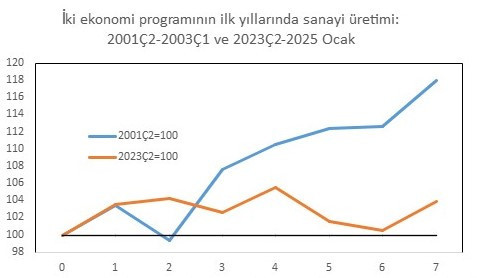

A comparison of industrial production under two different economic programs illustrates the shortcomings of the current approach. One example is the Transition to a Strong Economy Program, launched in May 2001. The other is the Return to Rationality Program, introduced in June 2023. A review of seasonally and calendar-adjusted industrial production index values by quarter reveals stark differences in outcomes.

The key distinction lies in program design. The 2001 program was far more comprehensive, while today’s framework remains incomplete. While external conditions certainly play a role, they are beyond policymakers’ control. What can be controlled is the design and execution of economic policy. Only by addressing these structural gaps can we create a more resilient and sustainable economic recovery.