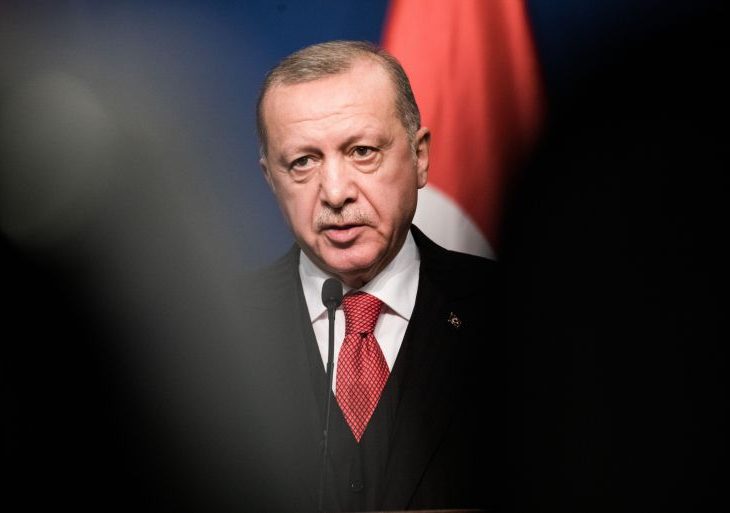

HSBC Research: TL pressure could lead to higher inflation

tl-dandik

tl-dandik

USD-TRY has deviated from the paths predicted by our framework and the risks of dollarisation and inflation have increased. A steeper move higher in USD-TRY by year-end is possible.

Our framework projecting USD-TRY based on various inflation and real TRY appreciation scenarios has been a useful guide over the past year or so. However, in the wake of Istanbul Mayor Ekrem Imamoglu’s detention (Bloomberg, 19 March), we believe the currency’s outlook has become more uncertain. Notably, we now see risks emerging around what we believe to be the TRY’s two main supportive drivers, which could in turn suggest a higher USD-TRY than we are currently forecasting.

The de-dollarisation trend

Over the past 15 months or so, the reduction of residents’ appetite for FX has been at the core of the policymakers’ objectives and has also been pivotal in the TRY’s performance. The sharp rise of FX volatility may encourage residents to increase their demand for foreign currencies. Türkiye’s FX reserves position is much stronger than two years ago and the central bank can face episodes of higher foreign currency demand. However, the panorama has become more challenging and residents’ demand for FX may become more persistent in the upcoming period.

The interplay between FX policy and inflation

Since the start of 2024, supporting real FX appreciation has been an implicit intermediate target to fulfil the core objective of lowering inflation. The sudden and abrupt rise in USD-TRY is a challenge to the current FX policy, which is based on a slow and moderate nominal TRY depreciation.

Over the medium term, we believe that the risks are still skewed towards a higher USD-TRY, even if the CBRT retains its FX policy stance. It is worth noting that Türkiye has one of the highest FX pass-throughs among its EM peers, and the TRY’s sharp depreciation could increase inflation risks. Thus, if inflation reaccelerates or disinflation slows in the coming months, it mechanically means that the TRY could depreciate more on a nominal basis.

Overall, our estimate that USD-TRY would end the year in a 41-43 range (with no real TRY appreciation) faces upside risks

So does our year-end forecast of 40.0, which now implies larger real TRY appreciation than before in light of the TRY weakness.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/