SEB/Eric Meyersson: Will Markets See Through Erdogan’s Power Grab If He Stays True to Policy?

tl-chart

tl-chart

Erdogan’s power grab to incarcerate his would-be main political rival is as outrageous as it is unexpected. We retell the political dilemma that has likely brought this to center, which we laid out in more detail last year. For now, market moves are considerable but lower than past crises dates. Should the Erdogan government push through with the authoritarian crackdown while also emphasizing its continued support for the current monetary policy strategy, markets could over time see through further democratic backsliding in Turkey, to its long-term detriment.

Erdogan Incarcerates Main Rival

Markets reacted forcefully following news Turkish police had detained Istanbul’s mayor Ekrem Imamoglu, and main political challenger to President Recep Tayyip Erdogan, in a sweeping government crackdown on opposition politicians. State-run Anadolu news agency claimed Imamoglu’s detention was part of an investigation into alleged terrorism links stemming from support he may have received from pro-Kurdish political groups in his 2024 re-election campaign for Istanbul mayor. Later this week, the opposition Republican People’s party (CHP) was supposed to have named İmamoğlu as its presidential candidate in a primary this Sunday.

The Dilemma: Democracy or Disinflation?

For readers of SEB research on Turkey, this should be outrageous, but not suprising, news. We have for a long time warned against the political constraints to Erdogan’s tenure, and how this could force through another authoritiarian crackdown. Turkey’s democratic institutions are already at a historical low but the current constitution’s presidential term limits still prevents Erdogan from standing for President once more in 2028, absent a constitutional change or parliament declaring early elections (both which the President’s coalition lack support for).

The dilemma, as we laid out in the above note, is thus that Erdogan losing power means unacceptable consequences for him and his poliitical allies (in terms of court cases, threats of jail time, legal expropriation, exile etc) whereas the political system he has helped built still restrains him. Moreover, a prolonged disinflation process and prolongued Erdogan rule are largely mutually exclusive under the current system, in that the policies needed to reduce inflation would work against the incumbents support (and possibly any of his successors too).

Could this Authoritarian Turn Be Different?

But once your remove the democratic restraints, the TCMB could in principle continue with its policy strategy without concern for political interference. That makes this authoritarian turn different also in terms of economic policy. We expect President Erdogan to have realized the value of a strong autonomous (if not independent) central bank does more good to him than harm, especially in a process of further democratic backsliding.

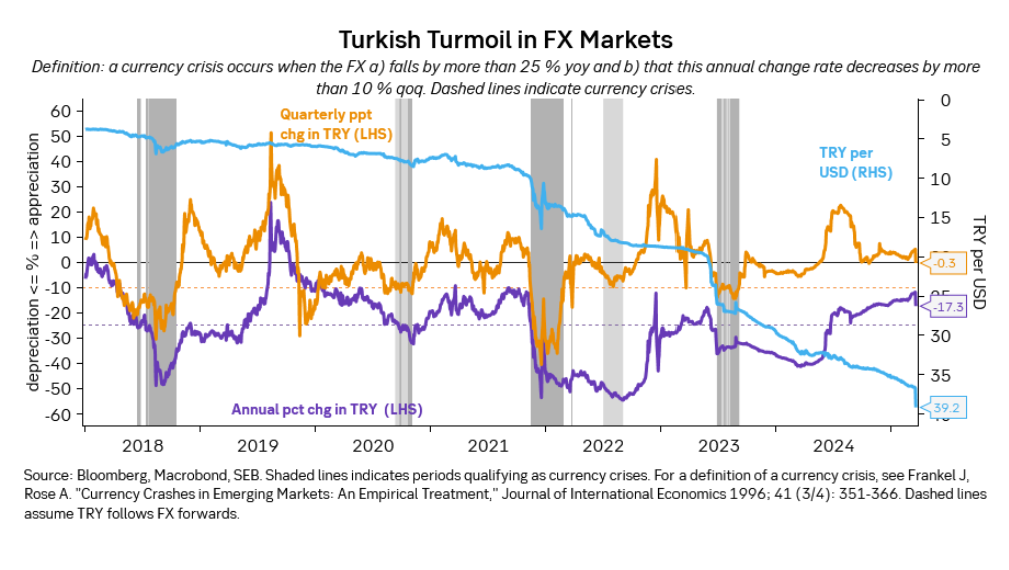

How markets will accclimatize to Erdogan’s renewed authoritian push depends partly on the TCMB and the Banking Regulator’s ability to slow things down, as well as the degree to which this also jeapordizes President Erdogan’s support for the TCMB’s monetary policy strategy. For now, the FX moves are by themselves a far cry from the enormous swings in the lira that occurred in previous years. And the lira has until 43 per dollar to fall into the kinds of currency crises Turkey experienced in 2018, 2021 and 2023.

Markets are likely to remain jittery as long as the assumption is one that the autocratic dragnet will ultimately affect the TCMB and economic policymakers as well. But many strongmen, including Russia’s President Putin, have over time learnt the value of combining autocratic rule with a credible central bank operating more or less autonomously. And with Trump as president, it is unlikely that the US will rush to save what little remains of Turkey’s democracy. Meanwhile, should the Erdogan government emphasize clearly that the current economic policy strategy remains in place, and that this is not also a reversal to Erdoganomics, markets could over time to choose to see through even more democratic backsliding in Turkey. Given the importance of inclusive institutions and liberal democracy in fostering modern economies and healthy societies, that would be to Turkey’s long-term detriment.

The author’s Linked-In post

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/