Turkey’s Inflation Expectations Rise Amidst Real Appreciation Strategy

inflation_batman

inflation_batman

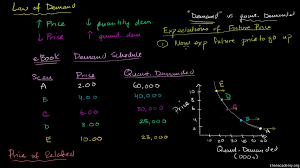

Turkey’s inflation expectations for 2025 have climbed, with the year-end forecast increasing to 28.3% following a higher-than-expected January inflation rate of 5.03%. Analysts note that disinflation efforts through real appreciation are expected to continue, as exchange rate projections remain below inflation expectations.

Inflation and Exchange Rate Forecasts

- 2025 Year-End Inflation: 28.3% (Up from 27.1%)

- 2026 Year-End Inflation: 19.1% (Up from 18.7%)

- 5-Year Inflation Expectation: 11% (Unchanged)

The CBRT’s official inflation target remains 24% for 2025 and 12% for 2026, meaning market participants expect higher inflation than the central bank’s forecasts.

- 2025 Year-End Exchange Rate (USD/TRY): 42.9 (Slight decrease from 43.0)

- Current USD/TRY Exchange Rate: 36.2

- Implied Exchange Rate Increase: 18.5% (≈1.5% per month)

Market expectations align closely with the CBRT’s implied exchange rate of 42-43 but remain below the futures market’s pricing at 46.3.

Monetary Policy & Interest Rate Expectations

Market participants expect the CBRT to continue rate cuts in the coming months:

- Policy Rate Projection (May 2025): 40.0% (Indicating 250 bps cuts in March and April)

- 12-Month Interest Rate Expectation: 28.9%

- 24-Month Interest Rate Expectation: 20.2%

- Expected End-2025 Policy Rate: 30%

This outlook suggests interest rate cuts will slow in the second half of 2025, maintaining positive real interest rates throughout the forecast period.

Economic Growth & Current Account Deficit

- 2025 GDP Growth Forecast: 3.0% (Slight downward revision)

- 2026 GDP Growth Forecast: 3.9% (Unchanged)

These expectations remain below Turkey’s Medium-Term Program (MTP) targets of 4.0% for 2025 and 4.5% for 2026, signaling a more cautious outlook on economic expansion.

Meanwhile, current account deficit (CAD) projections have worsened:

- 2025 CAD Expectation: $18.8 billion

- 2026 CAD Expectation: $24.6 billion

Given real appreciation trends, weakening European growth, and a declining EUR/USD parity, analysts predict a higher-than-expected current account deficit, with 2025 potentially reaching $24 billion.