Turkey’s Inflation Falls Below Expectations in March, But Risks Remain

inflation

inflation

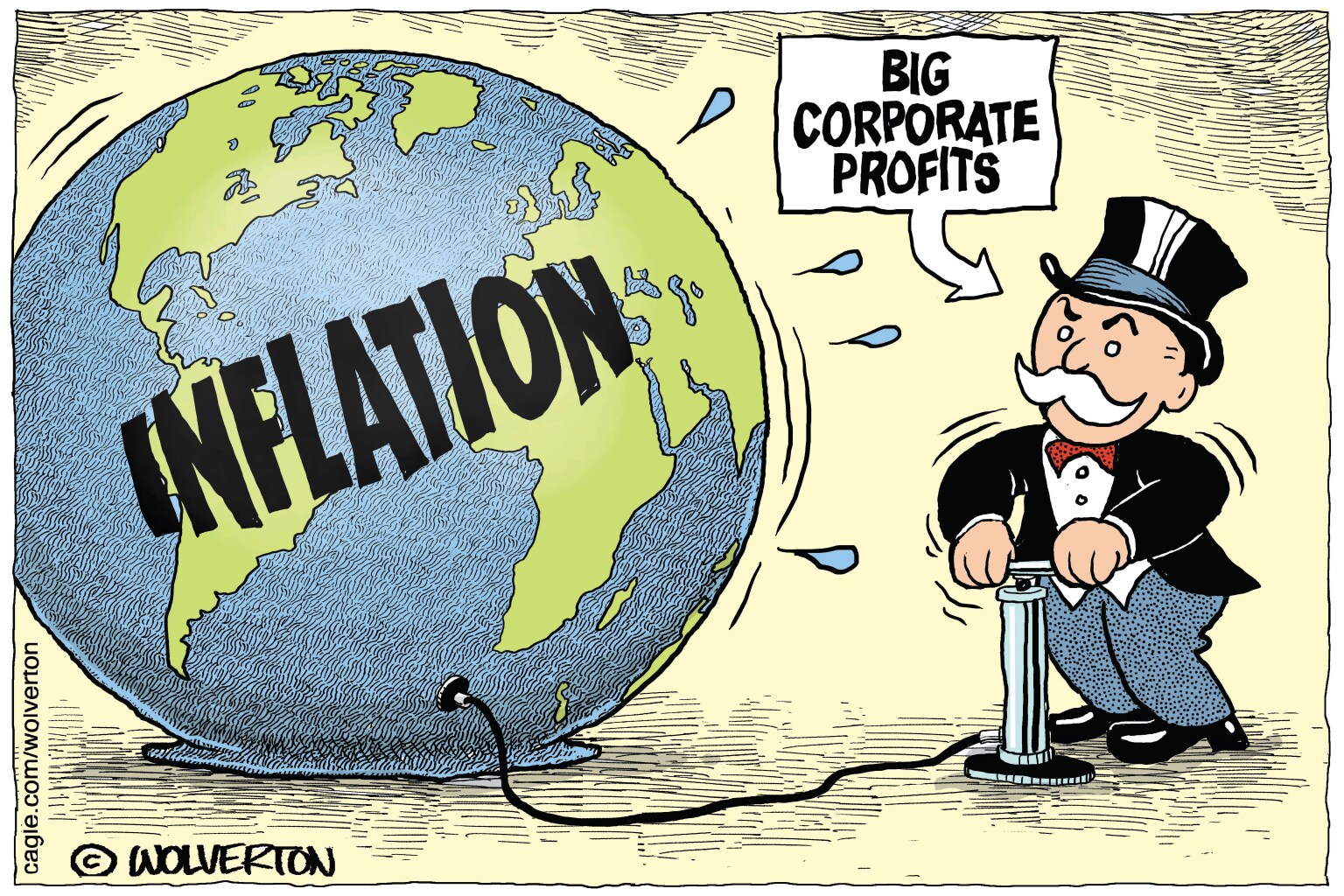

Turkey’s annual inflation rate fell to 38.1% in March, marking a better-than-expected slowdown, according to data released by the Turkish Statistical Institute (TÜİK). The latest figure is down from 39.1% in February, below analyst projections of 38.9%, and represents the lowest inflation reading since December 2021.

This marks the 10th consecutive month of disinflation, offering some optimism for economic stability. However, ongoing political uncertainty and new U.S. tariffs are emerging as potential inflationary risks going forward.

Price Growth Slows Across Key Categories

The March inflation report showed broad-based moderation across several consumer sectors:

-

Clothing and footwear inflation dropped to 14.8%, down from 20.8%

-

Transport prices eased to 21.6%, from 23.4%

-

Household goods inflation edged down to 32.4%

-

Health expenses declined to 42%

-

Restaurant and hotel prices fell to 43.4% from 45.9%

-

Recreation and cultural goods also saw slower price increases

However, food and non-alcoholic beverages inflation rose slightly to 37.1%, up from 35.1%, highlighting ongoing volatility in food costs.

On a monthly basis, consumer prices rose 2.5% in March, up from 2.3% in February.

Could Falling Inflation Lead to More Interest Rate Cuts?

Despite its relatively high inflation, Turkey’s central bank, the Central Bank of the Republic of Turkey (CBRT), surprised markets by cutting its key interest rate by 250 basis points to 42.5% in early March.

The CBRT’s move reflects optimism over the ongoing disinflation trend, but economists caution that external and domestic risks could reverse the trend:

-

The newly introduced 10% U.S. import tariff on Turkish goods

-

Volatile political environment following the arrest of Istanbul Mayor Ekrem İmamoğlu

-

Public calls for boycotts targeting businesses perceived as close to the government

EBRD: Inflation Eases, But Caution Needed

The European Bank for Reconstruction and Development (EBRD) maintained its 3% GDP growth forecast for Turkey in 2025, and projects 3.5% growth in 2026. The EBRD noted:

“Tighter monetary and fiscal policies have significantly reduced inflation and improved Turkey’s external balances, with rising net exports and a narrowing current account deficit.”

However, the EBRD warned against premature loosening of monetary policy, citing:

-

Persistent high inflation

-

Geopolitical uncertainties

-

The real appreciation of the Turkish lira, which could reduce export competitiveness

-

Turkey’s heavy reliance on short-term external financing

SEO Highlights: CBRT interest rate cut March 2025, Turkey GDP forecast EBRD, Turkey external financing risk, İmamoğlu arrest economic impact, U.S.-Turkey tariff trade risks

Political Instability Casts a Shadow

Turkey’s economic progress is being tested by growing political tension, particularly after the detention of opposition figure and Istanbul Mayor Ekrem İmamoğlu in March. The event triggered nationwide protests, and opposition groups are now urging mass commercial boycotts, further straining investor confidence.

Such developments risk creating price instability, lower consumer sentiment, and greater uncertainty around economic policymaking in the months ahead.