Turkey’s Market Shock: Imamoglu’s Detention Sends Lira Tumbling, Investor Confidence Shaken

turkish lira

turkish lira

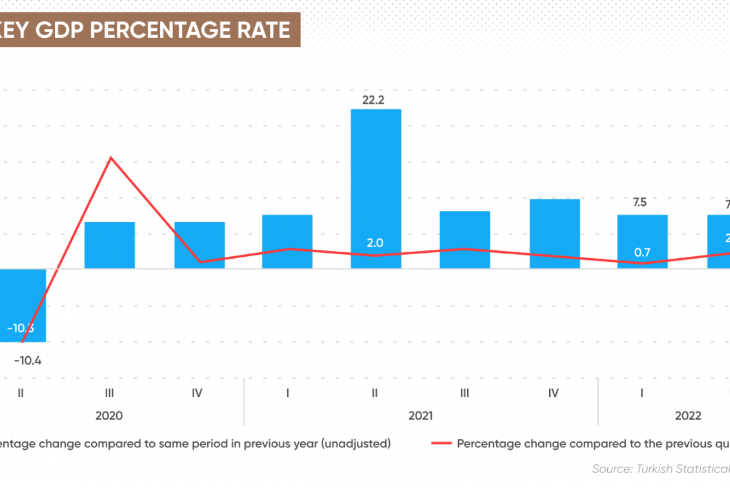

The detention of Ekrem Imamoglu, a key opposition figure and the greatest political challenge to President Recep Tayyip Erdogan, has triggered market turmoil, casting doubt on Turkey’s economic stabilization efforts. Analysts on March 20 warned that the unfolding crisis threatens Finance Minister Mehmet Simsek’s strategy of reviving investor confidence through a return to economic orthodoxy.

Lira Plunge, Stock Market Slump, and Debt Market Fallout

The Turkish lira (TRY) experienced a sharp selloff, weakening by 14% against the U.S. dollar at one point, as uncertainty spread through financial markets. Circuit breakers at Borsa Istanbul failed to prevent a significant downturn, while the Central Bank of Turkey (CBRT) reportedly intervened with $8-9 billion via public banks to curb the lira’s depreciation.

The turmoil extended to the debt market, where local currency bonds suffered a 170-basis point sell-off.

Kaan Nazli, an emerging markets portfolio manager at Neuberger Berman, called the developments “a serious blow to investor confidence” in Turkey’s economic recovery program.

Concerns Over Capital Flight and Central Bank Response

The risk of Turkish citizens converting their lira savings into dollars or euros has heightened, a trend seen during past economic crises. Investors who had been attracted by Turkey’s 40% interest rate carry trade are now reassessing their positions.

Francesc Balcells, FIM Partner’s chief investment officer of emerging market debt, warned that carry trades “require low volatility”, and when uncertainty spikes, “the economics of the trade are no longer there.”

William Jackson of Capital Economics noted that the lira’s sharp depreciation will “complicate the central bank’s task of bringing inflation down”, raising concerns over whether the government can maintain investor trust in its macroeconomic reforms.

Political Uncertainty Weighs on Market Stability

Piotr Matys, senior FX analyst at In Touch Capital Markets, highlighted the political dimension, stating that the market reaction is also a reminder of Erdogan’s tightening grip on power and his possible attempts to block Imamoglu from running in the 2028 presidential elections.

Veteran Turkey analyst Timothy Ash raised fears over political and social stability, warning that rule of law concerns will persist, potentially deterring long-term foreign direct investment (FDI).

Ash, however, suggested that the crisis could reinforce Simsek’s position, as Erdogan “will not want a financial crisis to run alongside a political crisis.” He expects the CBRT to respond with orthodox monetary measures, including verbal intervention and potential rate hikes, if lira weakness persists.

While the CBRT holds over $150 billion in FX reserves, Ash noted that the central bank’s independence will be tested as it balances political pressures with its disinflation strategy.

What’s Next?

With investor confidence rattled, all eyes are now on the central bank’s next move—whether aggressive rate hikes will be deployed to stabilize the lira, and whether Turkey can contain the economic fallout of its deepening political crisis.