Turkish external account turns negative in November, but improves year-on-year

cad net borrowing

cad net borrowing

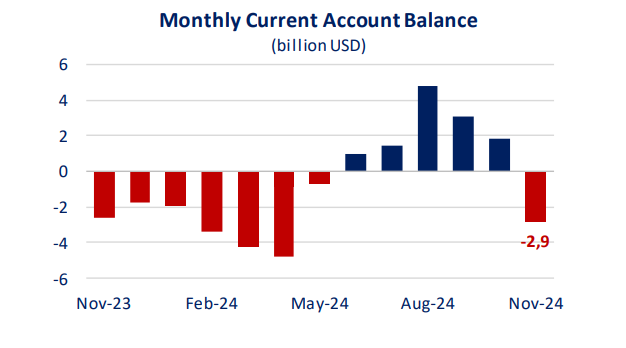

Turkey recorded a current account deficit in November, marking the first shortfall in six months, according to the Central Bank of the Republic of Türkiye (CBRT).

On the other hand, trade sales volume surged by 8.7% year-on-year during the month, while total turnover grew by 42.4% (in nominal terms) compared to the same period in 2023, the Turkish Statistical Institute reported on Monday.

The CBRT announced on Monday that the current account balance posted a $2.871 billion deficit, following five consecutive months of surplus. Türkiye had previously achieved its longest stretch of surpluses in five years, with positive balances recorded from June through October.

Turkish brokerage reacted to the data as follows:

HSBC Asset Management/İbrahim Aksoy

Turkey November CAD

While the recovery in industrial production was clearly visible in November, retail sales volume continued to rise. Retail sales volume index increased by 1.9% compared to October and 16.4% compared to the same month last year, reaching a new record level. Industrial production seems to have also contributed to the positive course in the retail sales volume index in November. As HSBC Asset Management, we predict that the economic activity, which shrank in the 2nd and 3rd quarters compared to the previous quarter, will grow, albeit limited, in the 4th quarter. We estimate 2.8% growth for the whole of this year. We predict that growth will accelerate to 3.5% in 2025, with the effect of interest rate cuts.

In November, the current account deficit was announced as 2.87 billion dollars, below the market expectation of 3.35 billion dollars. Thus, the 12-month cumulative current account deficit increased from 7.1 billion dollars to 7.4 billion dollars. The 12-month cumulative current account surplus, excluding energy and gold, increased from 53.2 billion dollars to 54.3 billion dollars.

While Turkey’s 12-month net energy bill and net gold imports continued to increase in November and after October, the positive contribution to the current account balance from these channels seems to have ended. We predict that the current account deficit, which may be below 10 billion dollars this year, may increase to 20 billion dollars (1.3% of GDP) in 2025. We believe that this amount of current account deficit may not have a negative impact on TL, considering the recovery in the Central Bank reserves.

İs Bank Research: Net capital inflows accelerated in portfolio investments, but errors and omissions turned deeply negative

In November, net capital inflow in portfolio investments was realized as 1.2 billion USD, the highest level of the last 4 months. In this period, net asset acquisition of financial assets decreased to 1.1 billion USD due to banks’ and other sectors’ reduction of their portfolio investments abroad, while non-residents’ net capital inflows to domestic markets became 2.3 billion USD. Moreover, in November it was noteworthy that the equity market recorded a net capital inflow for the first time since April, albeit limited with 39 million USD.

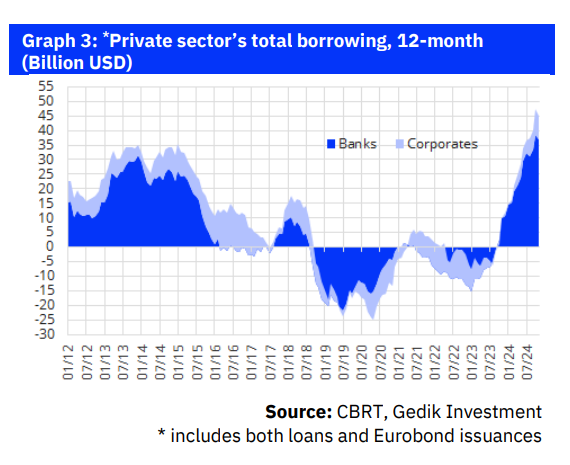

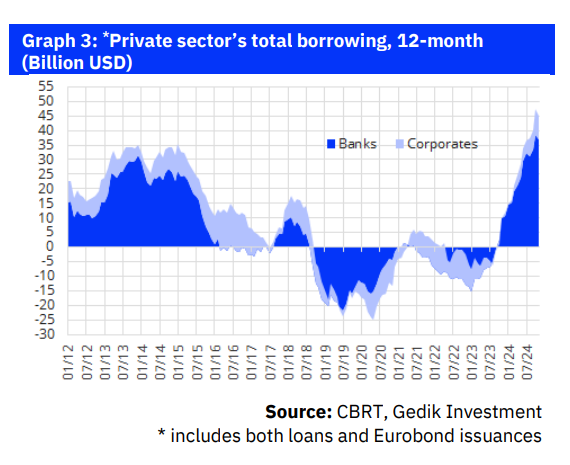

Turkish FX borrowing ample through the year

As of November, according to 12-month cumulative figures, longterm debt rollover ratios in the banking sector and other sectors were 133.6% and 110.7%, respectively.

Reserve assets increased by 1.3 billion USD in November, leading a rise of 2.1 billion USD in January-November period.

Net errors and omissions item, where capital outflows continued with 1.5 billion USD in November, recorded a total outflow of 15.8 billion USD in the first 11 months of the year.

Gedik Investment/Serkan Gonencler

External borrowing by banks remains the major source of financing. As was the case throughout 2024, banks’ external borrowing stood out as the primary financing item in November. Banks secured a net financing of USD3.8bn from international markets, comprising USD3.2bn in loans and USD0.6bn via Eurobond issuances. Meanwhile, corporates issued a net USD0.5bn in Eurobonds but recorded a net repayment of USD0.1bn in loans.

Over the last 12 months, banks raised USD36.8bn in net financing, including USD22.8bn in loans and USD14.0bn in bonds. Corporates, on the other hand, secured USD8.2bn in financing, with USD2.6bn from loans and USD5.6bn from bond issuances. As a result, total external borrowing on a 12-month rolling basis reached USD45.0bn. While this was down from USD47.2bn in October, still remains significantly above the peak levels of the 2012–2013 period.

Additionally, non-residents’ net purchases of government domestic debt securities (GDDS) reached USD1.6bn in November, maintaining their role as another critical financing source. This brought total foreign GDDS purchases over the past 12 months to USD17.5bn.

C/A deficit may stabilize at 1.5–2.0% of GDP in 2025. We think that the downward trend in the current account deficit, ongoing since May 2023, reversed course in November. With the acceleration in imports of consumer goods and intermediate goods expected to persist in the coming months, coupled with the reversal of favourable base effects, we anticipate the C/A deficit to close the year around USD10bn and continue increasing in 2025.

Nonetheless, we expect the C/A deficit to remain at manageable levels throughout the year, at approximately 1.5-2.0% of GDP.

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/