Weekly Flow of Funds: Large increase in CB reserves, money market funds see record inflows

dolar2

dolar2

In the week of February 14, the USD6.3 billion increase in the CBRT’s net FX reserves excluding swaps, the USD1.9 billion purchases of GDDS by non-residents and the USD139 million increase in FX deposits are particularly noteworthy.

The weekly movements can be summarized as follows:

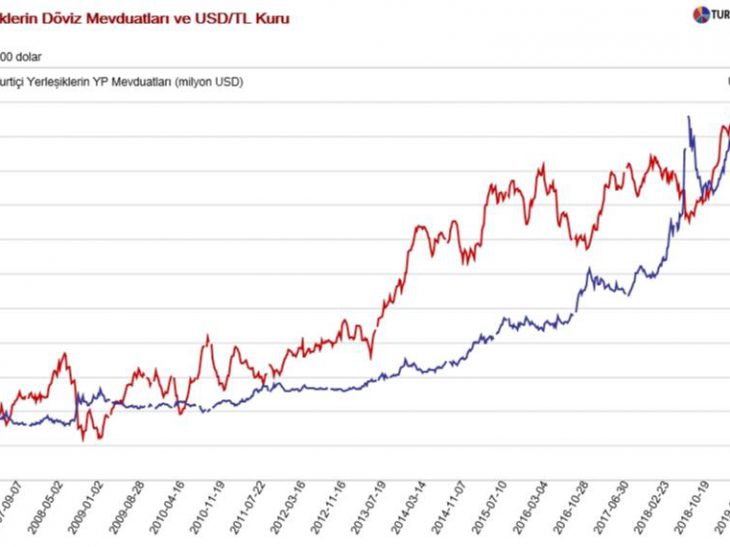

➢ Parity adjusted FX deposits increased by approximately USD139 million with USD198 billion sales by corporates and USD337 million purchases by individuals. Since the week of March 29, FX deposits have declined by USD25 billion, with USD13.4 billion of this decrease coming from individuals and USD11.6 billion from corporates.

➢ FX-protected deposits (KKM) decreased to TL920 billion with a weekly outflow of TL46.4 billion (USD1.4 billion). Since the peak in August 2023, KKM accounts have decreased by TL2.5 trillion (USD110.9 billion)

➢ The share of FX deposits + KKM in total deposits decreased from 40.6% to 40.4% WoW. Note that the share of FX deposits and KKM accounts in total deposits had peaked at 68.4% in August 2023.

➢ TL deposits decreased by TL335 billion weekly, increasing to approximately TL12.7 trillion.

➢ FX loans increased by 0.6% weekly, reaching USD174.9 billion with a 30% (USD40.2 billion) rise since the end of March.

➢ Looking at the annualized 13-week average loan growth, commercial loans increased from 30% to 30.4%, while consumer loans rose from 41% to 48.7%.

➢ Net foreign inflows into GDDS were USD1.851 million, with the stock balance reaching approximately USD19.7 billion. In equities, net purchases amounted to USD108 million, reaching the stock balance to USD33 billion.

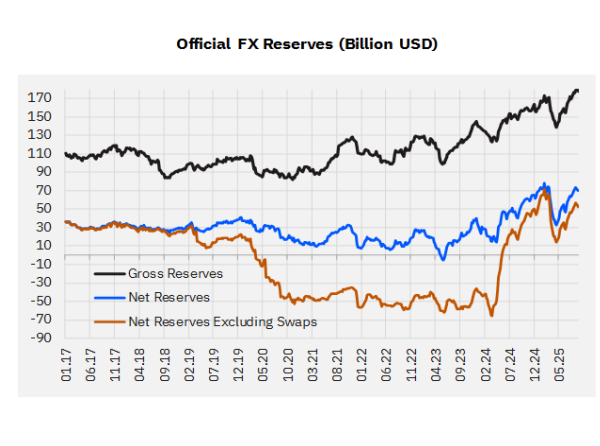

➢ In the week of February 14, gross reserves increased from USD167.5 billion to USD173.2 billion. Net reserves increased by USD5.8 billion, rising from USD72.3 billion to USD78.2 billion. Net FX reserves excluding swaps also increased by USD6.3 billion, reaching USD71.4 billion. Since the beginning of the year, the improvement in net FX reserves excluding swaps has totaled USD27.6 billion. From the end of March, when net FX reserves excluding swaps were at -USD65.5 billion, the total improvement has reached USD136.9 billion.

➢ As of February 19, according to the CBRT’s analytical balance sheet, gross reserves decreased by USD2 billion, net reserves by USD3.8 billion, and net reserves excluding swaps by approximately USD3.3 billion.

➢ As of the week of February 14, the total size of MMFs had further increased to TL1.88 trillion from TL1,60 trillion at end-2024. While the size of Money Market Umbrella Funds declined by TL79 billion during last week, the size of Money Market Funds under the Hedge Umbrella Fund rose by TL86 billion, resulting in a net increase of TL7 billion in MMF assets. In a week when FX deposits increased by USD139 million, the net asset value of hedge FX funds rose by approximately USD455 million. Since the beginning of 2024, FX deposits (adjusted for exchange rate effects) have declined by USD15.4 billion, whereas the net asset value of hedge FX funds has increased by USD20.6 billion. The dollarization ratio, which we calculate by including investment funds, declined from 41.5% to 41.0% last week. This ratio stood at approximately 59% at the beginning of 2024.

Source: Gedik Investment

IMPORTANT DİSCLOSURE: PA Turkey intends to inform Turkey watchers with diverse views and opinions. Articles in our website may not necessarily represent the view of our editorial board or count as endorsement.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/