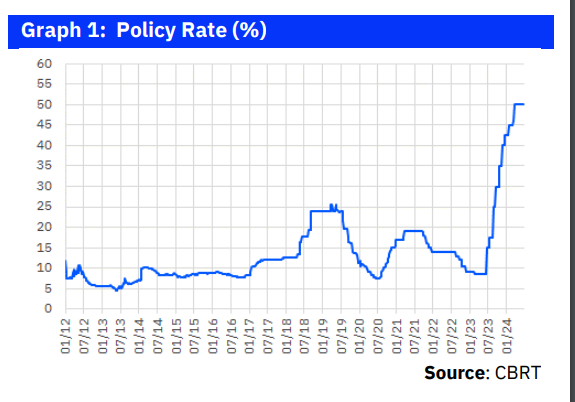

The CBRT maintains policy rate at 50%

In its June MPC meeting, the CBRT kept the policy rate unchanged at 50%, in line with expectations, just as it did last month.

The CBRT continues to keep the door open for further rate hikes. The CBRT maintains the “monetary policy stance will be tightened in case of a significant and persistent deterioration in inflation” expression, which is also in line with our expectations. As such, we believe that the CBRT continues to leave the door open for further rate hikes. That said, given the ongoing strong capital inflows, we believe the CBRT’s current strategy might be to avoid further rate hikes.

Finally, the CBRT acknowledges that there has been an ongoing slowdown in domestic demand, albeit notes that it remains at an inflationary level. This, in our view, suggests that the CBRT is not considering a rate cut in the short term. We believe the CBRT would need to see more concrete signs of a cooling in domestic demand before initiating a rate cut process.

The CBRT continues to refer to liquidity sterilization measures

In the May MPC meeting, more important than the rate decision were the CBRT’s reserve requirement ratio (RRR) hikes and FX loan growth restrictions due to the TL500bn liquidity surplus in the system. Those RRR hikes managed to sterilize a significant amount of TL liquidity to the tune of about TL700bn in the following days.

Yet, with ongoing capital inflows and shrinkage in TL deposits, the CBRT’s FX purchases have continued rapidly since the recent MPC meeting. For instance, the CBRT’s net FX reserves excluding swaps have increased from a negative USD15 billion to a positive USD12bn after the last MPC meeting (between May 17 and June 21). This, coupled with the slowdown in credit growth, has once again led to an excess of TL liquidity in the system. Continued FX purchases have been pushing the system into TL surplus recently, occasionally driving O/N rates to 47% on certain days.

Consequently, the CBRT stated in today’s announcement that it is closely monitoring liquidity developments and sterilization will be implemented effectively by enriching the toolset whenever needed. In this context, we anticipate that new RRR hikes and/or the issuance of different sterilization tools, such as liquidity bills, could be on the agenda in the coming days, although not immediately.

By Serkan Gönençler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/