July CPI inflation rate came in at 3.23% MoM, while the annual CPI inflation rate decreased from 71.60% to 61.78%. TurkStat revealed July’s CPI inflation as 3.23%, slightly below the median market expectation of 3.4% and our 3.6% forecast. Yet, note that the had highlighted upward risks through various statements CBRT throughout the month (most recently Deputy Governor Cevdet Akçay’s remarks), which led to an increase in market expectations. For instance, the average July CPI inflation expectation in the CBRT’s Market Participants Survey, published mid-month, was 2.77%.

Core, trend inflation figures still awful

Consequently, due to strong base effects (July 2023: 9.49%), the YoY CPI inflation rate fell from 71.6% to 61.8%. Core CPI inflation (Group C) exceeded our 2.0% forecast, reaching 2.45%, but again due to base effects, it decreased from 71.4% to 60.2% on an annual basis. Domestic PPI inflation continues to present a more favorable outlook compared to CPI inflation, thanks to the stable exchange rate trend and the moderate course of global commodity prices. Here, with a monthly realization of 1.94%, the YoY rate fell from 50.1% to 41.4%.

Service inflation stubbornly sticky

Hikes in energy and tobacco prices influenced inflation in July, while service inflation exceeded our expectations. The 38% increase in electricity prices and the hikes in fuel and cigarette prices due to SCT adjustments pushed the monthly CPI inflation rate back above 3.0% in July. We should note that inflation figures in the tobacco & alcoholic beverages and energy groups (5.8% and 10.0%) came in below our expectations, mostly explaining the downward deviation in our headline inflation forecast. Food inflation aligned with our expectations at 1.8%. Yet, looking at its breakdown, it is worth noting that there is a 3.1% increase in vegetable and fruit prices, which should typically decline in summer months.

Although the stable exchange rate limited durable goods inflation to 0.6%, service inflation surpassed our 3.5-4.0% expectations, reaching 4.4%, indicating ongoing disruptions in pricing mechanisms. This does not paint a positive picture for the upcoming inflation trend, either. Lastly, it is noteworthy that clothing inflation, with a monthly realization of -2.6%, came in better than expected and remained well below alternative inflation indicators for the same component.

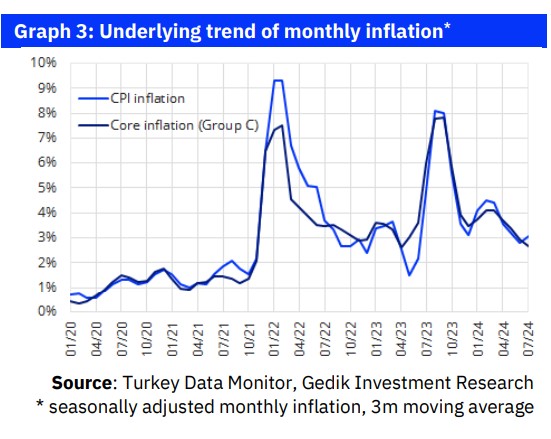

The monthly inflation trend remains higher than the CBRT’s projected path

Seasonally adjusted monthly inflation (3-month average), which the CBRT closely monitors, remains above 3.0% for the headline CPI and above 4.0% for the services group, while core inflation has dipped just below 3.0%. In fact, these figures suggest that the inflation trend remains above the CBRT’s projected path. Accordingly, although the CBRT is inclined to consider the rise in July as temporary, we expect it to maintain its cautious stance. In this regard, we do not agree with the market views that the rate cut process will begin in September/October.

We believe that the CBRT may consider rate cuts starting from November at the earliest, depending on monthly inflation realizations between August and October. For this, seasonally adjusted monthly inflation should converge towards around 1.5%, as repeatedly guided by the CBRT.

By Chief Economist Serkan Gonencler, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/