Gedik Invest chief economist Mr Serkan Gonencler shared his analysis of budget trends with PA Turkey. While October deficit declined in real terms YoY, and the annual turn-out is likely to undershoot the projections announced in Medium Term Economic Program, the underlying trend is worrisome. “The rapid surge in the budget deficit has been contained thanks to robust tax revenues and delays in the utilization of budgetary allocations” argues Gonencler. Much of the improvement in the red ink is due to one-off taxes and rampant inflation. The low draw-down of earthquake assistance funds suggests aid is not reaching the disaster zone, potentially paving the way for social backlash in the winter.

Robust tax revenues continue to bolster the fiscal performance

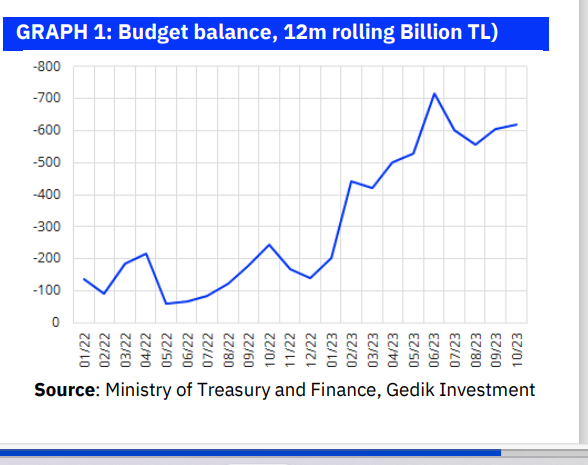

The central government budget posts a TL96bn deficit in October, while the 12-month rolling deficit stands at TL618bn. In October, the central government budget posted a TL95.5bn deficit compared to the TL83.3bn deficit in the same month of last year, while the primary deficit was TL28.1bn vs. the TL22.1bn primary deficit. For the January-October period, TL608.1bn of budget deficit and TL70.4bn of primary deficit implies a significant deterioration compared to TL128.8bn budget deficit and TL139.5bn primary surplus achieved in the same period of last year.

Tax revenues soars, spending restraint not yet visible

The rapid surge in the budget deficit has been contained thanks to robust tax revenues and delays in the utilization of budgetary allocations. The 12-month rolling budget deficit, after rising sharply in 1H23 due to the election and earthquake related expenditures, seems to have been contained from July onwards, due to strengthened tax revenues and delays in the use of budgetary allocations. Specifically, the 12-month rolling budget deficit had increased from TL139bn at end-2022 to TL716bn by June, but now declined to 618bn TL as of October (GRAPH 1). We believe that this stabilization is mostly attributable to an acceleration in tax revenues since July due to strong domestic demand and various regulatory tax measures.

During the four-month time span between July and October, the YoY rise in tax collections (in nominal terms) reached 249% for motor vehicle tax (MTV), 310% for VAT on domestic goods and services, 213% for special consumption tax (SCT) on fuel, and 202% for SCT on motor vehicles.

Notably, the surge in VAT collections from TL68bn in the corresponding 4-month period last year to TL279bn this year underscores the contribution of enhanced tax revenues. Consequently, budgetary targets have been attained at 92% for domestic VAT and 87% for total SCT (97% for SCT on motor vehicles) (EXHIBIT 4). As such, we now project that the budgetary targets for these two taxes could potentially be surpassed by approximately TL150-200bn.

Rebuilding in quake zone painfully slow

The limited use of earthquake-related allocations so far has also played a pivotal role in stabilizing the budget deficit. Recall that in response to various election promises and escalating expenditures tied to earthquakes (and also the fact that inflation exceeded government’s forecasts by a wide margin), the government elevated budget expenditure projections from the initial TL4.5trl to TL5.6trl in July via a supplementary budget, and subsequently to TL6.6trl in September with the Medium-Term Program (MTP). The budget deficit projection was also raised from TL659bn to TL1.63trl.

In contrast to this revision, the budget deficit remained at TL 608bn TL by end-October and we may also witness a budgetary surplus of more than TL100bn in November (attributable to supplementary taxes). As mentioned above, the significant improvement in tax revenues since July has been instrumental in limiting the budget deficit. Yet, it should also be noted that a relatively modest portion of various budgetary allocations, particularly those earmarked for earthquakes, has been utilized so far, which has also played a major role in this outcome.

To be specific, although the projection for capital transfers, initially set at TL37bn for the year, was increased to TL685bn due to earthquake-related allocations, only TL163bn has been utilized as of October. Similarly, out of the TL539bn allocated for capital expenditures, TL297bn has been disbursed, and for current transfers, out of the TL2.5trl TL allocation, only 1.83bn TL has been utilized. With the release of unused allocations (even if, partially), there will be a significant increase in the budget deficit, particularly in December.

That said, also considering the potential surpassing of tax revenue targets, we expect the year-end budget deficit to hover around 1.2-1.3trl TL (roughly 5.0% of GDP).

Serkan Gönençler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/