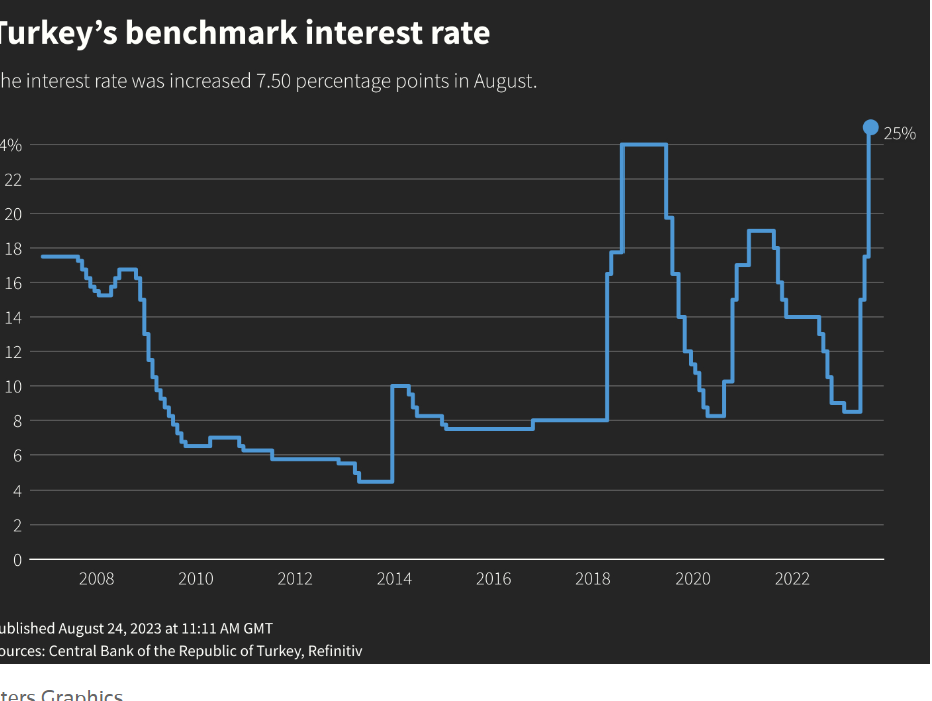

Central Bank of Turkey’s outsized rate hike shocked experts and market participants at home and abroad. However, the joy was marred by rumors of Erdogan not having been informed about the rate hike beforehand, which might cause him to fire Mehmet Simsek and or Gaye Erkan. It is also not clear how far rate hikes will go, given the 24 month forward inflation expectations are at only 22%. However, the Central Bank survey measuring expectations is highly biased towards optimistic participants. REAL inflation expectations can be substantially higher, or become unmoored in coming months, because of March 2024 local elections, President Erdogan has already started to make lavish spending promises. Will Erdogan persevere in his quest to eradicate inflation from “our daily lives”, as he promised on Monday after the Cabinet meeting?

I’ve surveyed major global financial press outlets to find some answers to this questions.

The first quote comes from Bloomberg, which suggests President Erdogan was bypassed in the decision. This was the kind of carelessness, that led to the firing of previous CBRT governor and a traditional economist Naci Agbal:

The buying-spree proved short lived though, with investors bracing for the risk of more political meddling in monetary policy. Erdogan has chased out three central bank governors since 2019, spurring an exodus of capital that has weighed heavily on the lira.

“If in the coming days President Erdogan comments on the latest stunning decision and he strongly indicates that Governor Erkan and her team have his full support, the lira may become one of the most popular EM currencies,” said Piotr Matys, a currency analyst at InTouch Capital Markets. “At least until the Turkish president decides to reshuffle the Turkish central bank once again.”

As of 21 pm Friday, I could not find any objections to the rate decision in pro-Erdogan press. To the contrary, Erdogan’s mouth piece SABAH called the decision “A necessary but risky step”..

Bloomberg also earns the second quote, by informing readers that major investment banks upped rate forecasts for YE2023, which could stimulate some inflows into the TL bond market, which flows are essential for Turkey to spend the winter without a major FX shortage:

“Global banks from Morgan Stanley to Barclays Plc and JPMorgan Chase & Co. now say rates will reach at least 30% by the end of the year, reflecting expectations of a massive shift from the central bank’s earlier guidance of “gradual” tightening.

The Turkish currency’s overnight indexed swaps — derivatives used to bet on future borrowing costs — are showing expectations for higher rates ahead. The one-year contract spiked to 33.5%, the highest level since before elections in May, from 28% on Wednesday”.

AFP claims Erdogan gave his tacit blessing to the rate hike, though my reading of the speech makes me a tad bit more cautious:

“The lira gained as much as six percent against the dollar after Erdogan followed up the announcement by voicing strong confidence in his team.

“We are taking determined steps to address the problems caused by inflation,” Erdogan said in nationally televised remarks.

Capital Economics analyst Liam Peach said the hike “will go a long way towards reassuring investors that the shift back to policy orthodoxy is on track”.

Reuters blesses us with comments from strategists, to which the link is here:

GRZEGORZ DROZDZ, MARKET ANALYST AT CONOTOXIA

“This marks another step towards abandoning ultra-loose monetary policy and saving the strength of the Turkish lira.”

“We should recall that sudden changes in interest rates usually have a delayed effect. Hence, we can still expect inflationary pressures to continue in the coming periods, with the weakening of the lira halting.”

METODI TZANOV, EMERGINGMARKETWATCH.COM, SOFIA

“It appears that the CBRT’s current reaction may have been triggered by July’s CPI inflation readings, which rose to 47.8 per cent year-on-year after a series of disinflationary readings and came in above expectations.”

“This was also the steepest rate hike since the CBT management reshuffle after the elections in May. We think the strong rate hike meant to address market concerns that the CBT wanted to avoid significant rate hike.”

“The concerns appeared after the restructuring of the FX-protected deposit scheme (KKM) in the beginning of this week, in which the CBT imposed a target ratio of converting KKM deposits into conventional lira deposits and imposed the security maintenance rule on banks which fail to meet the ratio.”

What do I think?

Erkan’s huge hike dispels the notion that Erdogan has set a ceiling on monetary tightening. From a sentiment perspective, it is very important for this belief to be broken. Now, markets and experts will speculate on the direction of policy rates based on data, more than leaks from the Palace.

Perhaps, the larger-than-expected hike was necessitated by the Emerging Markets sell-off, which made it very difficult to attract international financial capital to the system.

Yet, it is too early to rejoice. Much needs to be done. Thanks to a recent decree, deposit rates are now fully liberalized and can act as an anchor for the currency and domestic demand. Yet, commercial loan rates must also be fully deregulated for economic activity to slow down to a degree to equilibrate the economy at lower levels of inflation and current account deficit.

Finally, after a decade of disappointment, I’m not ready to swallow a new and more orthodox Erdogan. His indifference to monetary policy may be inspired by the weakness of the opposition, which increases AKP-MHP’s chances of recapturing major cities in local elections. Hopes for the opposition uniting once again are not dead, just dormant. CHP, IYIP and HDP may still cooperate in Istanbul and the Mediterranean coast cities, but the decision will not arrive before December.

Also, according to few available polls, AKP constituency is smarting from economic blows which means even if the opposition remains divided, AKP-MHP may lose cities in a protest vote.

To me, Erdogan’s true colors will be manifested in October, when a series of foreign policy developments coincide with evolving economic conditions, the result of which may turn him more orthodox, or force him to revert to his erratic ways.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel