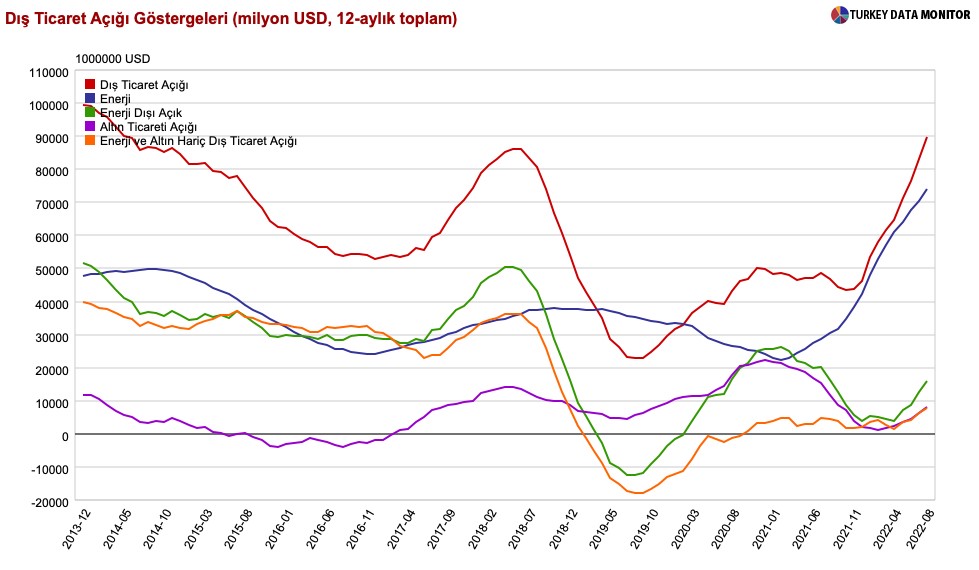

Cover chart legend:

RED: Total trade deficit

BLUE: Energy

GREEN: Core deficit

Turkey’s foreign trade deficit surged 159.9% year-on-year to $11.19 billion in August, with imports surging 40.4%, data from the Turkish Statistical Institute showed on Friday. Current account, too, will remain in a wide deficit for the next year, begging the question of how it will be financed with the meagre FX reserves of Central Bank of Turkey (CBRT). New spikes in energy prices, or a sizeable decline in EU export orders could easily push the economy into another currency crisis.

Imports stood at $32.53 billion, while exports rose 13.1% to $21.34 billion, the data showed.

Under an economic programme unveiled last year, Turkey aims to shift to a current account surplus through stronger exports and low interest rates, despite soaring inflation and a tumbling currency. Soaring global energy and commodity prices have made that target all but unattainable.

President Erdogan sticks to his view that lower interest rates will eventually cap inflation, instructing CBRT to cut the policy rate from 12% to single digits by the end of the year. AKP’s election strategy rests on keeping GDP growth very high, to improve poll ratings, which have suffered since the beginning of the year because of worsening economic conditions. Yet, sustaining a high growth rate in an economy with 80% p.a. CPI inflation and current account deficits (CAD) estimated at 7% of exp GDP carries lethal risks.

The deficit in the first eight months of the year climbed 146.3% to $73.44 billion, the data showed. PAIntelligence survey of economists reveal a $45bn CAD for 2022, which shows no sign of decelerating in 2023, unless there is a bear market in energy commodities.

WATCH: Turkish Economy Won’t Survive The Winter | Real Turkey

Sabotages to critical natural gas pipelines from Russia to Europe and upcoming sanctions by EU and G-7 on Russian gas and oil sales in likely to keep energy prices elevated, despite a deepening global slump.

EU is expected to spend most of 1H2023 in a recession, which is going to depress Turkish exports worth $125 bn p.a. The combination of a soaring energy import bill and falling exports could widen CAD beyond current estimates, at a time when Turkish entities face steep rises in FX debt roll-over charges, while foreign financial institutions have completely abandoned the system. CBRT’s liquid FX reserves, which can be used to defend TL against a speculative attack or to pay off CAD is estimated at $40 bn, very slim compared to foreseeable outflows of FX and a prickly political atmosphere, which would give birth to sporadic outbursts of spot FX demand by retailers.

WATCH: Turkey’s Slow-Motion Currency Crash | Real Turkey

According to IFC, the fair value of dollar/TL is 2.15, whereas the currency traded at 18.50-54 at Friday’s close.

If balance of payments difficulties push the exchange rate towards IFC’c target, inflation will leap higher, depressing economic sentiment and undermining Erdogan’s chances of re-election in 2023 (May or June) presidential and parliamentary races.

By Cuneyt Akman (translated)

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/