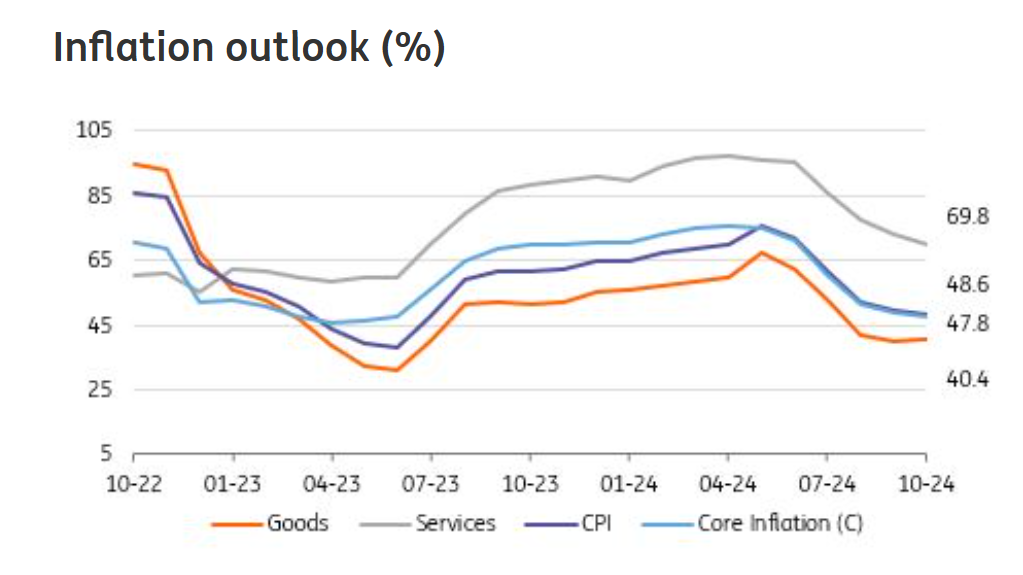

Turkish inflation was reported at 2.9% in October, higher than the market consensus of 2.5%. The annual figure, however, has maintained its declining trend and fell to 48.6% from 49.4% a month ago, given that favourable base effects (as it was 3.43% in October 2023) were more apparent in the second half of this year.

Cumulative inflation in the first 10 months of the year reached 39.8%, exceeding the Central Bank of Turkey’s 38% forecast for the year (with a forecast range of 34-42%). PPI stood at 1.3% month-on-month, reflecting a decrease to 32.2% year-on-year compared to the previous month.

“The data implies further moderation in cost pressures with supportive currency developments (USD/TRY up by slightly higher than 16% on a year-to-date basis). Global commodity prices, and particularly oil prices, in the current geopolitical backdrop will likely remain the key determinant of the PPI trend ahead” commented ING EM research team.

PA Turkey regular contributor, Mr Serkan Gonencler, chief economist at Gedik Invest commented:

The main upward pressure on inflation came from food and clothing prices, whereas services inflation provided some supportive signals this month.

Food inflation, at 4.3%, was a principal factor behind the above-consensus result, although this aligned closely with our own projection. This high food inflation rate was primarily driven by a 19% increase in fruit and vegetable prices, though processed food prices also sustained a steady rise, staying above 2.0%. Additionally, clothing inflation climbed 14.6% MoM, with our forecast for this category around being 11.5%, which also contributed to the uptick in inflation.

On the other hand, services inflation at 1.95% MoM surprised to the downside this time, following the 4.6% and 4.9% increases in August and September. After adjusting for seasonality, this would translate to roughly 2.5-2.6% by our rough calculations, a considerable easing from the levels above 4.0% observed in recent months.

Supported by exchange rate stability, monthly inflation in durable goods and other core components registered at 0.7% and 1.2%, respectively, again acting as a moderating force on headline inflation. In YoY terms, core goods inflation has declined to 28.3%, though services inflation remains elevated at 69.8%. This discrepancy highlights that exchange rate stability alone is insufficient for sustained disinflation, and that improvements in inflation expectations and pricing behaviour are also crucial.

The CBRT may adjust its year-end CPI inflation forecast from 38.0% to 43.0-43.5% in its upcoming Inflation Report

Gonencler added: With Y-t-d CPI inflation reaching 39.8% by October, the CBRT’s latest year-end estimate of 38.0% has already been exceeded. Even to achieve the Medium-Term Program (MTP) target of 41.5% (announced in early September), cumulative inflation for the last two months would need to remain at about 1.2%, making the MTP target very challenging (almost impossible) to attain. As a result, the CBRT is likely to revise its year-end projection to approximately 43.0-43.5% in its upcoming Inflation Report on November 08, while we continue to hold our own year-end estimate at 45%.

Market expectations for rate cuts deferred to 2025

In May, the CBRT had projected seasonally adjusted monthly inflation would decline to around 1.5% by the last quarter. Although TurkStat is set to release seasonally adjusted monthly inflation data tomorrow at 4:00 p.m. (local time), we anticipate a reading of around 2.5%. Consequently, while the recent easing in services inflation is consistent with the CBRT’s guidance, headline inflation remains well above the CBRT’s projected path. Thus, while a symbolic rate cut in December remains a possibility, the broader market consensus on the timing of the first rate cut may shift to 2025, factoring in the CBRT’s likely upward revisions to inflation projections on Friday.

ING economist Mr Muhammet Ercan, on the other hand, thinks a December rate cut is still on the table: “Overall, despite the continued fall in annual inflation mainly due to base effects, the underlying trend remained elevated in October, albeit recording a drop in comparison to September thanks to a moderation in the services inflation trend.

The CBT seems to have slowed down the depreciation of the TRY recently. It has done this not by selling FX to the market, but by slowing down the pace of FX purchases.

Given this backdrop, in addition to the lagged effects of the monetary tightening on credit and domestic demand, the downtrend in annual inflation will likely continue and the underlying inflation trend will remain on a downward path for the remainder of this year. Accordingly, we think a measured cut in December is still on the table, despite a higher-than-expected October reading, while the last inflation report of this year (to be released on 8 November) is likely to provide more clarity on the CBT behaviour going forward”.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/