Led by Gaye Erkan, Turkey’s Monetary Policy Council is meeting on 24 August Thursday to decide on the course of monetary policy. According to Turkish news agency Foreks’ survey of economists, the consensus is for a 150 basis rate hike, which would raise the policy rate to 19%.

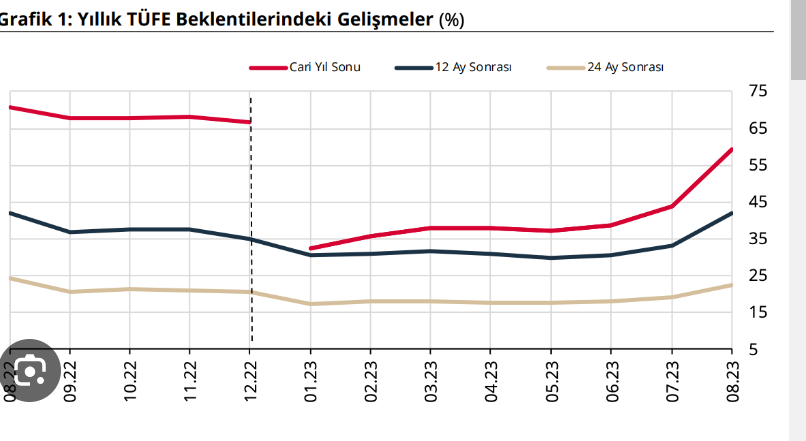

If so, Gaye Erkan and her teammates will be fighting a losing battle against inflation. According to Central Bank of Turkey’s own monthly survey, — inflation expectation in 12 months rises to 42.01% from 33.21% in prior month, according to central bank’s August survey of market participants.

The all-important year-end inflation estimate ratcheted up to 59.46% (prev. 43.82%), meaning policy tightening this far has not positively affected inflation expectations. Next 24 months inflation estimate is now 22.54% (prev. 19.04%).

Of course, monetary policy is of no effect, if its main policy rate is lower than even 2-year ahead inflation forecasts. It remains to be seen how MPC minutes would finesse this detail. In the first Inflation Report prepared under the bailiwick of Gaye Erkan, CBRT dispensed with hubris, firmly addressing the inflation problem, however, underline the need to balance growth and employment with disinflation.

Clearly, the current policy rate and the consensus forecast is not the equilibrium point for such a balance. One would expect the policy rate to be raised at least above the 2-year forecast of 22.54%, to 25%.

It is certain, economy impresario Mehmet Simsek, VP Cevdet Yilmaz and governor Erkan understand the problem, but it is widely believed that Erdogan still makes the ultimate monetary policy decisions, with any policy rate above 20% considered “damaging” in the context of upcoming elections.

Mehmet Simsek might have to visit his boss once again to ask for a higher final rate, because the recent sell-off in Emerging Markets has made it even more difficult to manage the exchange rate with low policy rates. That is, in an environment of risk aversion, strong dollar and rising US long-bond yields, Turkey must offer substantially higher rates to keep locals in TL and attract some international financial capital.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel