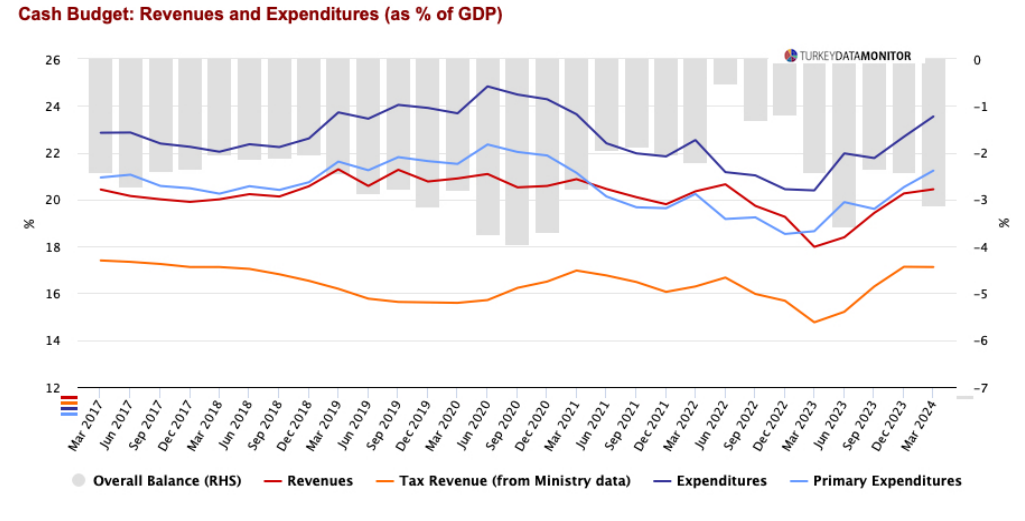

The central government budget posted a TL97bn deficit in July, while the 12-month rolling deficit rose to TL1.78trl. In July, the central government budget posted a TL96.8bn deficit compared to the TL48.6bn surplus in the same month of last year, while there was also a primary deficit of TL4.2bn vs. last year’s TL86.3bn primary surplus. During the January-July period, a budget deficit of TL844bn and a primary deficit of TL177bn was recorded compared to respective TL435bn and TL122bn figures in the same period of 2023. The 12-month trailing budget deficit rose to TL1.78 trl from TL1.37trl at end2023, while the non-interest budget deficit increased from TL700bn to TL756bn during the same period.

Expenditure growth remains elevated

Non-interest expenditures increased nominally by 76% (9% in real terms after adjusting for CPI inflation), with this significant rise observed across all categories rather than being concentrated in specific items. During the January-July period, the increase in non-interest expenditures reached 89%, with personnel and premium payments, as well as capital expenditures, particularly prominent.

On the other hand, in the capital transfers category, where a significant portion of earthquake allowances was recorded, only TL31bn out of a budget allocation of TL721bn has been used so far. This suggests that the increase in expenditures is not related to earthquake spending.

Although the gap between the accrual-based and cash-based budget deficits has slightly narrowed in the last two months, it remains high, indicating that the cash utilization of last year’s earthquake allowances is still limited.

Meanwhile, there has been a notable rise in interest expenditures as well, which surged by 145% in July and 113% during the January-July period in nominal terms.

There are signs of a partial slowdown in tax revenues

Despite the sharp rise in expenditures, strong tax revenue growth, driven by the tax increase measures implemented after the elections and, more significantly, by robust consumption, has so far limited the expansion of the budget deficit. During the January-July period, tax revenues increased by 86% nominally (11% in real terms), while VAT revenues saw a 119% increase (31% in real terms).

Yet, there seems to be some deceleration in the growth trend of tax revenues in recent months, indicating a potential softening in domestic demand. Due to the strong base effect created by tax items (VAT) carried over from June to July last year, we prefer to evaluate the June-July results collectively and we observe a 61% YoY nominal increase in total tax revenues, which translates to a slight real decline. During the same period, VAT revenues rose nominally by 50% but contracted by nearly 10% in real terms.

The central budget deficit-to-GDP ratio for the year-end could stand at 5.0- 5.5%

Recently announced expenditure-reducing and tax-increasing measures are not expected to make a significant contribution to the 2024 budget (with a potential impact of around 0.2-0.3% of GDP). The uncertainty regarding the extent to which earthquake allocations will be utilized adds further complexity to budget deficit forecasts. Although the budget deficit-to-GDP projection for 2024 is set at 6.4%, we believe that this ratio may come in at around 5.0-5.5% by year-end, due to the incomplete utilization of earthquake allocations and the strong performance of tax revenues to date.

We may also see a revision in the government’s projections with the new Medium-Term Program (MTP) expected to be announced in early September.

By Serkan Gonencler, Chief Economist, Gedik Invest

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/