The Turkish government posted one of its widest monthly budget deficits as of April 2020. The lockdown measures to contain the spreading of coronavirus hit the revenue through deferred taxes and with the economic shock that pulled demand to the contraction territory. In contrast as elsewhere the AKP government was pushed to up spending to keep the economy afloat.

As of January-April Turkey’s fiscal deficit of TL 72.2 billion makes up 52% of the end of official fiscal deficit estimation. The corona related revenue loss is unlikely to recover in the following two quarters of the year given that a V shaped recovery is unlikely. In parallel, the government will keep on spending to maintain employment in Turkey. All combined Turkey’s fiscal deficit to GDP ratio will jump to 6-7% from last year’s 3%.

With all the government’s across the globe engaged in heavy spending and bearing loss of income at the same time, at first sight it might seem Turkey will not be outlier in that sense. Yet, added the policy mistakes that have resulted in depletion in fx reserves, heavy external debt payments, double-digit inflation, money printing and continuing slide in the value of Turkish lira, Turkey’s economy stands among the most fragile in the emerging market universe. So will the Turkish lira be.

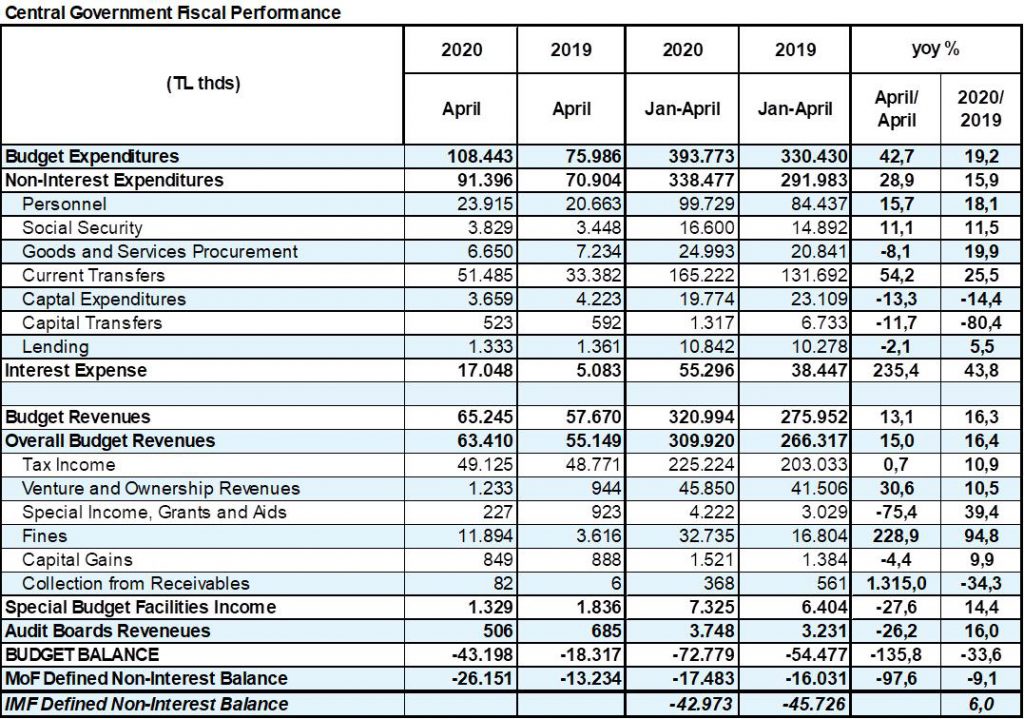

The central government’s monthly fiscal deficit in April stands at TL 43.2 billion (USD 6.3 billion), that stands slightly below the March level of TL 43.7 billion and compares with a deficit of TL 18.3 billion a year earlier. Thus, the Turkish central government registered TL 72.8 billion (USD 11.6 billion) budget deficit in January-April, that is shockingly up by 135.5% yoy.

Turkey’s coronavirus related lockdowns had begun in mid-March and April staged the peak of the coronavirus spread. The government thus launched a TL 240 billion (USD 34.7 billion) stimulus package mainly consisting of tax deferrals to help businesses.

Hence, spending excluding interest payments rose 28.9% yoy to 91.4 billion liras in April with the current transfers at TL 51.5billion (up yoy 54.2%) making the bulk of the non-interest expenditures. The government was absent from the public investment scheme while the personnel payments was eye-catching with a rise of 15.7% yoy to TL 23.9 billion. Turkey’s consumer inflation was at 10.9% as of April.

In fact the Treasury’s cash balance for April showed how aggressively the government was forced to borrow from the local markets raising TL 60 billion which was almost the double of the amount it had targeted.

Budget revenues rose 13.1% yoy from a year earlier while the tax income little changed at TL 49.1 billion from TL 48.8 billion last April given the postponement of corporate and income tax collection.

In fact the income tax was down by 15% yoy and the corporate tax was down by 53% yoy, both as of April 2020.

Curiously, the tax on consumption of goods and services was up 43.9% yoy to TL 25 billion while the VAT income was also 117% higher to TL 9.1 billion, yoy in April. The motor vehicle tax and the taxes on tobacco were the outliers; respectively rising by 55% and 64%.

Reflecting the contracting demand, taxes on imports was down by 25% in April to TL 7.7 billion.

The average USD/TL exchange rate in April was 6.85, while one dollar traded for 6.30 liras on average in the first four months of 2020.