(Bloomberg) — Turkey is selling its first bonds in euros in almost three years as its risk premium narrowed to the lowest since the global financial crisis.

The country tapped international bond markets for the second time this year, capitalizing on a recent ratings upgrade, high demand for riskier debt and increasing confidence in the government’s management of the economy.

Turkey hired Deutsche Bank, HSBC, JPMorgan and Societe Generale for the sale of euro-denominated debt with a six-year tenor. The Treasury was able to reduce its cost of borrowing by 37.5 basis points from the initial price target and the notes were launched at 6.125% with a €2 billion ($2.18 billion) offering, according to people with direct knowledge of the matter.

The government has a borrowing target of $10 billion for the year and will have raised more than half of it with the latest sale.

Turkey last sold euro-denominated bonds in the international market in 2021, when it raised €1.5 billion in six-year bonds at a yield of 4.5%.

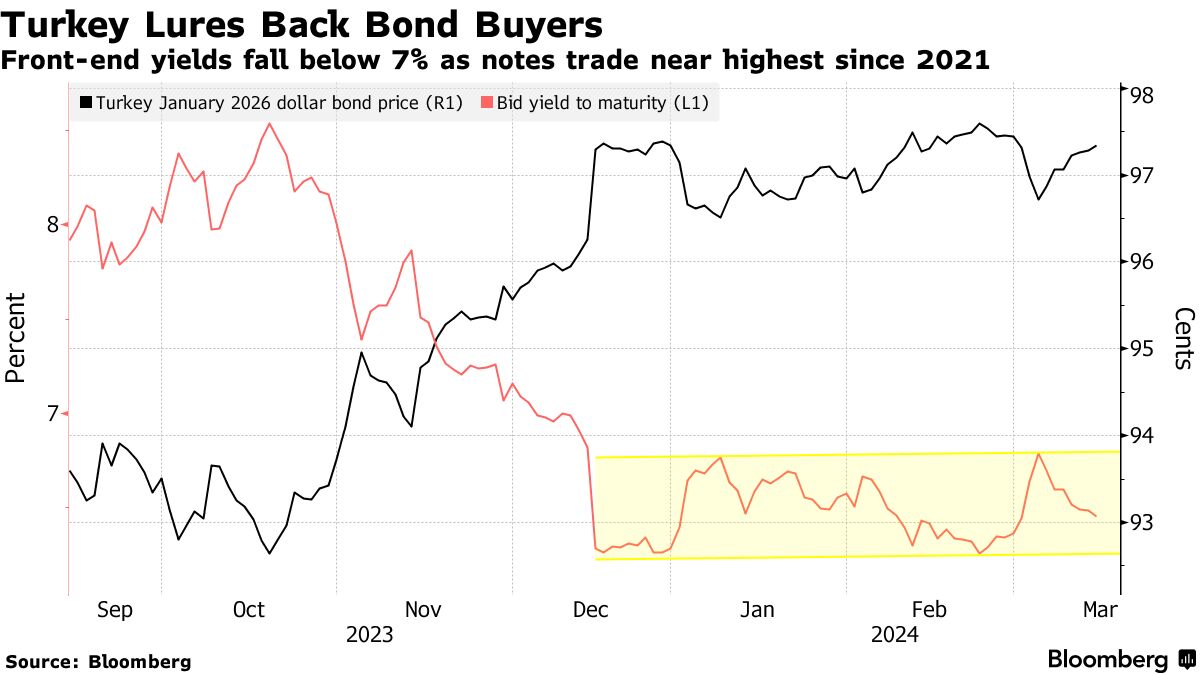

The extra risk premium demanded on the junk-rated nation’s bonds in euros fell to as low as 104 basis points on Feb. 26, the lowest since 2007, according to a Bloomberg index tracking Turkish debt spreads. It stood at 123 basis points on Wednesday against a 10-year average of 359 basis points.

The anticipation of interest-rate cuts by the Federal Reserve and the European Central Bank has helped reignite interest in higher-yielding assets. Alongside the Turkish Treasury, the country’s wealth fund has taken advantage of increased global appetite for risk. In February, it sold an inaugural $500 million, five-year bond at a yield of 8.4%.

According to four individuals familiar with the matter, Turkey’s Treasury has engaged in discussions with bankers regarding the potential repurchase of short-term dollar bonds to exchange them for debt with longer maturities.

The individuals, who requested anonymity due to the confidential nature of the talks, stated that the bonds maturing in the upcoming years could potentially be exchanged for longer-term bonds, such as 10-year debt, through planned auctions. They also noted that discussions with certain lenders are in the early stages, and the exchange may not ultimately proceed.

Some of the individuals mentioned that this move would serve to extend the government’s borrowing maturities and alleviate short-term repayment pressures, particularly in 2025. In response to a Bloomberg request for comment, the Treasury and Finance Ministry stated that no decision has been finalized on the matter, without providing further details.

On Wednesday, Turkey returned to the international bond markets for the second time this year, leveraging a recent ratings upgrade. With a borrowing target of $10 billion for the year, the country has successfully raised $3 billion thus far.

According to Treasury projections, Turkey’s central government faces a repayment obligation of $17.3 billion in foreign debt in 2024. Data indicates that in March alone, the Treasury has $3.4 billion in foreign debt redemptions.

Following this news, shorter-term hard currency bonds of Turkey experienced further gains, while credit-default swaps saw tightening on Thursday. The yield on 2-year dollar bonds decreased for the seventh consecutive day, and 5-year CDS dropped by 7 basis points to 307 basis points.